- BNP Paribas has made a strategic investment in BlackRock’s iShares Bitcoin Trust ETF (IBIT).

- The move positions BNP Paribas ahead of many US wealth and pension funds in adopting Bitcoin-based investment products.

- BNP Paribas invested approximately $40,000 in the Bitcoin ETF, a modest amount compared to its $600 billion in assets under management.

- This investment marks one of the first instances where a major European bank has ventured into Bitcoin exposure via an ETF.

- The BlackRock iShares Bitcoin Trust ETF has accumulated over $200 billion in traded volume, indicating robust market confidence and investor appetite.

BNP Paribas, a major European banking institution with over $600 billion in assets under management, has recently made a strategic move into the world of cryptocurrencies.

The bank has acquired exposure to Bitcoin, the world’s leading digital currency, through an investment in BlackRock’s iShares Bitcoin Trust ETF (IBIT).

A Modest Yet Significant Investment

While the investment amount of approximately $40,000 may seem small compared to BNP Paribas’s vast asset pool, the move is significant.

It marks one of the first instances where a major European bank has ventured into Bitcoin exposure via an exchange-traded fund (ETF). This investment reflects the escalating acceptance of cryptocurrencies among conventional financial entities.

Positioning Ahead of the Curve

By acquiring Bitcoin exposure through BlackRock’s ETF, BNP Paribas has positioned itself ahead of many US wealth and pension funds in adopting Bitcoin-based investment products.

This move could potentially set a precedent for other institutions to follow, leading to a new wave of adoption in the cryptocurrency market.

Surging Investor Confidence

The BlackRock iShares Bitcoin Trust ETF has experienced substantial success since its introduction earlier this year. To date, it has accumulated over $200 billion in traded volume, setting a benchmark for the product and illustrating robust market confidence and a strong appetite among investors.

Further insights from BlackRock suggest that investments in ETFs are set to expand, with potential upcoming allocations by sovereign wealth funds, pensions, and endowments.

Robert Mitchnick, BlackRock’s head of digital assets, highlighted the ongoing discussions and educational efforts at these institutions, indicating a sustained interest and a proactive approach toward embracing Bitcoin.

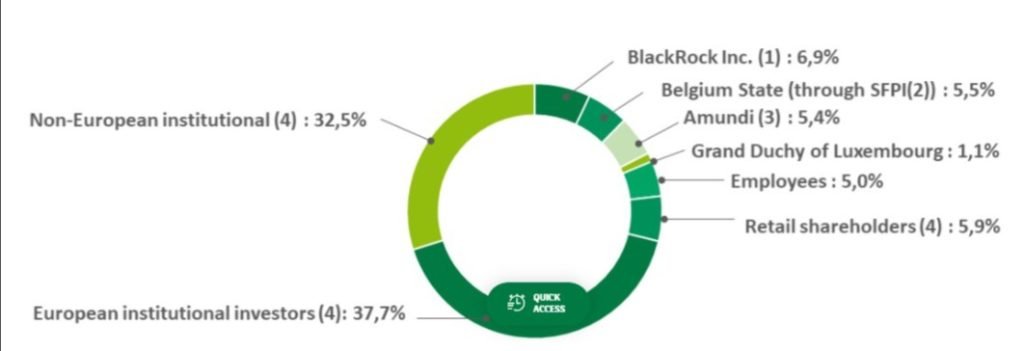

It’s important to mention that BlackRock, the world’s largest asset manager, holds a significant stake of 6.9% in BNP Paribas.

LATEST POSTS

- Bitcoin FilmFest Turned Warsaw Into The Capital of Independent Cinema and Sound Money

- Australian Securities Exchange Set to Launch Bitcoin ETFs by 2024

- 8 Hosting Providers To Buy Hosting With Monero (XMR)

- SEC Charges Crypto Mining Firm Geosyn Mining with Fraud

- Solana Prepares for Major Network Update to Address Congestion Issues

Previous Articles:

- Bitcoin FilmFest Turned Warsaw Into The Capital of Independent Cinema and Sound Money

- Australian Securities Exchange Set to Launch Bitcoin ETFs by 2024

- 8 Hosting Providers To Buy Hosting With Monero (XMR)

- SEC Charges Crypto Mining Firm Geosyn Mining with Fraud

- Solana Prepares for Major Network Update to Address Congestion Issues