An army of thousands of developers, in every corner of the globe, find themselves with… keyboards in hand.

The suspense is building up as the long-awaited software update “The Merge” of the second largest cryptocurrency, Ethereum is going alive.

This upgrade, dubbed “merge”, one of the largest in the cryptocurrency space, is expected to have a huge impact on the entire ecosystem.

How big you might say?

If all goes well, analysts say, it’s possible that Ethereum – which was founded by Russian-Canadian billionaire Vitalik Bouterin, even “dethrone” Bitcoin from its position as the most valuable cryptocurrency and even be adopted by official state authorities.

But if something goes wrong, it is likely to undermine the already damaged credibility of the entire cryptocurrency world, with dramatic consequences for the industry, which lost $2 trillion in the immediate past.

And why is this upgrade so important?

Experts say that the main “asset” that the upgrade will give Ethereum is the fact that it will cut the cryptocurrency’s power consumption by… 99%!

Even this alone is capable of making a difference, not only because in times of hard times for power waste, Ethereum consumes annually more energy than New Zealand, or Chile, or, to be more clear, Ethereum consumes about twice as much energy as Greece consumes every year!

This update is not a new idea.

It’s been many years that developers have been planning these changes to the Ethereum blockchain, a multi-billion dollar ecosystem that includes cryptocurrencies, NFTs, games and applications.

The new changes, which will make Ethereum more viable, easier to use and friendly, have generated excitement among cryptocurrency fans, as they believe it will spark a round of widespread adoption, even by central banks, as it will provide an “avenue” for automating transactions and other processes with secure protocols that will make it easier for financial institutions.

It is, in other words, the next step expected for blockchain which is currently used mainly for the creation of speculative financial products.

After this update, moreover. Ethereum will “get rid” of miners, the professionals who “mine” cryptocurrencies, using entire “farms” with thousands of powerful computers that solve puzzles to be rewarded with cryptocurrencies as proof-of-work.

With the new system, which will be called Proof of Stake and will begin to be implemented on ether around September 15, only those who put in 32 Ether, worth $55,000 based on its current value, will participate to be rewarded for the evolution of the blockchain.

With PoS, transactions on the ethereum blockchain will be authenticated not by computers, but by a network of investors who will prove their “loyalty” to the system by holding at least 32 Ether.

This idea makes sense, as the guarantors of the system’s good functioning will have a financial incentive to preserve the security of the network and, therefore, are unlikely to try to sabotage it.

This, unlike Bitcoin transactions (which use PoW), is a system successfully used by a number of cryptocurrencies competing to Ethereum, such as Solana and Cardano.

And it’s not just cryptocurrency fans who hope so, or believe so. ING, in a note to investors, says that the merger may help Ethereum become accepted by regulators, noting that this, in turn, “may provide the necessary impetus for traditional financial institutions’ intention to evolve ethereum-based services.”

The risks

However, not everything is rosy when it comes to Ethereum. That’s because on the whole, the merger can help improve the image of cryptocurrencies and attract, in addition to retail and institutional investors, but it is not a… miraculous process.

The “shadows”, from the use of cryptocurrencies in illegal activities and money laundering, as well as doubts about the success of the process itself exist.

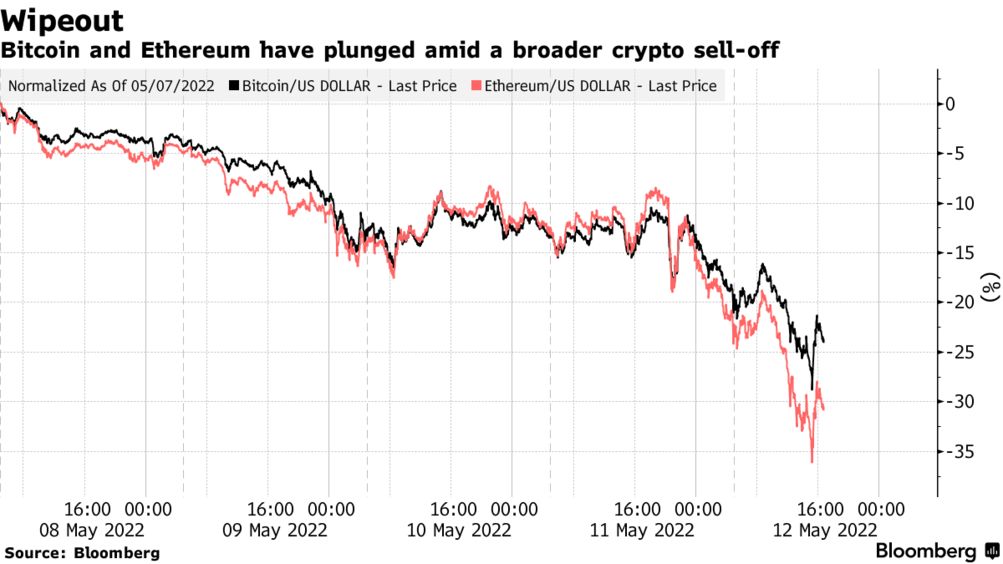

The spectacular collapse of Ethereum’s main competitor, Luna, which caused a “crypto-winter” and the bankruptcy of Celsius and other lenders to the cryptocurrency ecosystem, don’t help gain confidence, either.

A fact evidenced by the fact that already – despite the 100% rally – Ethereum suffered a similarly dramatic decline as Bitcoin, driving up to $876 in mid-June, returning today to around $1,700.

And if there is caution from investors and authorities, there are also risks. Even if no technical problem occurs and the merger goes well, there is a risk that it will be “sabotaged” by those who are most affected: The mining companies.

Experts say they may cause the new system to be destroyed, or create a “fork”, the process by which a smaller “child” blockchain is created that allows transactions to continue with the old system. Which would negate the main advantage of the new ether, the lower power consumption.

If all goes well, the ecosystem will take another major turn in Ethereum’s journey towards “Ethereum 2.0”, another major update, expected to happen in 2023.

And while if you type “Ethereum merge” into Google you will see a clock counting down, in reality this is the biggest test of Ethereum’s “life”, which will largely decide the future of cryptocurrencies…

Previous Articles:

- El Salvador’s Large losses in Bitcoin Brings it Closer With Bankruptcy

- Fidelity Investments to introduce 34 million customers to bitcoin

- Why Is Cryptocurrency Becoming More Widely Used By Businesses?

- Starbucks Will Use Polygon (MATIC) as the underlying technology for its Starbucks Odyssey Loyalty program

- Vitalik Buterin: Ukraine may become next Web3 hub