The global economy has not entered the modern era as of yet. Luckily, there are tools to make this transition a bit easier. Even in the cryptocurrency industry, adopting new technologies is crucial to achieving decentralized solutions.

Transitioning from CEX to DEX

Centralized exchanges – or CEXes – are a go-to solution for people looking to trade cryptocurrencies. Even the drawbacks of using these platforms – no control over one’s funds and potential hacking attempts – aren’t sufficient to force users to go elsewhere. It remains strange to see so many crypto investors willing to hand over their private keys to [foreign] exchanges with no audit record or proof of reserves.

Polkadex, as a decentralized exchange or DEX, wants to address all the problems that centralized exchanges present to users. Moreover, the team has added some features that are useful to traders of any plumage.

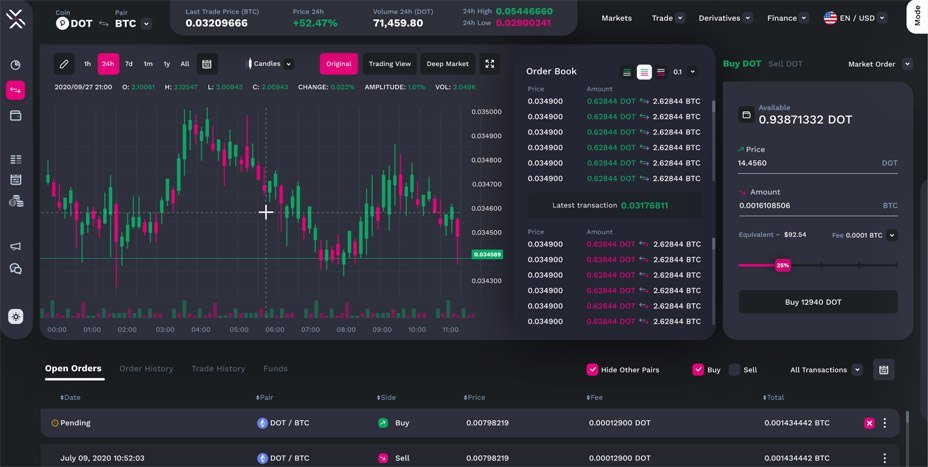

At its core, Polkadex is crafting a new kind of decentralized order book that can work across numerous blockchains. It allows traders and investors to access both cryptocurrencies and fiat assets at rates that have only been available on centralized exchanges. Offering a similar experience, but in a trustless environment, can propel the crypto industry to a higher appeal and adoption level.

The team is confident their platform will deliver speeds of 300 transactions per second, which is roughly double the processing requirements of some of the largest centralized exchanges today. In addition to fast transactions, the platform focuses on blockchain interoperability, which has been lacking in this industry. Polkadex’s approach to decentralized trading is worth a deeper look.

Polkadex makes decentralized trading more competitive

One of the biggest challenges for decentralized trading platforms is the price uncertainty associated with Automated Market Makers (AMM). Although the AMM model is popular among decentralized exchanges, we cannot underestimate the slippage related to this concept. Slippage depicts how the order size affects the “best price” at which a token can be bought or sold. A higher slippage will result in less profit potential for traders.

Using a traditional order book powered by an AMM pool, Polkadex addresses this inefficiency with its Fluid Switch Protocol. The protocol ensures that the order book and AMM are in sync and that the liquidity pool supports prices on the order book. As a result, all traders are more likely to be completed at favorable rates for traders. Eliminating slippage from the equation is a crucial step in the ongoing evolution of decentralized trading.

Moreover, the Polkadex team is intent on separating specific aspects of the protocol to improve the user experience:

“We believe that only those things that need public verifiability need to be on-chain. In Polkadex, Orderbook, Trader Assets Management, Bridge mechanism to Polkadot and Ethereum, and On-chain market making bots are On-Chain. Trading features like market data aggregation, technical analysis indicators, storage and retrieval of trade history, and all the remaining exchange related features are made off-chain.”

This design philosophy has allowed the developers to create decentralized trading tools that can eclipse centralized exchanges’ capability in terms of speed, pricing, and counterparty risks.

Benefits of this approach include better price visibility and more trading features. Enhancing the overall user experience to combine security with convenience is one of the main priorities as far as Polkadex is concerned.

The centralized conundrum

Two things have created an advantage for centralized exchanges: liquidity and “extra” trading features. A centralized exchange is a closed system with little public accountability. As such, its operators can create an environment where liquidity flows freely, and traders easily employ trading tools like automated trading (bots) and leverage.

Centralized exchanges also allow for high-frequency trading, contributing to their overall popularity. Even so, high-frequency trading is a mixed bag in terms of price discovery. At the same time, there is no doubt it has added a tremendous amount of liquidity to the established financial markets.

Investopedia states,

“High-frequency trading became popular when exchanges started to offer incentives for companies to add liquidity to the market. For instance, the New York Stock Exchange (NYSE) has a group of liquidity providers called Supplemental Liquidity Providers (SLPs) that attempts to add competition and liquidity for existing quotes on the exchange.”

While these centralized exchanges have been successful up to this point, that may not remain the case for much longer. As more institutional investors enter the crypto market, they simply can’t afford to take on the kind of counterparty risk that centralized exchanges present.

Due to these circumstances, larger investors are forced to use intermediaries that act as both a trading and custodial solution. Rather than adding liquidity to the markets via their holdings, early institutional adopters are essentially removing their tokens from the markets. Their funds are locked up in cold storage and aren’t generating any returns besides capital appreciation from overall market momentum. It is a viable approach, but not necessarily one that will benefit the industry as a whole.

Lower liquidity leads to more market volatility, an aspect that has prevented cryptocurrencies from entering the mainstream over the years. Decentralization is the way forward, assuming that we can create the necessary building blocks to smoothen this transition. DeFi solutions can eliminate counterparty risk and allow token holders to generate passive income from their tokens. However, even that model needs continual revisions.

In addition to counterparty risk, institutional investors use advanced trading algorithms on exchanges that provide fast transaction speeds. It can apply to decentralized exchanges too, but not in their current form.

The Next Step in the Evolution

Decentralized exchanges often suffer from low transaction speeds, price slippage, and the potential front-running of orders. Polkadex sees these problems as an opportunity and created its architecture to allow on-chain bot trading for anyone that uses the platform. Turning a weakness into an advantage is a sign of keen business sense.

Using these tools may appeal to new and existing institutional cryptocurrency investors. They can use existing algorithms to earn a profit by trading in decentralized markets. Without the kind of innovation that Polkadex is working on, larger traders and investors would likely avoid trading cryptocurrencies altogether. Additionally, existing participants would suffer from low liquidity without any sign of improvement on the horizon.

For non-institutional traders, Polkadex offers multiple benefits as well. The option to create custom trading algorithms will allow for more ideas to be shared with others. Additionally, they can tap into the high-frequency trading aspect popularized by centralized exchanges. They seem to be doing this in an environment supporting cross-chain interoperability, leading to bigger liquidity, and exploring new trading markets.