- House Financial Services digital asset subcommittee suggests lighter regulatory approach focusing on CFTC oversight for spot crypto markets.

- Proposed solution includes creating a joint SEC-CFTC self-regulatory organization for crypto exchanges.

- SEC exemptions for digital assets currently limited to Regulation S and D, restricting access to offshore or wealthy investors.

- Former CFTC Chair advocates for SEC-led initial regulatory framework over congressional action.

- Industry players urge immediate action on basic exchange regulations rather than waiting for comprehensive legislation.

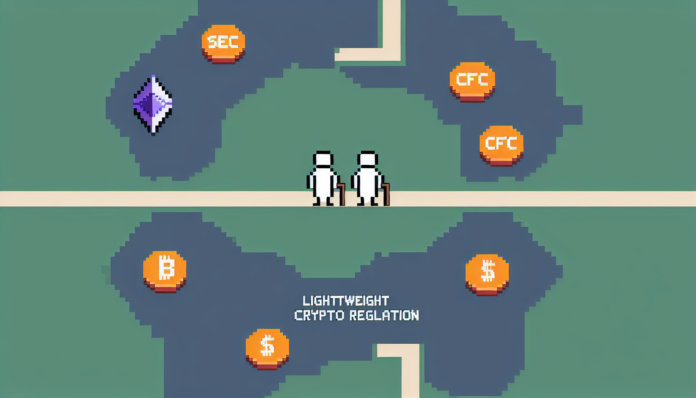

The House Financial Services digital asset subcommittee’s recent hearing revealed a potential streamlined approach to crypto regulation, focusing on delegating spot market oversight to the Commodity Futures Trading Commission (CFTC) while establishing a joint regulatory framework with the Securities and Exchange Commission (SEC).

Coy Garrison, former counsel to SEC Commissioner Hester Peirce, outlined existing regulatory pathways for digital asset issuance. Currently, issuers primarily utilize Regulation S for offshore investors or Regulation D for accredited investors, effectively limiting retail participation in the U.S. market.

The concept of a self-regulatory organization (SRO) gained traction during the hearing. Committee Chairman French Hill explored the possibility of a joint SEC-CFTC overseen SRO to streamline crypto exchange regulation. “Any type of communication between the two agencies and coordination on regulations would make sense,” Garrison affirmed.

Former CFTC Chairman Timothy Massad advocated for SEC-led initial regulation, noting the practical advantage of requiring only three commissioner votes compared to 60 Senate votes. However, Jonathan Jachym from Kraken Digital Asset Exchange countered this approach, emphasizing the urgency for basic exchange regulations: “We cannot wait any further… We are talking about the most basic, foundational rules of regulating centralized exchanges.”

The proposed lightweight regulatory framework would include:

– CFTC authority over spot crypto markets

– Formation of a joint SEC-CFTC self-regulatory organization

– SEC clarity on digital asset classification

– New exemptions for digital asset issuers

– Implementation of Commissioner Peirce’s recent regulatory proposals

Garrison highlighted the importance of clear guidance for regulated entities, particularly regarding how traditional financial intermediaries can engage with both security and non-security digital assets. This includes creating pathways for broker-dealers, investment advisers, and clearing agencies to participate in the crypto ecosystem.

While stablecoin legislation remains a priority, the hearing suggests a parallel track for market structure regulations could emerge, potentially accelerating the development of a comprehensive U.S. crypto regulatory framework.

✅ Follow BITNEWSBOT on Telegram, Facebook, LinkedIn, X.com, and Google News for instant updates.

Previous Articles:

- South Korea’s Sogang University AI Lab Adopts Theta EdgeCloud for Advanced Language Research

- Thailand’s Border Crackdown Frees Over 300 From Myanmar Crypto Scam Centers

- Bitcoin Drops Below $95K as January Inflation Data Exceeds Expectations

- Higher-Than-Expected January Inflation Data Sends Bitcoin Below $95K

- Bitcoin Whales Emerge as Critical Support Level Despite Price Stagnation Below $100K