What Terra Luna’s performance shows and how the new blockchain, with its smart contracts technology, works on price fluctuations. The climb of decentralized stablecoins like UST and the rise of the DeFi sector.

Terra has climbed into the top ten in terms of market capitalization in recent months. A relatively new blockchain developed in 2018 by South Korean Terraform Labs and entered the market in 2019, with Luna as its currency.

Today Luna is worth $50 (43.5 euros) and its capitalization stands at 20 billion.

As recently as December 27, the price of one Luna had surpassed $100, setting an all-time high of $103.34.

I wonder if being at half the price is a buying opportunity or is there something alarming going on? Let’s take a look, starting with what the Terra is.

How Terra works

Terra has an umbrella of twelve stablecoins, which are cryptocurrencies that maintain a fixed exchange rate with the dollar (UST), the euro (EUT) and the Korean won (KRT) and other assets.

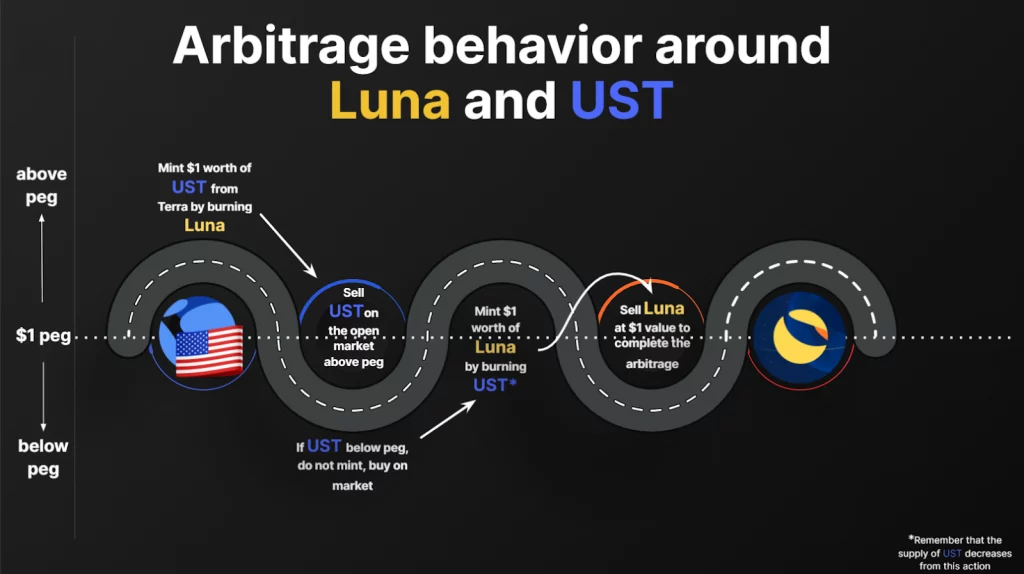

It is a protocol that issues decentralized stablecoins, which with the help of smart contracts technology has created a mechanism that automatically adjusts to market price fluctuations.

How does it do it? It is structured in such a way that their price is automatically stabilized by a flexible currency bidding mechanism, ensuring that their prices remain linked to their underlying assets.

Let’s look at Luna and UST, the stablecoin that has a locked parity with the dollar.

If UST shows increased demand, then its price will also rise, for example 3%. However they don’t want that because they need to be in proportion – a UST to a USD.

So what do they do? They increase the amount of tokens available so that the price will balance.

If instead the price of Luna goes up, their holders have every incentive to convert their tokens into USTs, selling them at the highest market price.

They are selling something that temporarily has a price of $1.03, while its value is $1. This again reduces the available quantity and at the same time the holders make a profit on the difference.

In our example, 3%.

The percentage may sound small, but if we consider that this is a profit that is the product of arbitrage, we realize that it is worth it.

But how does Luna’s value go up like that?

Because the money transferred into the ecosystem helps it grow.

As more people buy UST, the demand for Luna – which acts as collateral – will increase and vice versa.

The incentive to buy Luna arises from a number of reasons. The first is that you believe Terra will grow. Another reason is that you wish to be involved in decisions concerning the network.

Anyone who owns 50 Luna has the right to submit a proposal. In order to pass, it is required to vote 40% of the committed coins and get 50%+1 of the votes.

The next reason is that you need it to make transactions within the ecosystem, as this is the currency required for any action. Therefore the demand for Luna depends on the interest in using it.

The growing demand for smart contracts, integration with various blockchain and stablecoins platforms, as well as the rise of the DeFi industry is expected to create additional demand for Luna as time goes on, at least as its friends argue.

Tellingly, in early 2021 it had just two decentralized applications and now, with the help of its developers, it has triple-digit numbers for NFTs and DeFi.

How Did It Grow so Abruptly? Two Main Reasons.

- One is that Terraform Labs was able to raise $150 million from investors this past summer to fund its effort. Indeed, 2021 was of all the crypto ecosystems the one that added the most developers to its workforce.

- The second reason, according to Do Kwon, a young co-founder and CEO of Terraform Labs, is that the community enthusiastically welcomed the decentralized money that Terra was able to achieve with the idea of algorithmic stablecoins.

Korean-born Do grew up in Canada, studied at Stanford and served as a software engineer at Microsoft and Apple.

Unlike other stablecoins, those issued by Terra are not backed by dollars or any other sovereign currency like Tether or USDC, but by Luna and smart algorithms that achieve stability in the exchange rate.

It sounds risky, but it has an advantage: there is no central authority behind it like the others. Whatever is issued by a company, it has the power that traditional banks have over our funds, such as freezing them, seizing them or even losing them through bankruptcy. These risks are avoided in decentralized schemes.

Are the algorithms and this mechanism in general reliable? So far yes, although those who have attempted similar projects to date have failed, such as Titan. Where have they failed? In that they had no incentive to own the token. They acquired it with the intention of selling it at a higher price.

If you are a UST holder, you can deposit them at Terra Station or Anchor Protocol and receive extra coins as a reward.

An Alternative Version Of POS

Terra is based on a variant of Proof-of-Stake (PoS). It uses DPoS (Delegated Proof-of-Stake), meaning only selected validators approve transactions and add blocks to the blockchain. To become a validator there are certain requirements in terms of the number of coins that must be held in escrow for at least three weeks.

There is no minimum number of coins, however there is a limit to the number of validators, it is 130. Anyone who wants to become a validator must have enough coins to be one of the largest 130 holders.

In order to meet the required amount, cooperation with others is allowed. The pledged amount serves as a guarantee. If a validator acts in bad faith, he loses his money.

After the upgrade under the name Columbus 5, Terra gained new improved features:

- A percentage of Luna will be “burned” every time a stablecoin is created. This means that under certain conditions, the total supply of Luna can be reduced!

- Nearly doubled validator fees, as a portion of the fees will be directed towards them. This will increase the incentive for someone to become a validator, and thus acquire and commit more Luna.

- It provides additional support to the blockchain built by Cosmos, whose protocol is designed to interact with other blockchains.

- Increase the block size so that it can hold more transactions. In this way they plan to multiply the speed, making it more efficient.

The Climb of UST

The key variable for the price increase is the demand for stablecoins like UST. This will depend on its reliability, i.e. managing to keep the exchange rate stable one-to-one during crises. Once this is ensured, the rise in demand will come from an increase in its use in trading.

A major challenge is whether it will be able to compete with Visa. As exaggerated as it may sound, the likelihood of it standing up to it is not small, as its presence so far in Asian countries such as South Korea, where it already has 2 million active users, has proven.

The maximum fee is 1%, although in practice it turns out to be much lower. It therefore has a comparative advantage over cards such as Visa which charge the merchant 2-3%.

If the merchant is willing to accept cryptocurrencies for payment, why wouldn’t they prefer Bitcoin or Ethereum? To avoid price fluctuations that can potentially hurt them. By accepting payment on Terra’s network, they receive a currency with a locked exchange rate with the dollar, euro or any other they wish.

Yes, but we know Visa has the advantage of speed of transactions. It processes an average of 1,700 TPS (Transactions Per Second), with the potential to go up to 24,000 TPS.

And yet Terra doesn’t go back. It has the potential to perform 5,000 TPS. Ethereum currently handles about 12 TPS.

Here to add another element. Do Kwon has hinted that some kind of deal is imminent with the South Korean government, but without revealing more as he is legally bound.

The second challenge concerns decentralized DeFi protocols. Whether they will prefer UST over other established stablecoins.

A third issue concerns the legislation that is expected to be enacted regulating the operation of stablecoins. It is likely to apply to centralized tokens such as Tether and USDC, but will it necessarily require that there be dollar backing, which Terra does not have?

UST is the stablecoin with the highest growth rate. If it eventually manages to become the largest stablecoin, the price of Luna is expected to multiply. In what way? By making it easier to use and more attractive to own. If it’s safer than the others and gives you more interest (like Anchor does), why use any other?

A major role in its widespread adoption is planned to be played by the Transak app, which allows you to buy and sell UST directly from your card or e-banking. And all at a low cost. Transak is available in several European countries and will soon be available in the US.

Previous Articles:

- The First Decentralized Blockchain-based Hunting Metaverse launched by MetaShooter

- NFT Sellers Buy Their Own Digital Items To Drive Up Prices

- The Best Investment Options Are At IDOWall.com

- Should Canadian Gamblers Be Worried About Cryptocurrency Gambling?

- Russia vs Metaverse: Russian Authorities Assessing Potential Risks