The world of cryptocurrency trading is constantly evolving, and with it, the methods used to predict price movements. As technology continues to advance, so too do the tools available for traders.

One such tool is analytical AI agents – computer programs designed to analyze market data and make predictions about future prices.

In this article, we will explore how these agents work, their different types and applications in cryptocurrency trading, as well as their benefits and limitations. We will also delve into how they have impacted the crypto market so far and what kind of impact they may have on the industry in the future.

What Are Analytical AI Agents?

Analytical AI agents are computer programs that use artificial intelligence algorithms to analyze large amounts of data and generate predictions about future price movements. The idea behind these agents is that they can help traders make more informed decisions by analyzing complex market trends, such as the relationships between different cryptocurrencies or macroeconomic factors like consumer confidence.

How Do They Work?

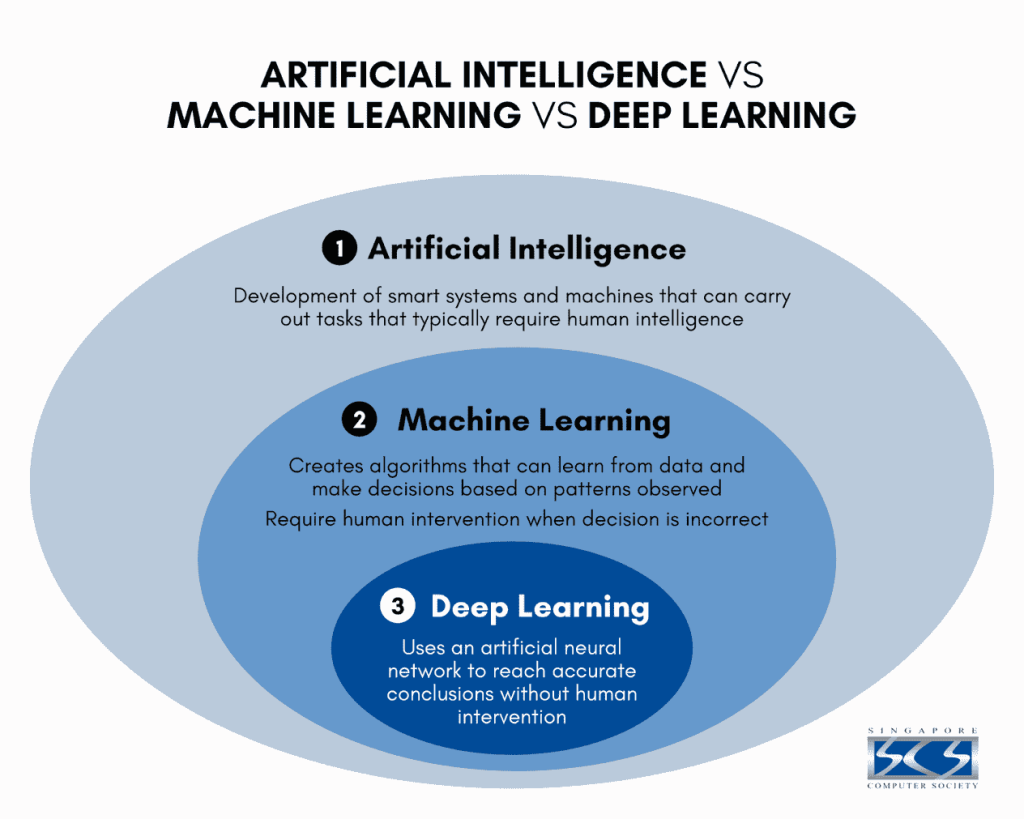

Analytical AI agents use a variety of methods to analyze data. These include natural language processing (NLP), machine learning (ML), and deep learning (DL).

Natural Language Processing (NLP)

Natural language processing (NLP) is a field of AI that concentrates on comprehending human languages, making it possible to communicate with machines. NLP technologies enable machines to process and analyze natural language data, such as text or speech, to extract meaning from it. These technologies are used in analytical AI agents to interpret written or spoken market data and predict future cryptocurrency price movements.

Machine Learning (ML)

Machine learning (ML) is a type of artificial intelligence that focuses on the development of computer programs that can learn from data, identify patterns, and make decisions without being explicitly programmed to do so. Analytical AI agents use ML algorithms to process large amounts of market data and detect patterns in order to make predictions about future price movements.

Deep Learning (DL)

Deep learning (DL) is an even more advanced form of machine learning that utilizes networks of artificial neurons to process data. Analytical AI agents use these networks to analyze large amounts of market data and generate predictions about future cryptocurrency prices. DL algorithms are also used to create predictive models which can be used to identify trends in the market and make more accurate predictions.

The Impact of Analytical AI Agents on the Cryptocurrency Market

As an ever-evolving landscape, the crypto market has seen the introduction of new technologies that have significantly impacted its dynamics.

One such development is the integration of accurate analytical AI agents, which are transforming the way investors and traders approach the market.

Let’s explore the impact of these AI agents on the cryptocurrency market, focusing on areas such as price prediction, risk management, and market sentiment analysis.

Price Prediction

The volatile nature of cryptocurrencies often makes price prediction a challenging task for even the most seasoned investors.

Analytical AI agents have emerged as a powerful tool in this regard, utilizing machine learning algorithms to analyze historical data and identify patterns that can inform future price movements.

These AI-driven predictions have the potential to provide investors with valuable insights that can inform their trading strategies, leading to more informed decision-making and potentially higher returns.

Risk Management

Managing risk is a critical aspect of investing in the cryptocurrency market, where fluctuations in value are common.

Analytical AI agents can assist in risk management by continuously monitoring and analyzing market conditions, identifying potential threats, and suggesting optimal portfolio adjustments.

By automating this process, investors can reduce their exposure to market risks and improve the overall performance of their portfolios.

Market Sentiment Analysis

Understanding market sentiment is essential for investors looking to make informed decisions in the cryptocurrency market.

Analytical AI agents have proven to be adept at analyzing vast amounts of data from various sources, such as social media, news articles, and discussion forums to gauge public sentiment toward specific cryptocurrencies.

These AI agents can help investors identify potential market trends and make more informed investment decisions by providing a comprehensive overview of market sentiment.

Trading Bots and Algorithmic Trading

The use of AI-driven trading bots and algorithmic trading strategies has become increasingly popular in the cryptocurrency market. These bots leverage machine learning algorithms to execute trades based on predefined parameters, ensuring that investments are made at optimal times and prices. As a result, human error is minimized, and traders can capitalize on fleeting market opportunities.

How to Use Analytical AI Agents for Trading Cryptocurrencies

Using analytical AI agents for trading crypto can seem daunting at first. Here we’re sharing a quick step-by-step guide to help you get started:

Step 1: Research Analytical AI Platforms

Before diving into the world of AI-driven cryptocurrency trading, it’s essential to research various analytical AI platforms available in the market. Look for platforms that offer robust AI-driven tools, including price prediction, risk management, market sentiment analysis, and algorithmic trading. Compare their features, ease of use, and pricing structures to find the platform that best suits your needs and budget.

Step 2: Set Clear Trading Goals

Determine your trading objectives and risk tolerance before using an analytical AI agent. Are you looking for short-term gains, or do you want to build a long-term portfolio? Establishing clear goals will help you customize the AI agent’s settings to align with your investment strategy and risk appetite.

Step 3: Choose Your Cryptocurrencies

Select the cryptocurrencies you want to trade and monitor using the analytical AI agent. It’s advisable to diversify your portfolio with a mix of established and emerging cryptocurrencies to minimize risk and maximize potential returns.

Step 4: Configure the AI Agent

Configure the settings of your chosen AI agent according to your trading goals, risk tolerance, and selected cryptocurrencies. This may involve adjusting parameters for price prediction algorithms, setting risk management thresholds, or customizing sentiment analysis filters. Make sure to read the platform’s documentation and tutorials to understand how to optimize the AI agent’s performance.

Step 5: Monitor Performance and Adjust Settings

Once you’ve set up your analytical AI agent, monitor its performance regularly. Keep an eye on the accuracy of price predictions, the effectiveness of risk management strategies, and the overall performance of your portfolio. If necessary, adjust the AI agent’s settings to improve its performance or better align with your evolving goals and market conditions.

Final Thoughts

Analytical AI agents are revolutionizing the way we predict and trade cryptocurrencies. By leveraging machine learning algorithms, these AI agents can analyze vast amounts of data to provide accurate price predictions, sentiment analysis, risk management strategies, and algorithmic trading services. With the right analytical AI platform in place, investors can leverage cutting-edge technology to stay ahead of the game.

Read Next

- Interview with Denis Sklyarov — Co-founder and CEO of WiFi Map App

- 5 Best Hacking eBooks for Beginners

- AI creators should pay for news content used in their products, says News Corp CEO

- Artificial Intelligence and Cryptocurrency: Separating Hype from Reality

- How Futuristic Artificial Intelligence is Transforming the Financial Industry?

Previous Articles:

- What Are Smart Contracts?

- Interview with Denis Sklyarov — Co-founder and CEO of WiFi Map App

- LooksRare upgrades to v2, reducing fees by 75% and implementing new features

- Polygon Emerges as Second-Largest Blockchain Gaming Network with Massive User Surge

- Reddit’s Third-Generation NFT Avatars Hit the Polygon Blockchain