The main factor that will determine the value of XRP in 2021 and the fate of cryptocurrency in general will be the result of a lawsuit initiated by the US Securities and Exchange Commission (SEC), which accuses Ripple of illegal securities trading in the amount of $ 1.3 billion.

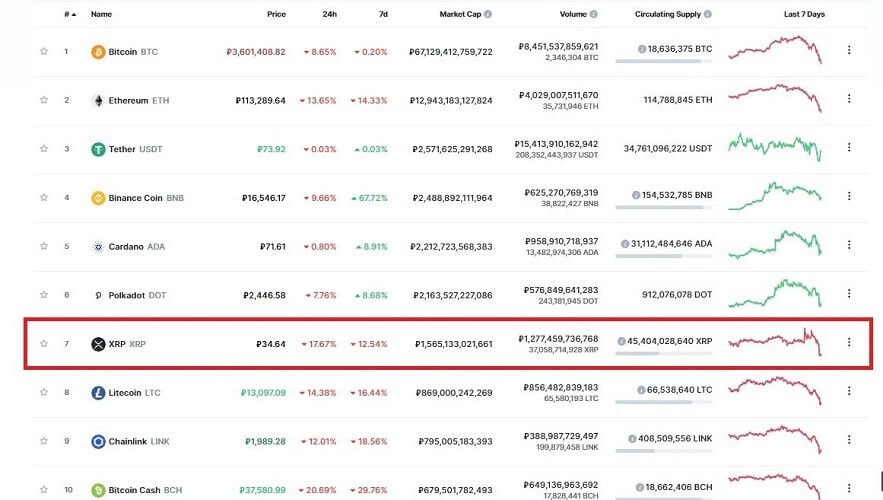

At the start of the bull rally, which began in the fall of 2020, XRP ranked third in the cryptocurrency rating and showed excellent growth potential, like the rest of the TOP coins.

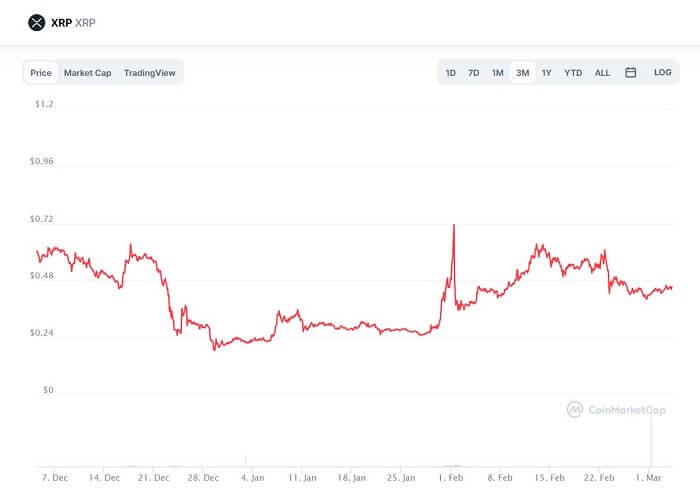

After XRP rose 192% to $ 0.78 in November 2020 in five days, it seemed to many experts and investors a real price of $1 when Bitcoin hit $20,000. However, the US Securities and Exchange Commission (SEC) lawsuit released on December 23, 2020 dashed all these hopes.

The Ripple company was accused by the regulator of an unregistered sale of securities under the guise of XRP tokens in the amount of $ 1.3 billion.

It cannot be said that this was a complete surprise because the SEC announced its plans for Ripple long before the lawsuit was filed. However, after this news, the XRP rate collapsed by 65% in a short time, the price at the moment was $ 0.17:

Ripple also lost its third place in the Crypto Market Capitalizations, which it held firmly over the years:

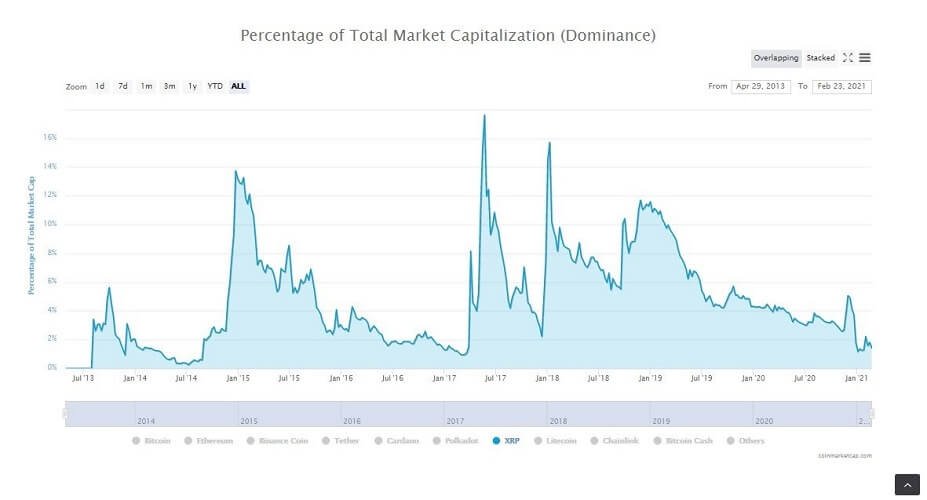

In addition, XRP’s dominance in the market has dropped significantly:

Shortly after the start of the lawsuit, many major exchanges stopped supporting XRP.

The next blow to Ripple was the severance of cooperation with one of its key partners – payment provider MoneyGram, to which Ripple paid large quarterly royalties for the development of the market.

In 2020, their amount was $ 38 million. But after a preliminary hearing in the case, which took place on February 22, the management of MoneyGram announced its refusal to use products based on XRP tokens.

The official reason is “regulatory uncertainty due to a dispute with the SEC”. However, in the situation of legal and reputational risks that MoneyGram received, it could hardly have been otherwise.

After all, due to the situation with Ripple, MoneyGram itself was involved in a lawsuit. Its investors, who purchased the company’s securities between June 17, 2019 and February 22, 2021, filed a class action claim that MoneyGram did not warn them about the possibility of recognizing the XRP token as an unregistered security.

Of course, given the above, the outlook for Ripple in 2021 looks bad. But does this mean that XRP will finally cede the market to its competitors like Stellar (XLM)? It is too early to talk about this for a number of reasons:

- Ripple is one of the TOP coins with huge trading volumes and a large community. Large capitals of investment bankers have been invested in it. Therefore, this coin has significant stability, and the Ripple team has resources to fight for the future of the startup. As a last resort, if need be, she will have the money to pay the fines.

- The Ripple team from the very beginning declared their disagreement with the actions of the SEC and their intention to fight for justice. The seriousness of these allegations was confirmed by the filing of a motion to dismiss the SEC lawsuit by Brad Garlinghouse, CEO of Ripple. Garlinghouse’s lawyers called the lawsuit unfounded, because earlier the Justice Department and the Financial Crimes Agency (FinCEN) recognized XRP as a virtual currency, requiring Ripple to monitor money laundering. This control does not apply to securities transactions.

- After Ripple became the target of persecution, it has not lost the loyalty of its community. On the contrary, users began to seek to “pump” XRP precisely because of the SEC claims. There was even created a telegram chat “Buy and hold XRP on February 1,” which now has about 200 thousand participants. Of course, psychology played its role here – the desire to support those who are “beaten”. In addition, people like to realize that their collective action can influence the situation.

- Although many regulated cryptocurrency exchanges have begun to refuse to work with XRP, it cannot be said that the delisting of Ripple has not become global in nature. Not all exchanges agree to delimit XRP and stop trading.

- No matter how things are in the United States, Ripple may continue to work in other countries. So, on October 10, 2020, Ripple announced a successful partnership with the Swedish bank SEB, when Ripple processed $ 180 million in international transactions between Sweden and the United States.

Now it is difficult to give an accurate forecast of the coin rate for 2021. The events in the market after the December drop testify to the resilience of Ripple even in the face of pressure from the regulator.

So, from the bottom of $ 0.17, XRP in a month and a half managed to grow to $ 0.71. True, then the rate decreased slightly, and by the beginning of March 2021 the coins were trading at about $ 0.45:

According to the latest information, Ripple and the SEC could not agree on a pre-trial settlement of the case, as a result of which the prospects for cryptocurrency remain uncertain.

On the other hand, the trial can drag on for years. It is difficult to say which side the court will eventually take. Ripple has good legal backing and strong arguments in its defense. But it is possible that political expediency may eventually prevail.

However, in the long term for 2021, especially if the company is able to resolve the dispute with the SEC, it is quite possible to expect the price to return to the resistance of $0.7, and if it breaks through, it will rise to $1 and above.

Previous Articles:

- India to reportedly outlaw crypto-miners and traders

- What On Earth Are NFTs? An Explanation Of The New Cryptocurrency Craze

- Why You Should Combine PR with IEO Marketing

- BlockFi receives $350M in growth capital for its booming crypto platform

- The Ether.Cards framework to launch on March 18th amid NFT Mania