- Bernstein Private Wealth Management forecasts a Bitcoin price of $150,000.

- The firm suggests buying into Bitcoin miners before the next halving event.

- Recent ETF inflows since January have already surpassed $9.5 billion.

- Riot Platforms and CleanSpark are preferred for their low production costs and strong balance sheets.

- Through-cycle analysis shows miners typically outperform Bitcoin in bull markets.

In recent communications with clients, investment advisory firm Bernstein Private Wealth Management has expressed a bullish stance on the future of Bitcoin, predicting its price could soar to as much as $150,000.

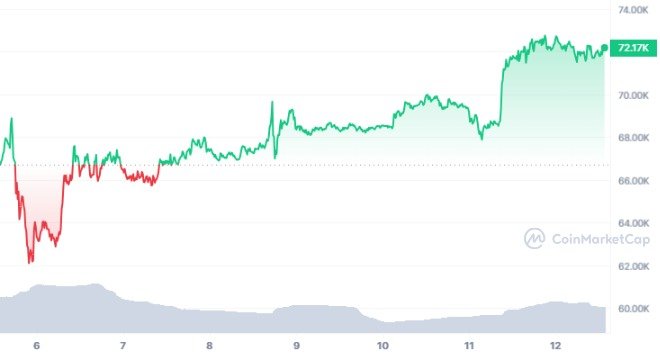

This optimistic forecast comes amid a current rally that sees the cryptocurrency trading above $72,000.

Drawing inspiration from Satoshi Nakamoto’s early comments on the digital currency, Bernstein analysts argue that now is an opportune time for investors to consider entering the market through mining stocks.

The firm’s confidence in this substantial price target stems from several key factors including institutional investments and upcoming structural changes within the cryptocurrency market itself.

Analysts at Bernstein have incorporated expected institutional flows into their valuation models; they anticipate around $10 billion worth of inflows in 2024 followed by an additional $60 billion in 2025.

Notably, since the launch of a new ETF on January 10th this year focused on bitcoin-related assets, there has been more than $9.5 billion in inflows over just 40 trading days.

Bernstein believes that we are still early in the process of integrating cryptocurrencies like Bitcoin into traditional asset portfolios.

Their analysis points towards bitcoin miners as being particularly attractive investment opportunities at present—especially those companies such as Riot Platforms (NASDAQ:RIOT) and CleanSpark (NASDAQ:CLSK), which engage primarily in self-mining activities.

These firms not only possess growing hash rate capacities poised to benefit from halving events but also maintain advantageous cost structures and robust balance sheets bolstered by holding bitcoin directly without leveraging debt.

The report highlights how investors often overlook miner stocks except during periods when bitcoin itself is rallying significantly—a perspective deemed too narrow by Bernstein analysts who advocate for a broader view recognizing patterns across entire market cycles.

Historically speaking, mining companies tend to outperform direct investments in bitcoin during bull markets while underperforming during bearish phases; however, given current trends and projections for continued growth leading up to—and following—the next halving event anticipated within this cycle spanning 2024–25, every dip is viewed as an opportunity for acquisition.

Furthermore, transaction fees associated with bitcoins along with their prices provide what Bernstein describes as “a cushion” for miners heading into these pivotal halving moments where rewards for mining activities are reduced by half automatically—a mechanism designed to control inflation within the digital currency ecosystem while simultaneously increasing scarcity over time.

As discussions around cryptocurrency continue evolving among both individual enthusiasts and large-scale institutional participants alike—coupled with ongoing debates regarding regulation—the outlook provided by firms like Bernstein offers valuable insights into potential strategies aimed at capitalizing upon these dynamic shifts within financial markets globally.

LATEST POSTS

- London Stock Exchange Opens Doors to Bitcoin and Ethereum ETNs

- SafePal Unveils In-App Banking Gateway and Visa Card in Collaboration with Swiss Bank Fiat24

- Bitcoin Cinema & A Halving Saga

- What Is Ethereum’s Dencun Upgrade: Everything You Need to Know

- Veteran Trader Tone Vays Predicts Bitcoin Could Hit $355K by 2027

Previous Articles:

- London Stock Exchange Opens Doors to Bitcoin and Ethereum ETNs

- SafePal Unveils In-App Banking Gateway and Visa Card in Collaboration with Swiss Bank Fiat24

- Bitcoin Cinema & A Halving Saga

- What Is Ethereum’s Dencun Upgrade: Everything You Need to Know

- Veteran Trader Tone Vays Predicts Bitcoin Could Hit $355K by 2027