Until recently we knew that the undisputed leader in the NFTs market was OpenSea. The marketplace that had the highest trading volume. However, nothing stays the same for long in the crypto space, let alone the even newer space of NFTs.

First of all, though, we should highlight the renewed interest in the NFTs market, as sales made on the Ethereum blockchain alone exceeded $1 billion in value for the first time since May 2022.

With one difference, as mentioned above.

That this time OpenSea is not the venue where most of the purchases were made.

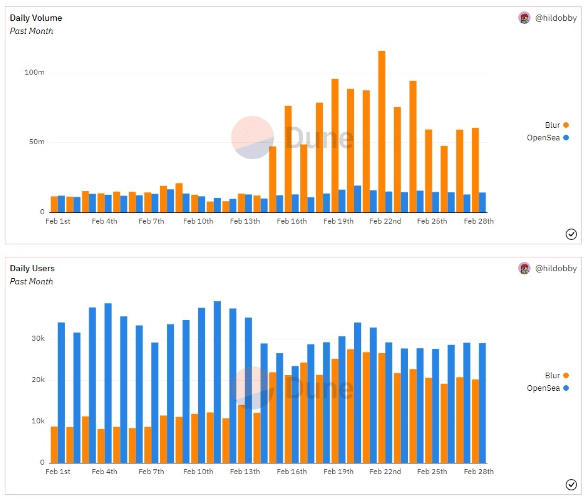

Who outperformed the previously undisputed leaders of the space? The Blur platform, which for the third consecutive month showed more sales than OpenSea, even though – at least for now – it has fewer users.

The charts below are for February. The first shows the trading volume and the second the number of users on OpenSea (blue bars) and Blur (orange bars):

This is largely attributed to Blur’s policy, which released its long-awaited token by giving away for free (airdrop) about 360 million Blur coins to users, or about 12% of the total supply. The rewards are given to those who exclusively use the Blur platform.

Read Also: Top 9 Best NFT Marketplaces

That’s why many assumed that, after the incentive of getting free tokens, transactional activity on Blur would subside. However, the volume continued to rise. The problem, however, is focused elsewhere. In that among the sales, several are labeled suspicious!

And that’s why CryptoSlam, the well-known NFT sales tracking platform, announced on Friday that it will deduct $577 million worth of Blur transactions from the total amount. From what its people claim, this amount was used to manipulate the market. The platform also said it will filter out future trades, excluding those that an algorithm rules out as suspicious sales.

Where did they draw this conclusion from? The data they study within the blockchain shows that the increase in trading volume on Blur is mainly fueled by whales, i.e. accounts with large volumes that make frequent trades.

From what they report, they were selling NFTs to themselves using different wallets in order to accumulate points to receive more Blur coins from the airdrop.

Not only are they planning to receive rewards for the next airdrop, but there are suspicions that this is money laundering. Blur, for its part, denies it. It points out that another data processing platform, Dune Analytics, detects a much lower percentage of suspicious transactions.

Why do the two research firms disagree? Because they use different criteria. Which one is right we don’t know, but we do know something else. That the market for NFTs is still being formed. And ready to surprise us (again).

Somewhere here we should note that a week ago we had one of the biggest mass sales of NFTs ever. Specifically, on February 24, a “whale” known as Machi Big Brother sold 1,010 units for 11,680 Ethereum or nearly $19 million in a 48-hour period. Among them sold 90 Board Cape Yacht Club, 191 Mutant Ape Yacht Club and others.

However, Machi Big Brother immediately bought 991 NFTs, which could be attributed to some profit-taking or possibly laundering or even market manipulation.

Read Also

- Binance Denies Forbes’ Claims of Misuse of Funds, Stoking Cryptocurrency Community Doubts

- Visa and Mastercard “Freeze” Plans for Cryptocurrency Partnerships Amid Regulatory Uncertainty

- Banks reduce exposure to Bitcoin and cryptocurrencies globally to 40%, says BCBS report

- Venezuela gives crypto some love: Bitcoin and other cryptocurrencies exempt from some taxes for one year

- Coinbase drops Binance USD stablecoin, SEC crackdown to blame

- SEC Chairman Gensler Sparks Concern in Cryptocurrency Industry with His Statements on Securities Law

Previous Articles:

- Binance Denies Forbes’ Claims of Misuse of Funds, Stoking Cryptocurrency Community Doubts

- Visa and Mastercard “Freeze” Plans for Cryptocurrency Partnerships Amid Regulatory Uncertainty

- Banks reduce exposure to Bitcoin and cryptocurrencies globally to 40%, says BCBS report

- Venezuela gives crypto some love: Bitcoin and other cryptocurrencies exempt from some taxes for one year

- Coinbase drops Binance USD stablecoin, SEC crackdown to blame