Table of Contents

Did you know that the Bitcoin network has experienced multiple forks, creating new cryptocurrencies like Bitcoin Cash (BCH) and Bitcoin Gold (BTG) and Bitcoin Satoshis Vision (BSV)?

If you’re puzzled by what this means or why it happens, you’re not alone. Many people find the concept of forking in crypto confusing and complex.

This article aims to clear up your confusion. By the end of it, you’ll understand what forking means in the context of blockchain technology, why it happens, and its impact on the crypto world.

So, let’s dive into the world of blockchain splits and make sense of it all.

Understanding Forking in Cryptocurrency

When it comes to cryptocurrency, forking is a critical concept that involves changes to a blockchain’s protocol. Understanding forking is important for recognizing how cryptocurrencies evolve and adapt over time.

Fundamentals of Fork

A fork in the world of cryptocurrencies refers to a divergence in the blockchain. It’s similar to a software update, but with a twist: it can create two separate paths for the blockchain.

This occurs when participants in the network disagree on a single version of the transaction history, leading to the need for a decision about the future direction of the cryptocurrency.

Types of Forks: Hard Fork and Soft Fork

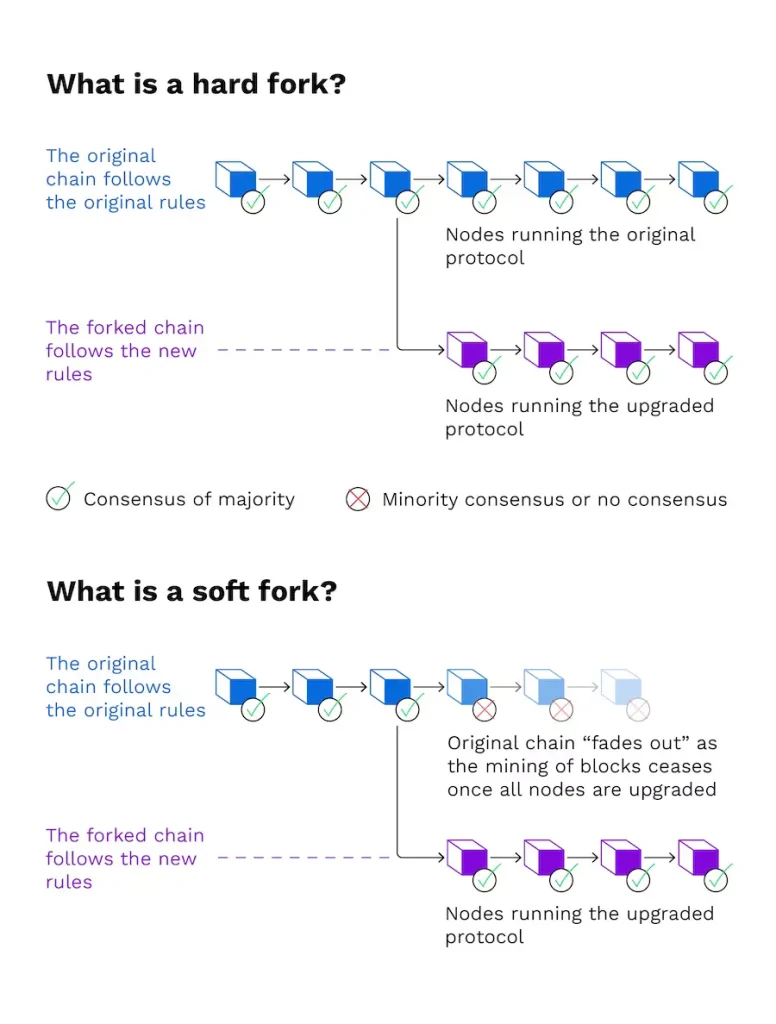

There are two main types of forks, each with a distinctive impact on the blockchain:

- Hard Fork: This is a permanent divergence from the previous version of the blockchain, and nodes running previous versions will no longer be accepted once a hard fork takes effect. A hard fork requires all nodes or users to upgrade to the latest version of the protocol software. It can create a new cryptocurrency, as seen with Bitcoin and Bitcoin Cash.

- Soft Fork: In contrast, a soft fork is more like a software upgrade that is backward-compatible. It’s a change to the blockchain protocol that is still compatible with older versions. With a soft fork, only one blockchain will remain valid as users adopt the update.

This illustration from Bitpanda. might help you better understand the difference between a hard fork and a soft fork.

Common Forks in Major Cryptocurrencies

Major cryptocurrencies like Bitcoin and Ethereum have experienced forks throughout their existence, influencing their development and the broader ecosystem.

Bitcoin Forks:

- Bitcoin Cash (BCH): This fork occurred in 2017 to increase the block size to 8 MB to improve scalability.

- Bitcoin Gold (BTG): Launched in 2017, this fork aimed to restore mining functionality with basic Graphics Processing Units (GPU), as the developers felt that mining had become too specialized.

- Bitcoin SV (BSV): Created in a 2018 hard fork of Bitcoin Cash, Bitcoin SV (Satoshi Vision) increased the block size to 128 MB.

Ethereum Forks:

- Ethereum Classic (ETC): After the DAO attack in 2016, Ethereum was split into Ethereum (ETH) and Ethereum Classic (ETC).

- The DAO Fork: This fork was executed due to a DAO (Decentralized Autonomous Organization) attack, which led to the loss of 3.6 million ETH.

- Homestead: The first planned hard fork on the network, it introduced several protocol improvements to enhance the system’s robustness.

- Metropolis: This upgrade was split into two phases: Byzantium and Constantinople. Both brought several technical improvements to Ethereum.

- Serenity (ETH 2.0): This is an ongoing upgrade to Ethereum that includes a shift from Proof of Work (PoW) to Proof of Stake (PoS) to improve scalability and energy efficiency.

Common Forks in Other Major Cryptocurrencies:

- Litecoin Cash (LCC): Forked from Litecoin in 2018, it increased the block speed to provide faster transaction confirmation.

- Monero Original (XMO): This is a fork of Monero that occurred when Monero’s developers changed its mining algorithm to counter ASIC miners.

- Zcash Classic (ZCL): This fork occurred when the Zcash team decided to change the underlying protocol to reduce the founder’s reward.

Here’s a cool 6-minute video I’ve found on YouTube that explains in an easy-to-understand manner what a crypto fork is:

Impacts and Outcomes of Forking

When a cryptocurrency forks, it can lead to significant changes in the blockchain ecosystem, potentially creating new coins, altering security protocols, and affecting market values.

Network Splits and the Creation of New Coins

A fork in a cryptocurrency can result in a network split, leading to the creation of a new blockchain.

For example, when Bitcoin underwent a hard fork in 2017, it led to the birth of Bitcoin Cash.

This new coin exists alongside the original, each with its distinct ledger and rules. Similarly, a split occurred with Ethereum, creating Ethereum Classic.

These splits give you, the coin holders, new assets equivalent to your holdings in the original network at the time of the fork.

Security Implications and Community Response

Forking can have critical security implications. New forks must establish robust security measures to maintain trust among users.

The community’s response to a fork can vary—some may support the change, while others oppose it, potentially leading to divided communities.

For example, the Ethereum community was split over a controversial decision to fork the blockchain after a significant heist (DAO Hack).

Market and Value Effects on Forked Coins

After a fork, the market may react in unpredictable ways. The value of both the original and new coins can be impacted, as seen with Bitcoin Cash, which initially started with high value but later fluctuated.

Investors and holders must weigh the potential risks and benefits of the market reaction to a fork. The introduction of a new coin can also dilute the value of the existing ones, as the fixed supply of the original cryptocurrency is now spread over more assets.

Technical and Community Driven Aspects

In the world of cryptocurrency, “forking” involves technical alterations and community decisions.

Understanding how developers and miners contribute to these forks, as well as handling community consensus and disagreements, is crucial for future innovations and protocol updates.

The Role of Developers and Miners in Forks

Developers are responsible for proposing changes to a blockchain’s protocol, suggesting new features or improvements that could streamline transactions or enhance security.

Miners, on the other hand, play a critical role in adopting these changes. They choose whether to update their systems to the new version of the blockchain protocol or continue with the existing one, essentially deciding the fate of the fork.

Community Consensus and Disagreements

Community members are key to achieving consensus. Without the majority agreeing on the proposed changes, a smooth implementation of updates is challenging.

Disagreements within the community can lead to a division, causing a fork where one blockchain continues as planned, while another diverges with different rules and philosophies.

Bottom Line

In conclusion, forking in crypto is a complex yet integral part of blockchain technology. It’s a process that allows for the development and evolution of cryptocurrencies, leading to the creation of new ones like Bitcoin Cash or Ethereum Classic.

Understanding forks can help you navigate the crypto world more effectively, as they often have significant impacts on a cryptocurrency’s value and functionality.

LEARN MORE

- What Creates Value in Cryptocurrency?

- What Is Zero-Slippage Trading?

- What is An Initial DEX Offering (IDO)?

- What Are Flash Loan Attacks?

- What Is Bcrypt Password Hashing Function?

Previous Articles:

- Gala Games Launches Rep Social Network on GalaChain

- 8 Must-Join Cryptocurrency Airdrops of 2024

- Friendzone Set to Launch on Polygon Blockchain

- Ronin’s (RON) Remarkable Recovery and Renewed Market Confidence

- TRUMP meme coin sees a significant rise, with trading volumes hitting $6.8 million in 24 hours.