In the financial sector, there are different ways of trading assets and commodities, Both spot trading and margin trading have their benefits. For those who want to truly maximize their profit potential, margin trading will always be the better option.

Spot Trading has Less Profit Potential

The main benefit to spot trading is how it is more accessible. Any platform providing exposure to commodities, assets, tokens, or cryptocurrencies will often maintain the spot trading approach. it caters to both novice users and experienced veterans, although it is also rather limited in what one can achieve in the process.

To be more specific, spot trading can only be executed at the current asking and bidding price dictated by market participants. That also means users will never be able to spend more than the currently available assets in their account balance.

For novice users, this is a positive aspect, as they will not be able to suffer from wasting money they can’t afford to lose. Veteran traders, on the other hand, may perceive this as a strict limitation on their profit-making potential. This is why more advanced users often flock to margin trading, as it removes those barriers altogether.

The Appeal of Margin Trading

As a margin trader, a user effectively “borrows” funds from a third party to leverage their market position. This is a big difference compared to spot trading, as one doesn’t need to own the entire trade amount to enter or exit positions. As long as they can provide sufficient collateral of assets, leveraging one’s position becomes a breeze.

READ ALSO: Top 10 BEST Crypto Trading Books for New Traders (2020)

For traders looking to take full advantage of good trading opportunities, margin trading is the way to go. It allows for profit amplification of up to 50x in most cases. Some platforms even go as high as 100x leverage, or in rare cases, 250x leverage.

Finding the Right Margin Trading Platform

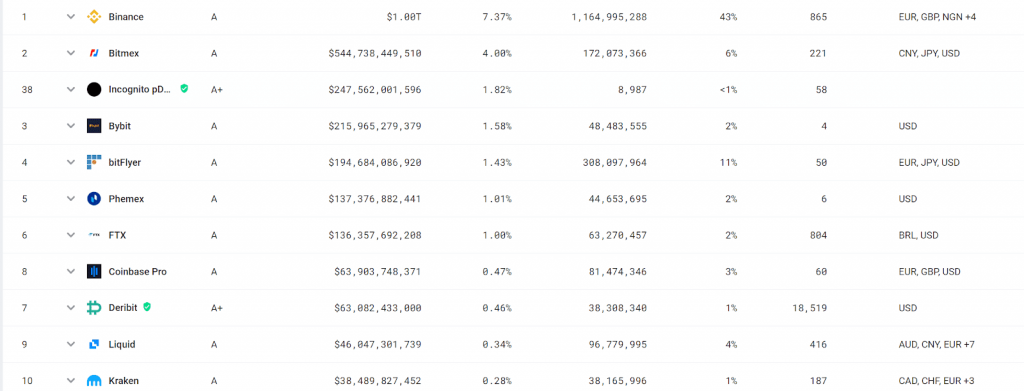

For those bold enough to venture into the world of margin trading, finding the right platform is crucial. Gaining exposure to cryptocurrencies, for example, can be done via platforms such as WhiteBIT, BitMex, Deribit, or Bitfinex. All of these platforms provide a full-fledged margin trading terminal.

Every single platform has its own advantages over the others. Users who value fast withdrawals and professional customer support may find themselves drawn to WhiteBIT. That platform also provides up to 5x leverage with 15x coming soon and access to high-liquidity fiat currency pairs. Especially users across Europe and the Commonwealth of Independent States may want to take note of this platform.

WhiteBIT is one of the few platforms catering to both spot and margin traders. Its initial success as a spot trading platform has created a loyal following of over 35,000 active traders. Adding margin trading to this platform will strengthen its market position.

In terms of overall margin trading volume, BitMEX still holds the crown, followed closely by ByBit and FTX. Competition is heating up in the world of cryptocurrency margin trading. Bitcoin has shown strong signs of moving up, meaning that gaining exposure to this crypto asset can yield significant profits.

Tips to Be Successful With Margin Trading

Amplifying the profit potential means the risks will be amplified in the same manner. It’s crucial for both novice and advanced users to take the necessary precautions before going off the deep end. With a few simple tips and practices, the potential for future profits will increase exponentially.

First of all, it is crucial to invest wisely when exploring the concept of margin trading. Start off by investing small amounts to fully understand the intricacies of leveraged positions and the impact they may have on one’s collateral. Throwing away money one can’t afford to lose is never a valid option.

Secondly. there is no obligation to leverage a market position to its maximum potential. For example, if a margin trading platform allows for 50x leverage, going to 25x or 30x as a personal limit might be a good idea. Having access to more capital is enticing, but it can also cloud one’s judgment. Until one knows the inner workings of margin trading properly – and experienced a few failed trades without significant losses – there is no real reason to explore the boundaries of leveraged positions.

READ ALSO: The Top 10 Best Bitcoin Debit Cards to Keep an Eye on 2020

Last but not least, margin trading requires a lot of attention and market knowledge. This is especially true for cryptocurrencies, as those are far more volatile in nature compared to traditional assets and commodities. Considering how there may be monthly charges for keeping a margin trade active, exploring short-term options may be more ideal. It does require a more aggressive manner of trading and monitoring charts, but it also reduces any potential overhead costs eating into one’s profits.

In the end, everyone wants to make money with margin trading. Going in blind is ill-advised, as one may run into certain aspects or fees that should have been researched prior. However, with the right mindset, and by using the best platform, there is good money to be made with margin trading.