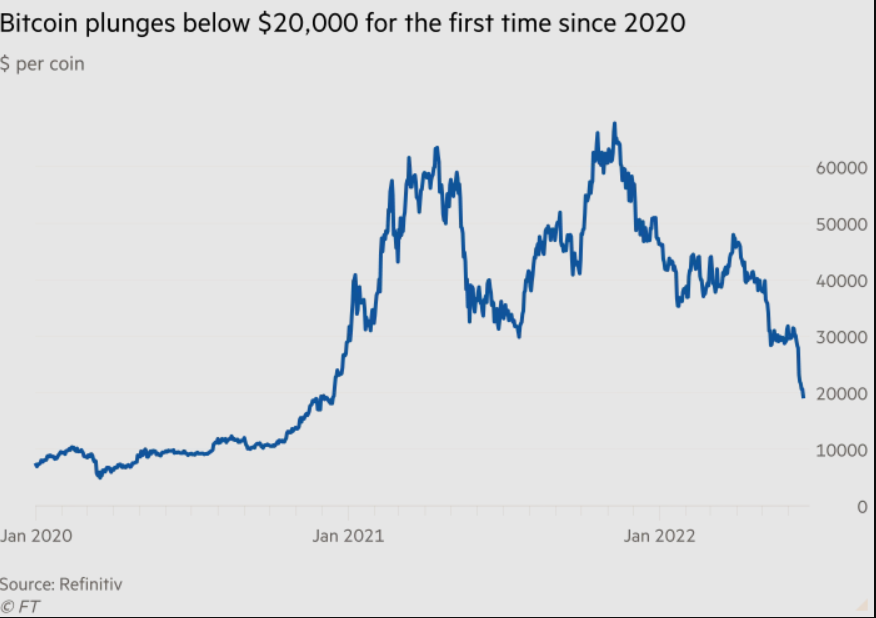

Bitcoin, broke the $20,000 zone for the first time since November 2020, which now risks triggering a new wave of selling, which will deepen the crisis plaguing the digital asset sector.

The top-ranked cryptocurrency by market capitalization, which serves as a benchmark for the broader market, fell below $18,000 on Saturday, dropping about 14%.

That drop drove it below the peak level of the previous bull market in 2017, eliminating years of gains for long-term investors.

You may recall that traditional financial markets were shaken this week after the Federal Reserve, the ECB and the BOE raised borrowing costs in an effort to reduce inflation.

On the other hand, global equities have seen their worst days since the outbreak of the coronavirus crisis in March 2020, with traders worried that an upgrade in monetary tightening by central banks could hit global growth or even cause a recession.

In this dystopian environment, understandably the crypto market is under particularly intense pressure, triggered by the massive stimulus efforts of central banks and governments, has come to an abrupt end.

Investors and analysts have been anxiously watching the price of bitcoin in recent days, fearing that a drop below $20,000 could lead to massive liquidations of leveraged positions, putting even more pressure on the price and exacerbating the credit crunch that has already hit major crypto lenders and traders.

Last week Celsius and Babel Financial blocked withdrawals while Three Arrows failed to cover margin calls of millions. Last month, luna and terra – two tokens popular with crypto traders seeking extremely high returns – crashed.

“The domino effect kicked in,” Conor Ryder, an analyst at research and data firm Kaiko said Friday. “Further declines will likely cause more downward price action, resulting in a liquidation blitzkrieg.”

Bitcoin has lost more than 70% of its value since its historic highs last fall as investors are fleeing the markets due to the tightening attempted at the monetary policy level by policy makers.

In this environment, cryptocurrency market capitalization has fallen below $1 trillion from a peak of $3.2 trillion.

The price of ethereum has also fallen below $1,000. Smaller exchanges have also reduced or halted withdrawals, while Toronto listed crypto platform Voyager on Friday signed a deal to borrow more than $200 million from trading firm Alameda.

“Today’s actions give Voyager,” said Stephen Ehrlich, CEO. “The credit facilities will only be used by Voyager if it needs to safeguard customer assets,” he added. Ryder expects the further decline in the markets will put more pressure on other lenders and dealers.

Previous Articles:

- PRD Marketing Group Surpasses Milestone In Their NFT Press Release Marketing Division

- How the fall of Celsius and the next day came about

- Midas Investments Review: My Thoughts After 6 Months Investing With Them

- Musk and his companies sued for Ponzi-type fraud on Dogecoin

- EUROC is launched, a stablecoin with 100% coverage in euros