Bitcoin, the world’s most popular cryptocurrency, has lost more than half its value since April. In particular, it recorded a drop of more than 55% from its historic high of nearly $65,000 on April 14.

Bitcoin has been trading for the past seven weeks between $31,500 and $40,500. On May 15, it fell below the 20-week average, dragging with it the least popular cryptocurrencies.

The past shows that when Bitcoin is below the 20-week average, altcoins (all cryptocurrencies except Bitcoin) find it difficult to climb back up, let alone reach new highs.

This is the situation that prevails today. And despite what financial experts say, there is no bear market on the horizon.

In fact, the opposite signs dominate… Bitcoin becomes stronger and stronger, day by day.

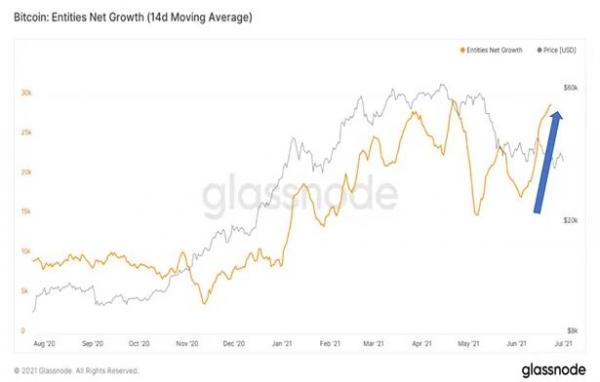

More than 34,000 new investors enter its market every day, which lends credibility to the view that the post-April plunge is only a routine correction.

The mathematical models used by Glassnode to identify investors in the blockchain confirm the growth.

Factor #1: Whales Are on A Buying Spree

Bitcoin’s “whales” (investors who own 1,000 or more Bitcoin) continue to buy. “Whales” are important for the cryptocurrency market, as their ”firepower” can affect it in a variety of ways.

According to the latest data, large investors have stopped selling and are strengthening their portfolios. This means that they see the current situation as a buying opportunity and estimate that prices will soar again.

Factor #2: Bitcoin Disappears From Exchanges

Experienced crypto traders usually do not leave their assets in cryptocurrency exchanges, as this contradicts the basic principles of cryptocurrencies. On the contrary, many investors keep their cryptocurrencies in safer places, such as offline digital wallets.

In general, a significant increase in the volume of digital currencies in exchanges can be seen as a bear market sign, as it shows that investors are preparing to sell.

On the contrary, removing assets from cryptocurrency exchanges is an indication that investors are likely to retain their positions. That’s the situation today, as more than 31,000 Bitcoin disappeared from the platforms in a single day the past week. That’s a bullish sign.

Factor #3: The Puell Multiple

Miners are the backbone of the Bitcoin network and their behavior often reveals the direction of the market. This includes the Puell multiple, which is calculated as the ratio of the current daily volume of Bitcoin produced and valued at the current purchase price to the moving daily average of the value of Bitcoin exported in the last 365 days in dollars.

The Puell multiple provides information about possible purchase and sale zones based on historical data.

The green shaded box in the chart below shows periods when the daily issue value was extremely low. When the Puell multiple (orange line) sinks to this level, it represents an excellent buying opportunity.

The black line reveals the price of Bitcoin and you can see that investors who bought these periods were rewarded in the long run with big to unreal profits.

Looks like the Puell multiple is back in the green box. And if Bitcoin is about to rise, it’s bound to drag altcoins with it.

The awakening of the cryptocurrency market that has been talked about for months has already begun…

Bitcoin, altcoins, and blockchain technology will change our daily lives, from buying a home or paying taxes, to paying for goods and services. As people realize that these changes have begun, the price of Bitcoin – and the strongest altcoins – will reach new highs.

Previous Articles:

- Binance Burns Almost $400 Million Worth Of BNB Tokens

- ESP Project seeks to Disrupt the Education system, DeFi, and Renewable Energy

- How to Wisely Invest in Cryptocurrencies?

- Apple Rumoured To Have Bought Bitcoin worth $2.5 Billion

- Ethereum: London’s hard fork is just around the corner