With the close of another quarter, you might find yourself pondering the intriguing trajectory of the NFT market and its prospective course for 2024. As we transition into a new phase, questions naturally arise about the recent calm in the NFT arena and what lies ahead on this remarkable journey.

Amid this period of relative peace, exploring the underlying factors that shape the NFT landscape becomes important. So, let’s delve into the state of the NFT market during Q2, unraveling its nuances and dynamics.

Moreover, we’ll shed light on the seemingly peaceful phase of Q3 and unearth the underlying reasons for its subtleness.

As we traverse this terrain, we’ll unlock insights into the NFT realm’s opportunities and unveil the potential trajectory it may carve out in 2024.

The State of NFTs in 2023 or Q2

While the first quarter of 2023 offered an unclear glimmer of hope for the NFT market, showcasing notable growth in total trading volume compared to recent strong quarters, the outlook for the second quarter is notably less optimistic. So, what happened to NFTs?

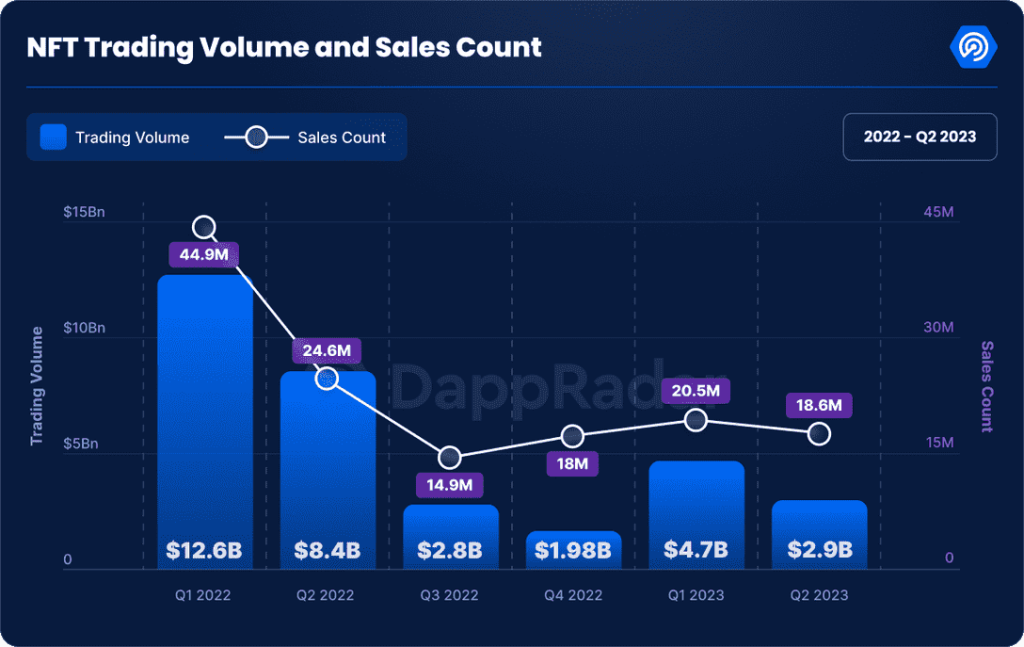

The trajectory of the NFT market in Q2 hints at a potential downturn, with trading volume experiencing a 38% decrease, amounting to $2.9 billion.

Furthermore, considering the span from January to July, there was a significant 49% decline in NFT sales.

Still, it’s crucial to steer clear of directly correlating trading volume with the level of market enthusiasm. A decline in trading volume doesn’t automatically signify a decline in market interest or activity. This concept is substantiated by the fact that Q2 still saw 18.6 million in sales, indicating a decrease of 9.2%, all of this based on a report from DappRadar.

The drop in NFT sales can be attributed to the fact that more than 80% of the popular NFT collections were not being used for trading in 2023.

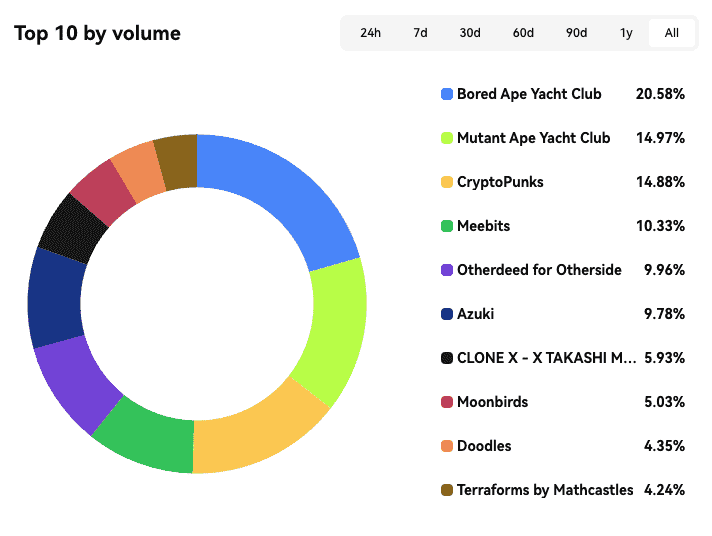

This makes sense because big collections like Bored Ape Yacht Club, Mutant Ape Yacht Club, CryptoPunks, and Meebits usually contribute a lot to the market.

Together, they make up over 60% of all NFT trading. Since these collections are not being traded as much as before, it’s no surprise that the NFT market has gone down.

However, there were some positive aspects despite the disappointing data. The Polygon network experienced a significant increase in activity, with 772,424 traders participating.

While Polygon, Solana, and Cardano have previously shown growth compared to Ethereum, it’s important to note that Ethereum still holds the top position in terms of trading volume.

Out of various blockchain networks, Solana saw the biggest drop in trading activity in the second quarter (Q2). The trading volume decreased by 78.6%, going from $184.91 million in the first quarter (Q1) to $39.66 million in Q2. This decrease can be partly explained by the fact that major Solana collections, namely DeGods, and y00ts, moved to Ethereum and Polygon, respectively.

And here are some positive aspects despite the disappointing data. The Polygon network experienced a significant increase in activity, with 772,424 traders participating.

So, we can notice a slight shift towards other blockchains for NFT minting than the classic Ethereum, which we can be happy about.

NFTs in Mainstream Media and Pop Culture

To better understand the current state and future trajectory of NFTs, as well as to gain insights into their recent trends in Q2 2023 and possible upcoming opportunities, it’s essential to explore their realm more deeply and enhance your understanding of this technology.

Although NFTs initially found their footing within small online communities, they have since outgrown those limits. Today, NFTs have seamlessly integrated into mainstream media and pop culture.

Despite initial reservations about certain aspects, the significance and purpose of NFTs within mainstream media and pop culture have become unmistakably evident.

NFTs have shattered traditional norms in the entertainment industry by offering a new dimension of ownership and engagement. What was once confined to physical galleries and venues now has a digital home on the blockchain.

How’s that? In today’s context, notable figures like musicians Grimes and The Weeknd, alongside acclaimed artist Beeple, have enthusiastically embraced NFTs to engage with their fan bases directly.

For instance, Grimes made millions by selling a collection of digital artworks as NFTs in 2021, and The Weeknd introduced an NFT album granting buyers exclusive content and experiences.

These examples highlight how NFTs enable celebrities to offer unique content and experiences to their fans, blurring the lines between digital art, music, and connecting with followers.

Additionally, some of these NFTs are gifted to fans through NFT giveaways and airdrops, symbolizing more than just money-making art pieces — they represent a strong connection between artists and their audiences — a cornerstone for their legacy.

Challenges and Criticisms – Regulatory Landscape

NFTs becoming a part of mainstream and pop culture didn’t sit well with everyone, as expected. As artists embraced technology, it brought forth challenges and regulations. This is evident through numerous examples that can be highlighted.

For instance, GameStop‘s entry into the NFT domain initially garnered attention with its marketplace aimed at supporting crypto games. However, as the NFT market’s activity weakened, the retailer backtracked and announced its intention to halt support for its own crypto wallet. This decision was attributed to the “regulatory uncertainty of the crypto space,” a common explanation among companies facing challenges due to evolving regulations.

This move coincided with increased enforcement actions by the SEC under Chair Gary Gensler and occurred after CEO Matt Furlong’s departure. This highlights businesses’ difficulties in navigating NFT-related initiatives amid changing regulations and market dynamics.

And remember, this is just one example in a market where such cases are increasingly common.

And the discussion and criticism of NFTs don’t stop there. Many other criticisms of NFTs often concern the following issues:

1. Investor Protection and Scams

The NFT market’s rapid growth has led to investor protection concerns. The lack of comprehensive regulations has left room for fraudulent schemes and scams, where unsuspecting buyers may be tricked into purchasing counterfeit or non-existent NFTs.

2. Market Manipulation and Speculation

NFT markets, like any emerging asset class, can be vulnerable to market manipulation and speculation. Price volatility and rapid price increases have prompted regulators to monitor potential market abuses, such as pump-and-dump schemes, where coordinated efforts artificially inflate prices before crashing them.

3. Intellectual Property and Copyright

The integration of copyrighted content into NFTs has raised complex intellectual property concerns. Artists, brands, and content creators are exploring the NFT space to monetize their digital works. However, using copyrighted materials without proper authorization has led to disputes and legal challenges. Striking a balance between enabling creative expression and respecting intellectual property rights remains a critical challenge for both NFT platforms and regulatory bodies.

4. Cross-Border Regulations

The global nature of NFT markets has prompted discussions about cross-border regulations. As NFT transactions can occur across different jurisdictions, harmonizing regulatory approaches becomes crucial to prevent regulatory arbitrage and ensure consistent investor protection standards.

NFTs as an Investment

Let’s circle back to the NFT market’s recent trajectory and highlight the lack of significant sales for the most sought-after NFTs. This aspect reveals an important facet of NFTs beyond challenges and criticisms – their role as investments.

The reason these prized NFTs haven’t been moving as briskly in recent months is quite straightforward, and it’s not something terrible – the market is currently in a downturn, making it unwise to sell these valuable assets at lower prices. This underscores that many individuals view NFTs as investments (they don’t sell them because they don’t make a profit now, and they trust that their NFT will appreciate more). But that’s not the only takeaway.

In NFTs, there’s also the opportunity to acquire them for free through NFT airdrops without substantial involvement or financial commitment. These airdrops, often occurring during a project’s early stages, are aimed at attracting public attention. Obtaining these airdropped NFTs is akin to an investment strategy, as recipients often do so with the anticipation of profiting when the project gains recognition.

If you think this perspective on NFTs being seen as investments is one-sided, it’s worth noting that many venture capitalists share this viewpoint. Notably, big names like Andreessen Horowitz and Paradigm, renowned managers of cryptocurrency venture funds, have begun making direct investments in NFTs. Furthermore, many specialized fund managers have raised substantial amounts, totaling tens of millions of dollars, for new funds focused on NFTs.

So the attribute of NFT as an investment has to be considered to justify what happened with NFTs.

Predictions for 2024

As we stepped into Q3, traditionally characterized by a quieter period in the crypto and NFT markets, it’s important to temper expectations for instant explosive growth.

Q3 typically witnesses vacation breaks and reduced news consumption, creating a build-up phase for those seeking opportunities.

However, an intriguing trend emerges: the longer this accumulation phase persists, the more it sets the stage for a dynamic 2024 marked by a potential explosion in NFT prices.

The growing influx of brands, events, projects, and artists into this space further fuels the anticipation for a remarkable 2024, drawing from the accumulations made over time. Amidst this, true investors are strategically accumulating assets during this phase, and the involvement of prominent names amplifies the optimistic sentiment within the NFT market.

For those uncertain about where to start or hesitant to risk their own funds, numerous projects offer the allure of obtaining free NFTs. By exploring these opportunities, individuals can gain insights into the trajectory of the NFT market, potentially providing a glimpse into what the landscape might hold in 2024.

Previous Articles:

- Opinion: Can Cryptocurrency Replace Money?

- Bitcoin ETF Approval on the Horizon: Industry Leaders Confident in SEC’s Green Light

- PayPal Steps into Crypto: Introducing PYUSD Stablecoin Backed by Confidence

- Can I Buy Cryptocurrency In India? Yes, Here’s How.

- Cryptocurrency Analyst Raises Alarming Concerns Over Huobi’s Financial Stability