You are reading this post because you want to get your hands on the best bitcoin debit card – right? Well, we got you covered. We have compiled a list of the Top 10 Bitcoin Debit Cards (plus one bonus) that are currently available in the market.

Best Bitcoin Debit Card

Here is the complete list of best bitcoin debit cards in this article.

| DEBIT CARD | FEES | COUNTRIES |

|---|---|---|

| Wirex | 1% fee to fund accounts | EU & UK |

| Crypto.com | None | Worldwide |

| Up to 0.9% per transaction and ATM withdrawals | EU (excluding UK) | |

| Nuri | None | EU & UK |

| Coinbase | 2.49% | Worldwide |

| ClubSwan | None | Worldwide |

| BlockCard | Monthly Fee: $5.00 | Worldwide |

| Bitpay | 3% foreign transaction fee, $2.50 ATM withdrawal fee | U.S. |

| Nexo | None | Worldwide |

| CoinZoom | None | U.S. |

Presently, even though there are a lot of individuals holding Bitcoin, it is not used swiftly to convert it into fiat or spend it on goods and services.

The early scenario was if you had a vendor accepting cryptocurrencies, it is well and good, but if you can’t find any, the proceedings would go long in exchanging, depositing into bank and then using it.

However, as changes are permanent and persistent, merchants have now found a way to liquidate the use of the cryptocurrency by releasing Bitcoin Debit Cards into the market that can be used in person or online at various places – anywhere, anytime.

The Blockchain Certification and its whole ecosystem made enormous companies to join hands with Bitcoin payment gateways in a bid to provide masses with trustworthy cards known as the Crypto/Bitcoin Debit Cards.

Bitcoin is synonymous with the internet of money that has the power to compete with present e-cards (credit/debit) thus offering 95% of the services a bank provides right now. Now, one can start trading by issuing a bitcoin debit card and connecting it to their Bitcoin balance, thereby, making it as easy to use as any ATM debit or credit card.

Bitcoin debit cards fall under two categories – plastic and virtual that can be owned as per the requirement and comfort of its owner, enabling purchases to be made at shopping stores, restaurants, petrol pumps, and many other places of use.

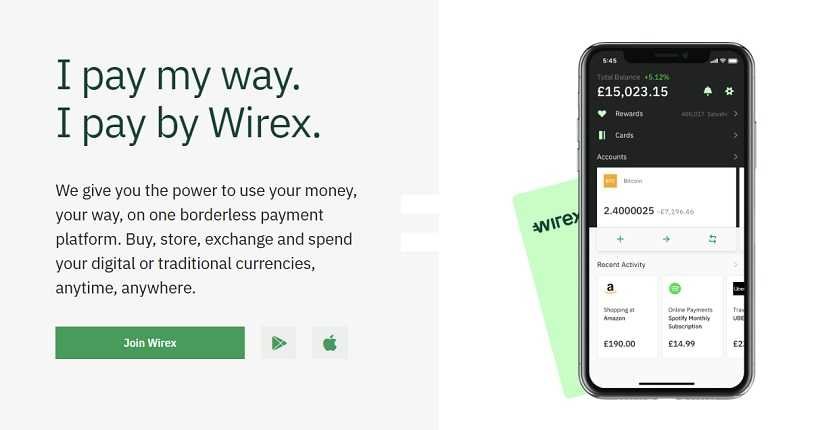

Wirex Debit Card

Best Bitcoin Debit Card For EU & UK

If you are in a hurry, note that the best bitcoin debit card come’s Wirex.

The reason is simple. Wirex’s debit card has this unique feature that allows you to spend your crypto’s without manually exchanging them from crypto to fiat from the Wirex app.

Instead, you simply choose your cryptpocurrency that you want to spend and when you go to pay Wirex app automatically converts crypto to fiat on the backend. In essense you ar

Now I haven’t seen any other debit card functions this way, and since I’ve been using Wirex without any problems for the past year, I feel it is the best bitcoin debit card option outhere for the moment.

Formerly known as E-Corner, the company was renamed Wirex in 2016. The company offers a debit card with a chip & pin visa, which can be charged via its Wirex application (desktop or mobile).

Pricing is pretty similar to other cards, with charges of 3% for international transactions, $2.5 for ATM withdrawals and $17 for physical shipments. The company also offers a virtual card in case you do not need plastic. Like Bonpay, Wirex charges a service fee, which is calculated monthly, not annually ($ 1.50 / month).

Pros:

Cons:

Crypto.com Debit Card

Best Bitcoin Debit Card Overall

Crypto.com, previously known as Monaco, is a South East Asian based company that provides cryptocurrency and blockchain related products and services.

The company’s most prominent product is their crypto.com debit card which allows users to spend their cryptocurrencies in real-world locations. The card has both a physical and virtual form and can be used in over 200 countries.

The card is linked to the user’s Crypto.com account and all transactions are made using the user’s cryptocurrency balance.

The card offers a number of features such as cashback, loyalty programs, and discounts which make it an appealing option for those looking to spend their cryptocurrencies.

PROS

CONS

Binance Debit Card

Best Bitcoin Debit Card With The Lowest Fees

The Binance Visa Card is a physical debit card that can be used to spend your Bitcoin, Binance Coin (BNB) and other supported cryptocurrencies at merchants around the world.

The card also comes with a built-in electronic wallet that allows you to store, spend, and receive your supported cryptocurrencies. You can apply for the Binance Visa Card now on the Binance website. The card is currently available in select countries, with more being added soon.

With binance visa card you can Earn up to 8% Cashback on All Purchases.

Use your Binance Visa Card to pay with cryptocurrency anywhere Visa is accepted, online or in-store. Get up to 8% cashback on all purchases in Bitcoin, Binance Coin (BNB), and other supported cryptocurrencies. Finally the Binance Visa card has some of the Lowest Fees in the Market and its backed up by the biggest company in the crypto space – Binance.

PROS

CONS

Nuri Debit Card

Best Bitcoin Debit Card For the European Economic Area

Nuri is a leading provider of financial products and services, with a focus on providing innovative solutions that make it easier for people to manage their money.

Their popular Nuri Debit Card is a prepaid debit card that can be used for shopping, withdrawing cash, and paying bills. Unlike other debit cards, the Nuri Debit Card has no annual or monthly fees, and can be reloaded at any time using your smartphone or computer.

Additionally, users have access to a mobile app which allows them to check their balance, transactions, and more.

Nuri’s fees are also low compared to other debit cards, making it an affordable and convenient option for anyone looking for a better way to manage their finances. To learn more about the Nuri Debit Card and how it can benefit you, visit the website today.

PROS

CONS

Coinbase card

Best Bitcoin Debit Card For Security

The Coinbase Card is a secure, easy-to-use, and Visa-supported debit card that converts multiple types of cryptocurrencies to local currency so users can make purchases and ATM withdrawals.

It allows users to spend their Bitcoin and other cryptocurrencies at any location that accepts Visa. The card has a high daily spending limit, supports over 50 cryptocurrencies, and is available in 49 states in the U.S. as well as internationally. The card also offers rewards so you can get up to 4% back on your purchases.

Coinbase Card is protected by security features including two-step authentication, instant card freeze, bank-level AES-256 encryption, and all Coinbase employees are subject to a background check. There is no card issuance fee but a 2.49% transaction fee for U.S. users. Overseas users must pay ₤4.95 and 2.9%, respectively. The card also comes with a host of other fees, so make sure to check the fee chart before signing up for a card.

If you are looking for a secure and easy-to-use option for spending your Bitcoin or other cryptocurrencies, the Coinbase Card is a great choice. With its high daily spending limit, support for over 50 cryptocurrencies, and rewards program, the Coinbase Card is a versatile and convenient way to use your cryptocurrency holdings.

PROS

CONS

Club Swan Card

Best Bitcoin Debit Card For Wealthy Individuals

Club Swan is an alternative banking platform that offers a unique experience to wealthy individuals by combining cryptocurrencies, traditional fiat currency, concierge services, and huge discounts (up to 40%) to its members.

The company issues a Club Swan card that allows you to spend both fiat and cryptocurrencies held in your Club Swan account effortlessly.

Club Swan is basically a membership club aimed at wealthy individuals and business people who tend to travel a lot. Their unique concierge feature makes them the only crypto debit card that differentiates its business model from the rest of the cards listed in this guide.

PROS

CONS

BlockCard

Best Bitcoin Debit Card With Low-Fees

BlockCard is a Bitcoin debit card that allows you to spend your bitcoins anywhere. You can use it in stores, online and even withdraw cash from an ATM. BlockCard is the first Bitcoin debit card that is available in the United States.

BlockCard is a powerful tool for spending your bitcoins anywhere. With its convenient features and intuitive user interface, it makes it easy to use your bitcoins in the real world. Some of the key features of BlockCard include:

- Wide acceptance at stores and online retailers, allowing you to easily spend your bitcoins wherever you go.

- Ability to withdraw cash from ATMs around the world, giving you fast access to your funds when you need them.

- Convenient mobile app that lets you easily manage and monitor your account on the go. Whether you want to check your balances or make a purchase, BlockCard makes it easy and straightforward.

If you are looking for a simple and powerful Bitcoin debit card that allows you to easily spend your bitcoins anywhere, look no further than BlockCard.

PROS

CONS

BitPay Card

Best Bitcoin Debit Card for Businesses

BitPay is a global bitcoin payment service provider headquartered in Atlanta, Georgia. The company provides bitcoin payment processing services for merchants and consumers, and is one of the largest bitcoin processors in the world.

BitPay offers debit cards denominated in both USD and EUR which can be loaded with both bitcoin and traditional currency. These cards can be used at any business that accepts Visa or Mastercard debit cards.

The fees are transparent, and there are no hidden costs. BitPay offers both a free version and pro version of the service.

PROS

CONS

NEXO Debit Card

Best Bitcoin Debit Card From a Borrowing/Lending Defi Platform

NEXO.IO is a financial technology company that provides crypto-backed loans to businesses and individuals. Leveraging blockchain technology and its own Nexo Token (NEXO), the company allows people to borrow against their cryptocurrencies without having to sell them. As an added bonus, NEXO offers investors the chance to earn interest on their cryptocurrency holdings.

Nexo issued recently their own crypto debit card that allows users to spend their cryptocurrency without spending the cryptocurrency. I know, it sounds crazy but here’s how it works.

With NEXO you can basically use your cryptocurrency as collateral to get loans from NEXO. With the NEXO card you can spend your loaned money everywhere around the world in a simple and easy way.

PROS

CONS

CoinZoom

Best Newcomer

The CoinZoom debit card is a prepaid Visa card that can be used at over 33 million merchants worldwide. It is also contactless, which means you can just tap it against a card reader to make a payment. The card has no annual or monthly fees, and you can load it with funds using Bitcoin, Ethereum, Litecoin, Bitcoin Cash and over 40 cryptocurrencies.

Depending on what card you choose , you can also benefit from other perks such as the ability to withdraw cash or make expenditures in foreign currencies. You can also use your CoinZoom card to pay bills and send money to contacts within the CoinZoom platform, making it a versatile option for anyone who wants to live a digital lifestyle but still needs traditional payment methods.

CoinZoom issues the zoom token , which allows you to send or request funds from anyone in the world, and is also used as a staking method for debit cards. This means that users who stake zoom can earn rewards based on their debit card usage, encouraging them to use the card often and increasing adoption of cryptocurrency. Overall, CoinZoom offers an innovative solution for anyone who wants to live a digital lifestyle but still needs traditional payment methods.

PROS

CONS

BONUS: Revolut Bitcoin Debit Card Review

Revolut is a fintech company offering a variety of non-bank-based, application-based financial products, including a cryptocurrency exchange.

Founded in 2015, UK-based Revolut has made significant investments in private equity and venture capital from some of Europe’s best-known investors. In its relatively short history, Revolut has attracted more than one million customers and handled over 50 million transactions worth more than $7 billion.

In addition to traditional financial services such as insurance and money transfers, the Revolut app offers a cryptocurrency exchange service.

Another advantage of Revolut’s Cryptocurrency Exchange product is that MasterCard contactless debit cardholders can make payments anywhere in cryptocurrency funds. The card will automatically convert Cryptocurrency into local currency at the current exchange rate.

Pros

Cons

Advantages And Disadvantages of Using a Bitcoin Debit Card

The future of finance with digital alliances can have better control and flow of cash, accelerating the revenue and turnover of a firm giving optimists outcomes of the world economy as a whole.

The venture into the provision of digital e-cards keeps the capability of empowering merchants and service providers over centralized banks and proves to be fruitful from the perspective of offers they promise.

Advantages of using a Bitcoin debit card

The advantages are obvious: with Bitcoin, you can buy almost everything at any place where credit or debit cards are accepted and of which your Bitcoin debit card will also be accepted. The debit company pays the merchant in its own currency and the fees are deducted from their Bitcoin balance.

This allows you to live only on Bitcoin. For example, when traveling abroad, I always use my Bitcoin debit card as a backup card in case my money is stolen. It’s like controlling the traveler in the digital age.

Disadvantages of using a Bitcoin debit card

The main disadvantage of a Bitcoin debit card is its centralization. To use the card, you must deposit money into your account with the debit card company, which means that you transfer control of your coins to a third party.

This risk is reduced by not depositing too many bitcoins in your account. Basically, only deposit an amount that you can lose in case of an attack. Since you use the service of these companies, it also has a price: As you will see below, you cannot ignore the fees charged by these Bitcoin debit card companies.

👉 Check Also: Best Cryptocurrency Wallets

Frequently Asked Questions

How do bitcoin debit cards work?

Bitcoin debit cards work similar to traditional debit cards. You can use them to spend your bitcoins at any retailer that accepts debit cards. Additionally, many bitcoin debit card companies offer rewards such as cash back, airline miles and other perks. When you use a bitcoin debit card, the funds are transferred from your bitcoin wallet to the card company. From there, you can use your card just like you would any other Visa or Mastercard.

Are there any fees associated with using a bitcoin debit card?

There are no fees associated with using a bitcoin debit card or converting your crypto to fiat within the card’s mobiel application. However, some debit cards have fees for withdrawing cash or making purchases in a foreign currency. Make sure to read the terms and conditions of your specific bitcoin debit card before signing up.

What can I use my bitcoin debit card for?

You can use your bitcoin debit card to withdraw cash from an ATM, or spend your funds at any merchant that accepts Visa or Mastercard. You can also use your card to purchase goods and services online.

How do I withdraw money from my bitcoin debit card?

To withdraw money from your bitcoin debit card, you will need to first exchange your bitcoin for fiat currency and deposit them to your debit card. This is usually done via the app that accompanies the debit card. Once you have done this, you can then withdraw the money from an ATM or through a bank transfer.

Which crypto debit card is best?

There is no one-size-fits-all answer to this question, as the best crypto debit card for you will depend on your individual needs and preferences. Some cards offer greater flexibility and convenience than others, while others may offer lower fees or more generous rewards programs. Do your research and compare the various options available to find the card that’s right for you.

If it help’s though, note that thi article’s author holds a Wirex Card, a Crypto.com Card and a NEXO Digital Card.

Is Coinbase debit card worth it?

Agian, there is no one-size-fits-all answer to this question, as the value of a Coinbase debit card will depend on your individual needs and circumstances.

That said, Coinbase cards can be a convenient way to spend bitcoin, and they offer some features that may be appealing to some users. For example, Coinbase cards can be used anywhere that accepts Visa, which makes it easy to use your bitcoin for everyday purchases.

Additionally, the fact that Coinbase cards are connected directly to your digital wallet can be a convenient way to easily convert between different currencies and spend them wherever you go. However, there are also some potential downsides to using a Coinbase card.

For example, fees may be relatively high compared to other options, and you may be limited in the types of transactions you can make. Ultimately, whether or not a Coinbase card is worth it for you will depend on your individual needs and preferences.

Can I use crypto card at ATM?

Yes, most crypto cards allow you to withdraw cash from ATMs.

Are crypto debit cards free?

Most crypto debit cards are free to issue. You may need to cover the cost of shipping. Other than that, a crypto debit card is free to obtain.

Note there are usually small fees associated with each transaction. This fee is used to cover the costs of maintaining the card and its associated infrastructure.

👉 Check Also: Top 12 BEST Crypto Trading Bots

Bottom line

Conclusively, some reputed Crypto debit cards have been detailed above with their pros and cons that can clear the doubts of an enthusiast investor dealing with digital currencies.

Also, the aforementioned queries would certainly act as a reference to a wise choice to makeover look-alike debit cards provided by the mushrooming service providers. Most importantly, you pay for a secured service and long-lasting profits that a company promises, so it’s better to dig deep into the available alternatives to reap the benefits and keep up with the worldly evolving technological advancements.

Debit cards are valuable assets for anyone who wants to pay for goods or services. They are easy to obtain and use, they eliminate cash and prevent you from becoming indebted.

Because this payment method is so popular, almost all merchants accept debit cards. Although debit cancellations are more difficult and credit cards are above loyalty points and credit notes, debit cards are still a very appropriate and desirable solution for daily purchases.

Making a wise decision is to analyze and compare all the key factors and traits of a crypto debit card. Before pulling the trigger, Bitcoin investors should widen their range of knowledge from all aspects of fee structure, exchange rate, and delivery options to benefit the most out of the offered deal and make it a worthwhile investment.

The new payment model is one of its kind, coming up with an innovative solution to make global trade surge over the web.

Previous Articles:

- 10 Easy Signs On How To Identify A Rug Pull In Crypto

- What Are Decentralized Exchanges (DEX) And How They Work

- Antoni Trenchev: Bitcoin will surpass 100,000 in the next 12 months

- Bitcoin And A World Of Rules Without Rulers

- The Energy System Benefits From Bitcoin Mining