Cryptocurrency has become a buzzword in the last decade, and it seems as if everyone is talking about it. But what exactly is cryptocurrency? How did it come into existence, and why has it gained such popularity over the years?

In this article, I will delve into the history of cryptocurrency and explore its rise to fame. The concept of digital currency has been around since the 1980s, but it wasn’t until 2009 that Bitcoin was introduced to the world by an anonymous individual or group known as Satoshi Nakamoto.

Bitcoin quickly became popular due to its decentralized nature and anonymity, which appealed to those who were distrustful of traditional banking systems. Since then, numerous cryptocurrencies have emerged on the market, each with their own unique features and purposes.

In this article, we will examine how cryptocurrency has evolved from a niche idea to a global phenomenon.

Key Takeaways

- Cryptocurrency was introduced in 2009 with Bitcoin as the first decentralized digital currency.

- Numerous cryptocurrencies have emerged on the market, each with their own unique features and purposes.

- Cryptocurrency has the potential to transform global finance due to its decentralized and borderless nature, allowing for greater financial inclusivity.

- Cryptocurrencies have faced significant regulatory challenges due to their association with illegal activities and lack of government regulation.

The Emergence of Digital Currency

You’re probably wondering how digital currency emerged and why it’s become so popular. It all started in the early 2000s when a new form of currency,

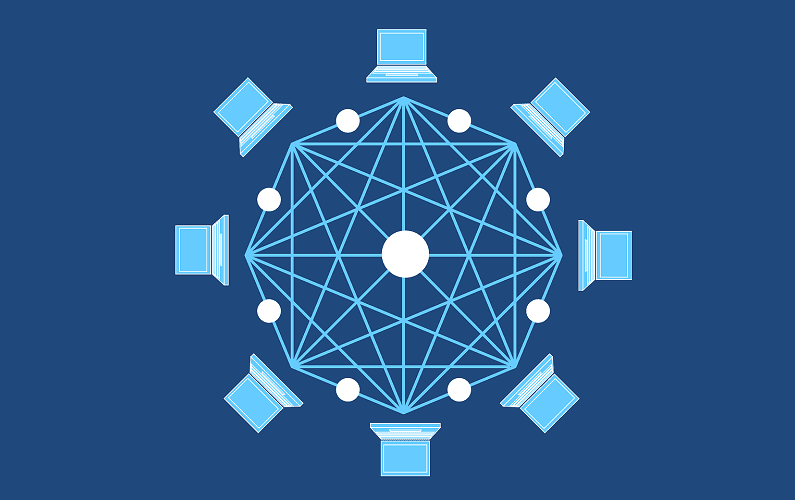

Bitcoin, was created by an anonymous person or group using the pseudonym Satoshi Nakamoto. This decentralized digital currency allowed for secure transactions without the need for intermediaries such as banks or governments.

However, it faced significant regulation challenges due to its association with illegal activities such as money laundering and drug trafficking.

Despite this initial setback, technological advancements in cryptography and blockchain technology have made digital currencies more secure and transparent.

This has led to an increase in their popularity among investors looking for alternative investment opportunities outside of traditional markets. The rise of other cryptocurrencies such as Ethereum, Ripple, and Litecoin has further cemented their place in the financial world.

Today, digital currencies are being embraced by individuals and businesses alike as a legitimate means of payment. Some countries have even gone as far as creating their own national digital currencies to reduce reliance on physical cash.

The emergence of digital currency may just be the beginning of a new era in finance that could revolutionize how we think about money forever.

The Rise of Bitcoin

I find it fascinating to discuss the rise of Bitcoin, the first decentralized cryptocurrency that emerged in 2009.

What makes this digital currency even more intriguing is that its creator remains unknown to this day, going by the pseudonym Satoshi Nakamoto.

Despite skepticism and initial hesitation, Bitcoin has grown into a global phenomenon with millions of users and a market capitalization in the billions.

The Unknown Creator Satoshi Nakamoto

Despite extensive investigation, the true identity of Satoshi Nakamoto, the creator of Bitcoin, remains a mystery.

Many theories have emerged about who this person or group really is, but none have been verified with concrete evidence. The lack of clarity around Satoshi’s identity adds an air of intrigue and mystique to the world of cryptocurrency.

Some people believe that Satoshi Nakamoto is actually a pseudonym for a government agency or intelligence organization. This theory suggests that Bitcoin was created as a way to track financial transactions in order to monitor criminal activity.

Others speculate that Satoshi Nakamoto is actually a team consisting of several individuals. This theory proposes that the creation and maintenance of Bitcoin required expertise in multiple areas such as cryptography and computer programming.

There are those who believe that Satoshi Nakamoto may be deceased, and that his/her/their identity will never be revealed. This adds another layer of mystery to an already enigmatic figure.

The unknown creator has left behind an enduring legacy, one which will continue to shape the future of finance and technology. As we move forward into uncharted waters in the world of cryptocurrency, it remains unclear whether we’ll ever uncover the truth behind this elusive figure known only as Satoshi Nakamoto.

The First Decentralized Cryptocurrency

Get ready to learn about the revolutionary creation that changed the financial game forever: the first decentralized cryptocurrency.

Bitcoin, created by Satoshi Nakamoto in 2009, was the first digital currency to operate on a decentralized network without any central authority controlling it. This means that no government or institution could manipulate or regulate Bitcoin’s supply and demand.

The benefits of decentralization were quickly recognized by early adopters who experienced firsthand how traditional banking systems can be slow, expensive, and insecure. With Bitcoin, transactions are fast and cheap as they don’t require intermediaries such as banks or credit card companies.

Additionally, users have full control over their funds without worrying about account freezes or confiscations by authorities.

The success of Bitcoin inspired other cryptocurrencies to emerge with similar decentralized models, marking the beginning of a new era in finance.

The Expansion of the Cryptocurrency Market

As I continued to explore the world of cryptocurrency, two key topics caught my attention: the introduction of altcoins and the growth of blockchain technology.

Altcoins are alternative cryptocurrencies that were created after Bitcoin’s initial success, such as Ethereum and Litecoin. The expansion of these altcoins has brought about new possibilities for investors looking to diversify their portfolios.

Additionally, blockchain technology has been increasingly adopted by companies in various industries due to its potential for secure and transparent record-keeping. These developments have significantly impacted the cryptocurrency market and will continue to shape its future direction.

The Introduction of Altcoins

You may be surprised to learn that altcoins were first introduced as a response to the limitations of Bitcoin. While Bitcoin was founded on the principles of decentralization, privacy, and security, it had its own set of weaknesses.

For instance, it lacked flexibility in terms of transaction speed and scalability. This led to the emergence of alternative cryptocurrencies or altcoins that aimed to overcome these drawbacks.

Today, the altcoin market has grown tremendously with over 5,000 coins available for trading. To understand why altcoin adoption has increased substantially in recent times, consider the following points:

- Altcoins offer lower transaction fees compared to Bitcoin.

- Altcoins have faster transaction processing times.

- Altcoins provide greater anonymity and privacy than Bitcoin.

- Altcoins enable more advanced features such as smart contracts.

- Altcoins are typically cheaper to mine than Bitcoin.

As a result of these factors, many investors and traders have shifted their focus towards exploring new opportunities within the altcoin market.

Despite being relatively newer in comparison with Bitcoin, several altcoins have already seen significant growth in value.

Therefore, it’s essential for anyone interested in cryptocurrency investments to keep an eye on both Bitcoin and altcoin markets for potential opportunities.

The Growth of Blockchain Technology

Nowadays, it’s hard to escape the buzz surrounding blockchain technology – with its potential applications ranging from supply chain management to digital identity verification. Blockchain is a decentralized ledger system that stores data in a secure and tamper-proof manner.

It first gained popularity as the underlying technology behind Bitcoin, but has since expanded to become an integral part of many other cryptocurrency projects. One of the biggest challenges facing blockchain innovation today is scalability.

As more users join the network, the amount of data being processed can quickly overwhelm even the most powerful systems.

To address this issue, developers are exploring different consensus models such as Proof-of-Stake (PoS) and Delegated Proof-of-Stake (DPoS), which aim to reduce the computational requirements needed to validate transactions on the network.

Despite these challenges, blockchain technology continues to evolve at a rapid pace and has already shown significant promise in disrupting traditional industries such as finance and healthcare.

The Controversies Surrounding Cryptocurrency

Despite its growing popularity, cryptocurrency has been the subject of numerous controversies.

One of the most pressing concerns is that a significant portion of Bitcoin users are associated with illegal activity. In fact, studies suggest that nearly 25% of all Bitcoin transactions involve criminal activity, ranging from drug trafficking to money laundering.

Regulatory issues have also plagued the cryptocurrency market from its inception. The decentralized nature of cryptocurrencies means that they’re not subject to government oversight or control.

This lack of regulation has led to instances where cryptocurrency exchanges have been hacked or shut down unexpectedly, resulting in massive losses for investors.

Security concerns are another major issue surrounding cryptocurrency. While blockchain technology is touted as being secure and tamper-proof, there have been instances where hackers have exploited vulnerabilities in digital wallets and other infrastructure to steal millions of dollars in cryptocurrency.

These incidents highlight the need for better security measures and education around safe storage practices for those investing in cryptocurrency.

The Future of Cryptocurrency

As I look into the future of cryptocurrency, I see vast potential for its integration into global finance. Its decentralized nature and ability to facilitate secure and fast transactions across borders have the potential to revolutionize traditional financial systems.

However, there are also a number of challenges that must be overcome in order for mainstream adoption to occur. These challenges include regulatory barriers and concerns surrounding security.

The Potential of Cryptocurrency in Global Finance

Cryptocurrency’s potential to transform global finance is undeniable. Its decentralized and borderless nature allows for greater financial inclusivity, which means that people who were previously excluded from the traditional banking system can now participate in global trade.

Cryptocurrencies such as Bitcoin and Ethereum have already gained significant popularity among individuals and businesses worldwide. For instance, some companies are accepting Bitcoin as payment for their products or services, while others are using it for cross-border transactions.

However, there are regulatory challenges in cryptocurrency adoption on a global scale.

Governments around the world have different approaches to cryptocurrencies; some countries have embraced them while others remain skeptical due to concerns about money laundering and tax evasion.

This lack of uniformity in regulations causes uncertainty among investors and businesses alike, which could slow down the growth of cryptocurrency’s potential impact on the global economy.

Despite these challenges, I believe that cryptocurrency will continue to gain traction as more people recognize its benefits and governments take steps towards regulating it properly.

The Challenges in Mainstream Adoption

You may feel like a fish out of water when it comes to navigating the challenges of mainstream adoption, as the road ahead is as bumpy as a rollercoaster ride.

One major barrier to widespread acceptance of cryptocurrency is regulatory challenges. Governments around the world are still grappling with how to classify and regulate digital currencies, which can lead to uncertainty and hesitation from businesses and investors.

Another obstacle in the way of mainstream adoption is public perception. Cryptocurrency has long been associated with illegal activities, such as money laundering and drug trafficking. While this association isn’t entirely unfounded, it has led many people to view cryptocurrencies with suspicion.

Additionally, high-profile hacking attacks on exchanges have caused many people to question the safety and security of digital currencies. Overcoming these negative perceptions will be essential for cryptocurrency to gain wider acceptance among the general public.

Conclusion

In conclusion, learning about the history of cryptocurrency has been an eye-opening experience. It’s fascinating to see how digital currency emerged from the need for a decentralized and secure form of payment.

The rise of Bitcoin showed us that it was possible for a new type of currency to gain mainstream acceptance, and this paved the way for other cryptocurrencies to enter the market. However, with its expansion came controversies as well.

From concerns over security breaches to issues with unregulated exchanges, cryptocurrency has faced its fair share of challenges. Yet despite these setbacks, there is still much excitement around the future potential of this innovative technology.

As I reflect on all that I’ve learned about cryptocurrency, it’s clear that this is more than just a passing trend – it’s a movement that continues to evolve and shape our world in unexpected ways. Who knows what new developments will emerge in this space? One thing’s for sure though – I’ll be keeping a close eye on it all!

READ NEXT

Previous Articles:

- How Much Money Do You Need To Start In Crypto?

- Bitso Introduces Innovative Solvency Proof with “Zero-Knowledge” Technology

- Binance.US Halts Dollar Deposits and Withdrawals Amid Regulatory Pressure

- How Cryptocurrency Works For Beginners?

- Commonwealth Bank of Australia Implements Anti-Fraud Measures, Blocks Payments at Cryptocurrency Exchanges