Table of Contents

Did you know that in just the last decade, Bitcoin, the first cryptocurrency, soared from a few cents to tens of thousands of dollars?

That’s the kind of stuff that can turn a pizza into a million-dollar meal if you paid for it with Bitcoin back in the day!

This makes a lot of people wonder, what really makes these digital coins valuable? If you’re reading this, chances are you’re scratching your head trying to figure out why something you can’t even hold can be worth so much.

Maybe you’ve tried to get in on the action, but the ups and downs of the market are giving you a real headache.

You’re not alone. A lot of folks find it tough to understand the whole cryptocurrency thing. It’s like you need to be a tech wizard and a finance guru all at once, and even then, the rules seem to change overnight.

In this article, we’re going to break it all down. I’m going to show you what’s behind the numbers and buzzwords, and by the end, you’ll have a clear picture of what drives the value of these digital currencies.

So stick with me, and let’s figure out this whole cryptocurrency value puzzle together.

Supply and Demand Dynamics

Cryptocurrency values really depend on how much people want them and how many are up for grabs.

People wanting to buy more usually means prices go up.

As someone who really likes the independence that cryptocurrencies provide, I’ve spent a lot of time getting to grips with what makes their prices change.

When lots of folks are looking to buy, it shows there’s a high demand, and this pushes up the prices.

Take Bitcoin, for example. It’s only ever going to have 21 million coins. This limit is like saying there’s only so much digital gold out there, making sure its worth isn’t watered down by making too many (like the FEDs are doing with the Dollar)

When there aren’t enough cryptocurrencies for all the interested buyers, the prices tend to shoot up.

Sometimes, the people behind a cryptocurrency will destroy some coins on purpose. Similar like the diamond industry destroys diamonds to keep the prices high.

This makes them even rarer, and can really make prices jump if more people want to buy at the same time.

The situation is always changing, with supply and demand bouncing up and down because of how people feel about the market, what investors are doing, and new tech developments.

Big-time investors (a.k.a Whales) can really swing things around. They’ve got a lot of money and can snap up a bunch of coins, pushing prices higher by showing there is demand and when the price is up to the point they like, sell them all causing the prices to fall.

Utility and Adoption

Cryptocurrencies get a lot of their worth from how useful they’re and how many people use them.

These things decide if a cryptocurrency is actually handy and if a lot of different kinds of users like it.

If a cryptocurrency becomes more useful, like being part of new apps or systems, often more people want it.

That happens because people are looking for cryptocurrencies that do more than just let them bet on prices going up or down.

For example, some tokens let people who own them make decisions about how a network should change. This can make more people want these tokens.

The big point is that when more people start using a cryptocurrency, it starts a “good cycle“.

More use means even more people will use it. This is important because even if a cryptocurrency is really new or smart, it only really matters if people use it for real things.

The mix of good technology and lots of people using it’s what can keep demand strong.

In short, for a cryptocurrency to do well, it’s not just about having a limited number of coins or fancy math.

It has to fix a problem, give people more freedom, and be something that lots of people want to use.

Market Sentiment Analysis

Getting a grip on market sentiment is key because it’s the overall mood of investors, which can really shake up the prices of cryptocurrencies.

Since the crypto market can be unpredictable, changes in how people feel can happen fast, affecting both how much is bought and sold and the price tag that comes with a crypto coin.

Here’s my simple game plan for keeping up with what the market feels:

- Gathering Data: I collect a bunch of info from places like social media, news sites, and mood indicators. This means looking at what’s hot on Twitter, Reddit, and other spots where folks chat a lot about crypto.

- Using Tools: I use software and tools that measure the market’s mood. By figuring out if people are mostly positive (bullish) or negative (bearish) about the market, I can guess better where crypto prices might be heading.

- Knowing the Crowd: Getting why people follow the pack and what pushes them to buy or sell helps me guess how they’ll react to big news, like changes in rules or new tech.

Competition and Alternatives

Paying attention to what people think about the market is important, but it’s just as key to see how different cryptocurrencies are always trying to do better than each other.

This isn’t just about the big names with the most value; it’s also about all the new and smaller coins, each finding their own way.

For example, in the DeFi space, there’s a lot of competition. Projects are fighting to get more money and people using them.

They all have different things they’re good at, like helping you earn more on your investment, borrowing against your assets, or having a say in how things are run.

This variety means people who want to be in charge of their own money can pick and choose to fit their own comfort with risk and how they want to invest.

New coins keep popping up, creating a place where each one has to prove it’s really useful to stick around. This keeps them on their toes because if they don’t get better, they could disappear.

Tokenomics and Distribution

When I’m checking out a new cryptocurrency or thinking about putting money into one, I make sure to look at two big things: tokenomics and how the digital money is handed out.

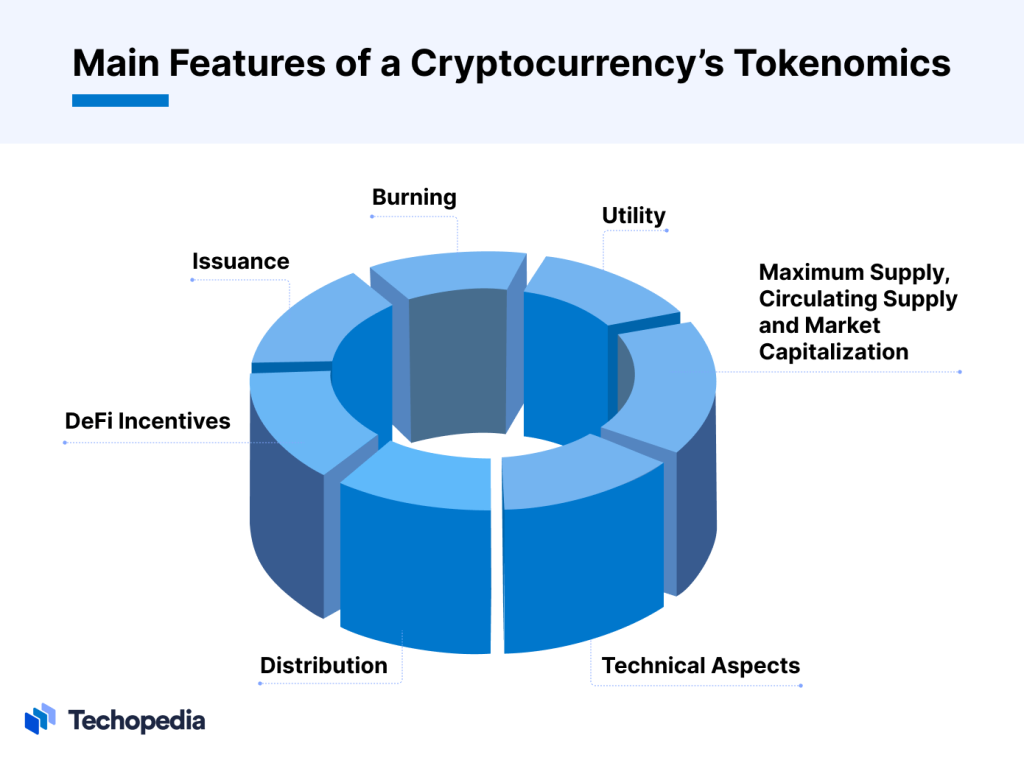

- Tokenomics refers to the economic system and principles that govern the behavior and value of a cryptocurrency or token.

- It involves the study of various factors such as token supply, distribution, utility, and demand.

- Tokenomics aims to create a sustainable and efficient ecosystem for the token, ensuring its long-term viability and value.

- It includes elements such as token issuance, token allocation, token utility, token governance, and token economics models.

- Tokenomics plays a crucial role in determining the token’s price, market cap, liquidity, and overall market perception.

These details really matter for figuring out if a token will stick around and be worth something down the road.

Here’s the lowdown:

- Max Supply: This is all about how many tokens will ever be out there. Keeping this number fixed can make the tokens more valuable over time, especially if more and more people want them but there aren’t any extra to go around.

- New Coins: This is the speed at which the system makes new tokens. You’ve got to strike a balance here. If you make too many, too fast, they could become less valuable because there’s just too many of them out there.

- Available Amount: How tokens get to people matters a lot. Whether it’s through giveaways, mining, or rewards for holding onto them, it’s got to be done right. You want to avoid a situation where just a few folks hold all the tokens, and everyone feels like they’re getting a fair shake.

Tokenomics and the way tokens are spread around are super important for any cryptocurrency. I’m always looking for systems that are steady and give people freedom. They’re what make people trust in the value and use of the tokens.

Regulatory Environment Impact

When thinking about how digital currencies work and how they’re shared out, it’s important to also look at how rules and laws are changing and what that means for the future and safety of the crypto market.

The influence of rules on the money value in the crypto world is huge.

Governments all over are trying to figure out how to fit these digital coins into the money rules we already have.

The SEC and the CFTC in the US are working hard to set the rules for how these digital assets should be handled.

Europe is rolling Markets in Crypto-Assets Regulation (MiCA) in an attempt to regulate the industry. Poland and Turkey too.

When the people in charge make the rules clear, it makes investors feel more secure, and more people might start using (thus buying) cryptocurrencies.

This kind of sureness can help the value of digital currencies because it lowers the worry about sudden, harsh rules that can hurt new ideas and stop people from joining the market.

But if the rules are too tough, they might kill the main idea of being free from control, and that could stop growth.

Following the rules can cost crypto companies a lot, and it could make it harder for them to come up with new ideas.

Big changes in rules can also make the market jump up and down a lot.

People who know the market well have to keep an eye on what’s happening with the rules and find a balance between wanting freedom and being practical by following the new rules.

This back-and-forth between being controlled and being free keeps affecting how people see the value of cryptocurrencies.

Final Words

In conclusion, cryptocurrency value is a multifaceted beast, shaped by supply-demand interplay, utility, market sentiment, competitive forces, tokenomics, and regulation.

As you can see there isn’t just one reason that drives the value in cryptocurrency up or down.

Understanding them is key for planning your next move.

READ ALSO

- What is Blockchain Technology?

- What Are Decentralized Exchanges (DEX) And How They Work

- What Does Hopium Mean In Crypto?

- What Is Bitcoin Halving – The Halving Explained (Litecoin/Bitcoin)