Cryptocurrencies, blockchain, tokens, digital wallets, HODL. These are some of the terms that dominate the cryptocurrency markets. If all these terms feel… Chinese to you, don’t stress as there are many others who feel the same.

Welcome to the world of cryptocurrencies, which may want to conquer the money markets, but it remains technically complex for most. In the following article we will try to explain in plain English some important terms of cryptocurrencies so you don’t get lost in translation.

So, here’s a list with 30 cryptocurrency terms explained in simple words that you should know.

Cryptocurrency Terms Explained

1. Algorithm

Coded instructions or rules that a computer executes to solve problems.

2. Altcoin

As Bitcoin is considered the first cryptocurrency to attract the spotlight, all the digital currencies that followed were labeled “altcoins”, meaning “alternative coins” or “alternative currencies”.

3. API

It is the acronym for Application Programming Interface. It is a set of tools, routines and protocols, etc., used in the creation of software applications. APIs define how software components interact, such as what data to use and what actions to take.

4. Bag

Used in the cryptocurrency language to describe a large amount of a particular cryptocurrency that one has in one’s possession. Less common is the use of the word for the contents of a digital wallet.

5. Block

Blocks contain information about transactions that are completed in a specific time period. They are synonymous with the digital pages of a “ledger”. They are sorted sequentially, with new blocks being added at the end of the chain.

Each block contains a reference to the immediately preceding block in the form of a hash. It is one of the key security features of blockchain technology, making it virtually impossible to forge the ledger.

6. Block Height

The block height is the sum of the individual blocks in each chain. The first block has zero height and is known as the first transaction (genesis block).

7. Blockchain

It is the basis of cryptocurrencies. A distributed ledger that records all transactions and smart contracts for a cryptocurrency.

In other words it is a correspondence (chain) of blocks or units of digital information stored in a public database. Think of a public ledger that is shared among all network users, with the goal of achieving transparency and stability. Instead of pages, the ledger has “blocks”, which are generated through mining and attached to the chain. If you want to dive deeper on what is blockchain technology, read this article.

8. Cypherpunk

The term “Cypherpunk” is used to describe any activist who advocates the widespread use of strong encryption and security-enhancing (data) technology as a means of achieving social and political change.

These informal groups of activists, who initially communicated through email lists that they compiled themselves, aim to protect privacy and security through the active use of cryptography. Cypherpunks have been organized into an active movement since the late 1980s.

9. Cryptocurrency

It is a decentralized digital currency that can be used to purchase goods and services, much like fiat money.

The word “cryptocurrency” comes from the encryption techniques used to secure the network. The first cryptocurrency ever released was Bitcoin, which was created in 2008 and released in January 2009.

10. Cryptocurrency Exchange

Cryptocurrency exchanges are websites or services that allow the exchange of digital crypto-currencies for crypto-currencies and vice versa, or the exchange of physical money (e.g. dollars or euros for crypto-currencies).

Two of the most typical examples of such exchanges are Kucoin and Binance. We also prepared a list with the best cryptocurrency exchanges – if you want to have a look.

11. Decentralization

Decentralization is a criterion by which to assess how much power a principal holder has. One can argue that blockchains are certainly much more decentralized than other methods of data distribution, as (at least in public chains) there is no gatekeeper to control who can participate: anyone who owns the computing power can become part of the blockchain.

12. Decentralized Finance – DeFi

What we were used to before cryptocurrencies is that almost all financial transactions involve an “intermediary”. For example, when a credit card transaction is conducted, the bank and the credit card company are involved. That is, there are some people who can control and block the transaction.

DeFi is based on the idea of a financial system that is not controlled by third party providers and is decentralized.

The most important applications have been built on the Ethereum platform. Through the utilization of “smart contracts”, the need for “intermediaries” is minimized or completely eliminated.

13. Decentralized Apps

These are computer applications that “run” through a distributed network of computer-nodes, rather than through a single server.

14. Distributed Ledger

It is the distributed ledger. It is a match that is often made on blockchain. Instead of a central ledger, the blockchain promises distribution of balances through a network of servers.

15. Fork

Think of a wire that in the process at some point splits in two and follows parallel directions. A fork, is an operation that creates an alternate version of the blockchain, allowing two chains to run in parallel in different areas of the network.

Bitcoin, for example, underwent a “hard fork” in August 2017 that led to a “split” into two cryptocurrencies, Bitcoin and Bitcoin Cash. After the “split”, those who owned Bitcoin were found to also own Bitcoin Cash.

16. HODL

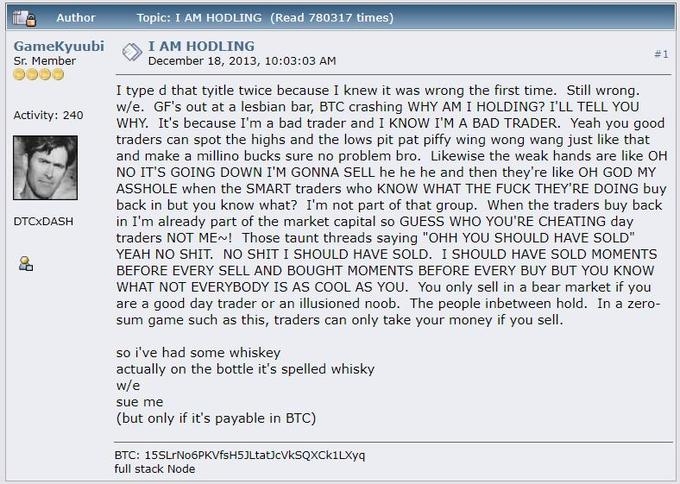

An anagram of the word “Hold” describing the investment “loyalty” of those who own cryptocurrencies and are not affected by short-term changes.

Derived from a typo in a comment made in 2013 by a user of a specialized bitcoin forum who certainly meant to state that he would not sell.

17. ICO

An initial coin offering (ICO) is the equivalent of an initial public offering (IPO), the initial public offering that a company makes to raise money by listing on the stock exchange. The difference is that through the ICO, cryptocurrencies are made available and not shares.

18. Mining

Typically, it is the process in which blocks are added to the blockchain to verify a transaction. It is also the process through which new bitcoins or certain altcoins are created.

More technically: Due to the encrypted nature of cryptocurrencies, verifying transactions requires a huge amount of computing power and specialized hardware. In exchange for the computing power, the people who solve (and thus approve) a transaction are paid in cryptocurrencies. This process is called mining.

Mining is a niche and competitive market where fees are split according to how much computation has been done. Not everyone does bitcoin mining and it is not an easy way to make money.

19. NFTs

Non-Fungible Tokens are in essence digital evidence of ownership.

Traditionally, cryptocurrencies, like “regular” coins, have the following property: each unit has equal value to the other units in circulation. There are, however, cases where the tokens do not all have the same value – usually when they are used as digital proof of ownership – and then we have Non-Fungible Tokens.

20. Node

This is the most basic element of the blockchain structure, where data is stored and transactions are passed through.

The node is responsible for authenticating transactions as well as maintaining and updating the distributed ledger.

There are different types of nodes, depending on the amount of data stored and the processing capacity.

21. Peer-to-Peer (P2P)

Peer-to-peer or P2P refers to a distributed network where “computing systems” communicate with each other to share data or actions. This means that in order to complete the process it is sufficient for two or more parties to agree and arrange to interact.

There is no need for a central server for communication to take place as participants in a P2P network deal directly with each other through a single point of mediation. Therefore there is no need for a bank as a third party for the transaction.

All parties are considered equal and enjoy the same privileges. The only requirement to access a P2P network is an internet connection and a copy of the software or protocol used.

22. Protocol

Protocol is the framework of rules that define the interactions on a network.

23. Satoshi Nakamoto

He is the man who invented Bitcoin, signed its white paper and the one who created the first blockchain database. Only we don’t know if he is one or many, if he is a man or a woman. Basically, we don’t know anything about the alleged creator of Bitcoin.

However, “Satoshi Nakamoto” is the nickname of the programmer or team of programmers who started it all and today we have a whole cryptocurrency market.

Since the creation of Bitcoin in 2008 until today, the nickname has been attributed to many cryptography and programming experts, however his real identity remains unknown, being the big secret of Bitcoin.

24. Smart Contracts

In essence, smart contracts allow for anonymous transactions and agreements between two or more parties that do not trust each other, without the need for mediation by an authority or any external mechanism.

It is a self-executing computer program where the terms of the agreement between buyer and seller are directly embedded in lines of code. In addition to cryptocurrencies (tokens or coins), some chains also support smart contracts.

The most prevalent form of smart contract network is Ethereum. Some contracts allow non-currency investment goods to change hands on the chain without the use of intermediaries.

25. Stablecoin

A cryptocurrency with extremely low volatility, which is also used as a portfolio diversification tool. Stablecoins are pegged to another asset such as the dollar or gold.

26. Token

In the “real” world a token is a chip, like the ones they give you in the casino. In the digital world of cryptocurrencies, a token is a digital unit that can be programmed, having its own base code that is associated with an existing chain.

Ethereum is the most common platform for token creation, mainly because of its “smart token” feature.

Tether, for example, is a token created on the Ethereum blockchain. What you need to know is that tokens primarily facilitate the creation of decentralized applications (DApps).

27. Whale

The term is usually used to describe those investors who own large amounts of cryptocurrencies and in particular those who are so large that they can theoretically manipulate the market.

28. Metaverse

Metaverse is a virtual world that allows users to enter that world. Inside the Metaverse, people can interact with each other through avatars. The term “Metaverse” was first used in Neal Stephenson’s science fiction novel Snow Crash.

Most of the virtual worlds that exist today are closed worlds, meaning that the only people who can enter and interact inside of them are those who have been invited or have been granted permission by the world’s creator. The Metaverse, on the other hand, is an open world that anyone can enter and explore.

29. Proof of Work (POW)

Proof of Work is a system that allows a person to prove that they have done work on a certain task. In the context of cryptocurrency, POW is used to verify transactions and prevent double spending. When a transaction is made, it is broadcast to the network where “miners” will then verify the transaction by solving a complex mathematical problem.

30. Proof of Stake (POS)

Proof of Stake on the other hand is a system where a person can prove that they own a certain amount of cryptocurrency. POS is used to verify transactions and prevent double spending. When a transaction is made, it is broadcast to the network where people who have staked their coins will then verify the transaction by solving a complex mathematical problem.

READ NEXT: Proof of Work vs Proof of Stake: What are their differences

Final Take

If you’ve made it this far, then you’re probably really interested in cryptocurrency investing. We hope we can help you make smart decisions, but in any case, remember that it takes a lot of caution!

Knowing and understanding the meaning of these words will help you navigate the world of crypto faster and easier. It will enable you to jump in conversations and understand a couple things or two more than others.