Cryptocurrency has been thriving throughout 2020 and booming in 2021 so far. Not only the investors and market enthusiasts but also different federal agencies are keeping a close watch on the crypto-market, for instance, goes without saying, the IRS.

“At that point, the IRS said ‘We’ll let you fix this,’ but is less likely to do that moving forward,” said Knox Wimberly, an IRS enrolled agent and the CEO of Taxaroo.

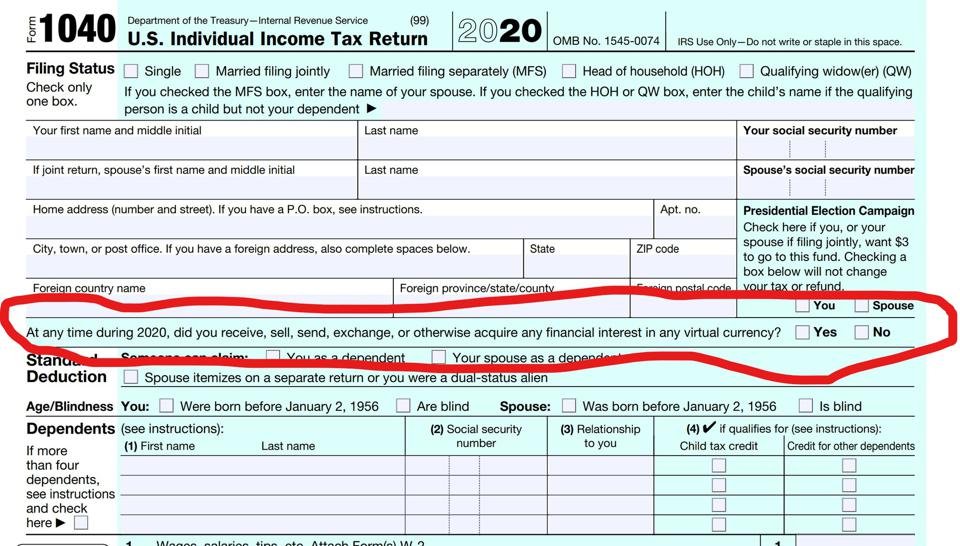

“Now, especially with the question on page 1, it’s a lot harder to say you didn’t know you were supposed to report it,” said Wimberly, who also is a fellow with the National Tax Practice Institute.

Think you can keep your interest in virtual currency to yourself? Think again. Suppose, you aren’t being paid crypto on your job, the IRS generally considers bitcoin and its siblings as property, not currency, for tax purposes. This indicates that whether you sell any crypto for cash, exchange it for another digital currency or use it at a retailer its value upon sale is either a profit or a loss.

“It could be a real tax mess for folks who try to hide crypto earnings from the IRS”

Kathryn Hauer, financial planner with Wilson David Investment Advisors in Aiken, South Carolina.

The Treasury Department has issued the 2020 IRS Form 1040, U.S. Individual Income Tax Return for 2020, which looks a little different this year:

No difference from stocks and other investments, you’ll be taxed on your crypto-profits. Well, if it’s for less than one year, then it may be considered as short-term profit and taxed as an ordinary income. But if you’re holding it for more than 12 months, then the profit against it will be taxed as a long-term gain at a rate of 0 to 20% depending on your income.

However, if you face a loss, you can use it against other investment profits up to $3000.

Talking about crypto payments, earning cryptocurrency via compensation or a revenue stream similar to interest income, mining income, and staking income are taxed as ordinary income, at the time of the receipt.

Therefore, if you have received any crypto payments that should not go without being reported.

The payment taxing procedure goes like this. Suppose, you earned 1 BTC as compensation for your freelance payment worth $10000 at that time, you will be taxed against the $10000. And if you earn $15000 by selling it later. Then, the profit ($5000) will be taxed as a capital gain according to your corresponding bracket.

Same goes for any cryptocurrency you mine.

Also, before filing your tax return, do not forget to ask your children who have access to the computer, whether they bought, sold, exchanged, or otherwise acquired an interest in virtual currency last year.

Previous Articles:

- Bitcoin plunges by 9% after Musk complains concerning excessive price

- Google Pay and Samsung Pay will allow Bitcoin payments

- Bitcoin surges towards the “$1 Trillion Milestone” as other crypto prices join the party!

- Ban Backfired in Nigeria: Bitcoin Selling at 36% Premium

- China’s cryptocurrency stocks slumped low by 16% in the bitcoin frenzy