WallStreetBets, the Reddit platform, which this year has become popular while the GameStop uproar is turning to crypto-miners.

Despite the board having a “no cryptocurrency” clause, it doesn’t prohibit consumers of cryptocurrency stocks. According to Bloomberg, this is absolutely what they are doing. The board’s conversations are focused on names such as Riot Blockchain (RIOT) and Marathon Digital Holdings (MARA).

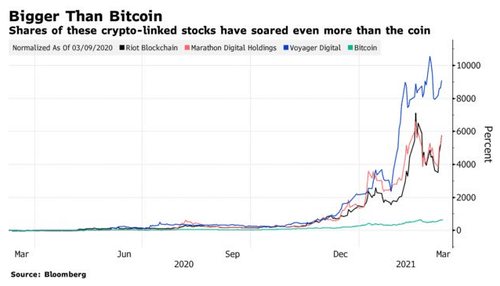

The reality that mining names returned vast amounts in excess of Bitcoin could be overlooked in the bitcoin bluster. As of March 12, both Marathon and Riot exceeded 7.600 percent improvements each year.

Topic users also derogated from the “NO Cryptocurrency” rule: “Oh, we can talk about RIOT now? Nice, I guess I can show this 16-bagger,” said one tweet. And even if the forum may not take the names off — they have watched the rise of bitcoin — it may continue to contribute to an increasing interest in names.

Cryptos seem like they’re going to continue popular, simultaneously. The impending listing of NASDAQ by Coinbase is valued at approximately $90 billion.

But rules of large numbers are going to come into force at some stage. Howard Wang, co-founder of Convoy Investments (Convoy Investments), a New York-based investment consultancy and consulting company, said: “Investors should understand the viable business model in a world where Bitcoin rates are not quadrupled year after year. Basically, bitcoin and mining investments are separate.”

And of course, putting a management team and a business above bitcoin brings extra danger to the existing risk of investment in bitcoin. “It’s very hard to do better than keeping up Bitcoin itself, honestly,” said Vijay Ayyar, Head of Asia Pacific with Luno crypto exchanges in Singapore. The possession of an asset versus the company producing this asset is completely different both in terms of expense and potential.’

The study identified gold miners as an indicator of this form of danger as a 40% decrease in the past decade and a 20% increase in gold.

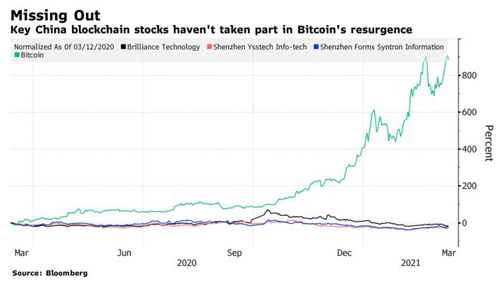

In addition, bitcoin mining is becoming a costly and energy-consuming sector over time. Locations like China’s autonomous Inner Mongolia have already forbidden the mining of cryptocurrency due to its energy drag. Chinese bitcoin miners such as Shenzhen Forms Syntron Knowledge Co., Shenzhen Ysstech Info-Tech Co., and Brilliance Technology Co. did not share this year, and the community was 12 percent smaller than it had been this year.

Moreover, this year’s Hindenburg Research said that China-based SOS Ltd. was an “obviously shell-based game in China.”

Previous Articles:

- Ripple (XRP) Forecast for 2021: Is There Any Prospect for Growth?

- India to reportedly outlaw crypto-miners and traders

- What On Earth Are NFTs? An Explanation Of The New Cryptocurrency Craze

- Why You Should Combine PR with IEO Marketing

- BlockFi receives $350M in growth capital for its booming crypto platform