- LP Burn in Solana tokens refers to the act of permanently removing liquidity pool (LP) tokens from circulation, securing the assets within the pool.

- By burning LP tokens, developers demonstrate commitment to their project and reduce the risk of a rug pull by making it impossible to withdraw the pooled liquidity.

- The process involves giving up claims to a liquidity pool’s assets, thereby creating a decentralized and permanent source of liquidity for the token.

- This action is often seen as a sign of good faith from project developers, indicating a long-term investment rather than a short-term scam.

- Burning LP tokens enhances investor confidence by ensuring that the liquidity provided cannot be easily removed or manipulated by project creators.

In this article I am going to explain using simple terms what does LP Burn in solana tokens mean and why it is important.

But, firest, lets start with the basics:

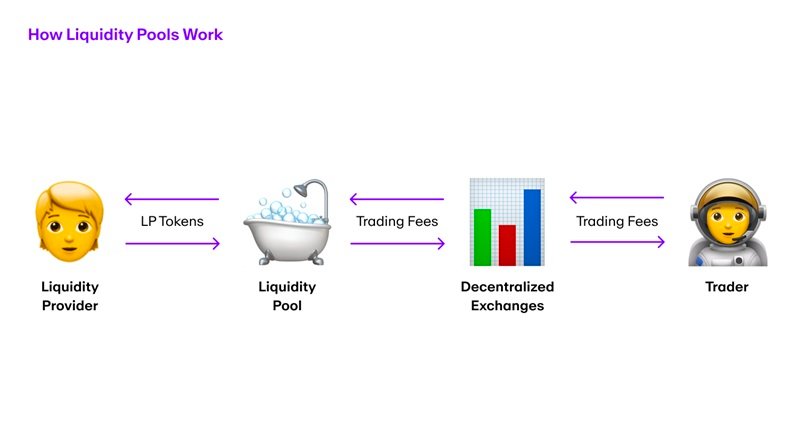

LP stands for Liquidity Pool. In the context of decentralized exchanges (DEXs) on the Solana blockchain, when a new token is launched, it’s added to a Liquidity Pool (LP).

Now, you need to understand first what is a liquidity pool and how it works.

A liquidity pool is a pool of funds that is locked in a smart contract on a decentralized exchange (DEX).

It is used to facilitate trading on the DEX by providing liquidity for different trading pairs.

Liquidity providers deposit their funds into the pool and receive liquidity provider (LP) tokens in return.

These LP tokens represent the provider’s share of the pool and can be used to withdraw their portion of the funds at any time.

The liquidity pool ensures that there are enough funds available for traders to buy and sell assets on the DEX.

When a trade is executed, the liquidity pool automatically adjusts the prices based on the ratio of assets in the pool.

Liquidity providers earn fees from the trades executed in the pool, proportionate to their share of the pool.

This pool is typically a 50:50 split of SOL (Solana’s native token) and the new token.

The creator of the pool – usually the token’s creator – receives LP tokens, which are essentially a claim to the assets in the liquidity pool. If the token’s value increases, the liquidity pool could end up with a significant amount of SOL.

However, these LP tokens also mean that the developer could potentially remove all that liquidity, which would be a standard rug pull.

This is where LP Burn comes into play.

LP Burn Meaning

Burning LP tokens means the developer is giving up their claim to the liquidity in the pool.

This action effectively locks the liquidity in the pool, making it impossible for anyone to remove it. This creates a decentralized, permanent pool of liquidity.

Why is it important?

Burning LP tokens is seen as a sign of good faith from the project developers, as it reduces the risk of a rug pull. It’s a way of ensuring that the project is less likely to be a scam and more likely to be a legitimate, long-term project.

In summary, LP Burn in Solana tokens is a process that helps to secure the liquidity of a token, making it more trustworthy and potentially more valuable in the eyes of investors.

Where can you find if a token has its LP Burnt or not?

When looking at a new coin, you can find information about LP Burn and other details in several ways:

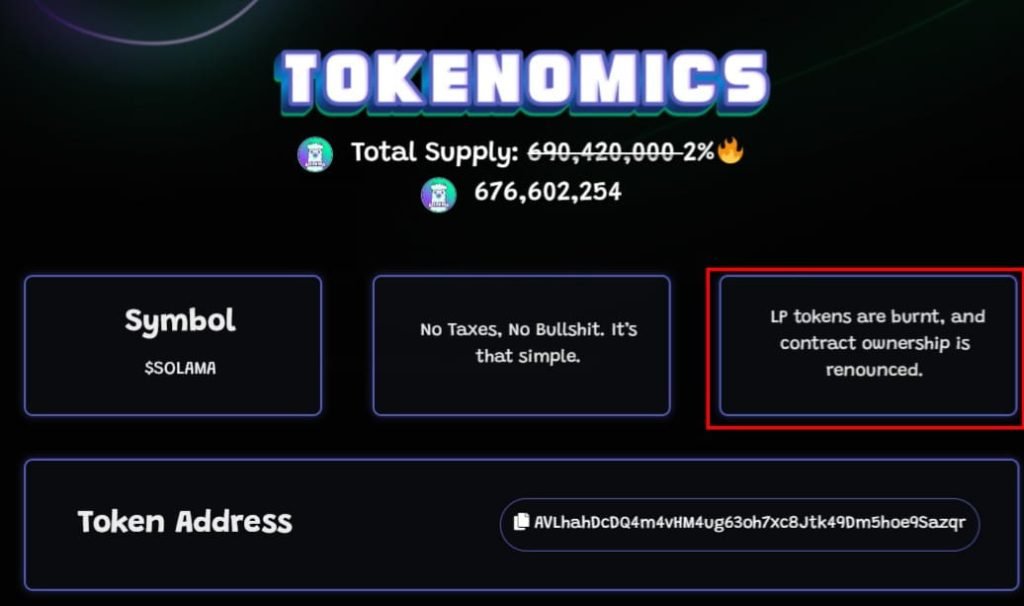

- Token’s Official Website: Usually, the token will announce details about LP Burn on their official website as a part of their effort to build trust with potential investors.

For example, here’s a screenshot from SOLAMA – a Solana memecoin – that showcase their LP token burn on their website.

- Dexscreener: Websites like Dexscreener provide detailed information about tokens. In the liquidity section, if you see a lock with a full circle, it means they burned the LP.

Here’s an example with another Solana meme coin – MARVIN.

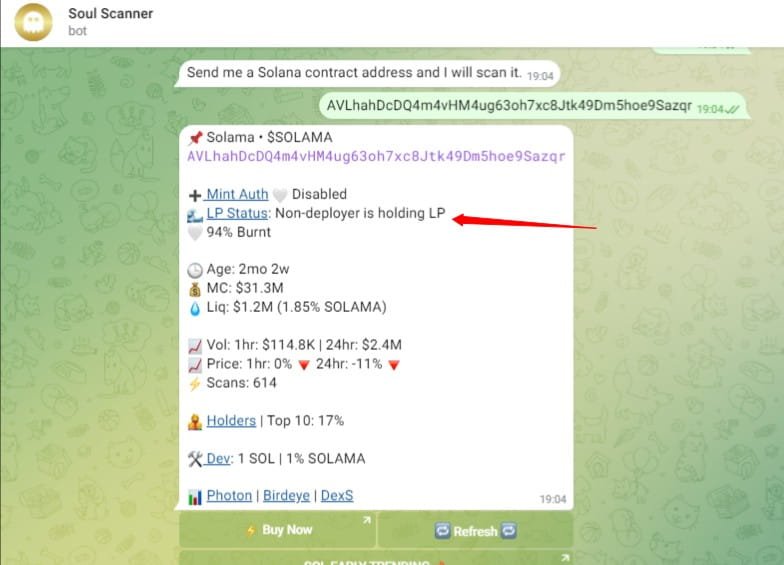

- Bots: There are various bots available that can provide this information as well. For example, if you use Telegram, you can use bots like @soul_scanner_bot. You just need to paste the Contract Address (CA) of the token into a chat with the bot, and it will provide the information in a few seconds.

Here’s an example with the SOLAMA meme coin:

As you can see, under the LP Status it writes 94% Burnt.

Non-deployer holding LP” refers to the Liquidity Provider (LP) tokens that are held by entities other than the deployer (the entity that initially launched the token and created the liquidity pool).

Bottom Line

So, the bottom line is, when you see a meme coin or any token that has it’s LP tokens burnt, that means that they are less likely to do a rug-pull.

That doesn’t mean that they can’t.. But, they can’t using the aforementioned method.

READ NEXT

- What is Snapshot in Cryptocurrency?

- What is a Crypto Airdrop And How Does It Work?

- What Does Forking Mean in Crypto: Understanding Blockchain Splits

- What Creates Value in Cryptocurrency?

- What Is Zero-Slippage Trading?

Previous Articles:

- Bitcoin’s Pre-Halving Pattern Emerges Again Amid Market Uncertainty

- El Salvador Moves Bitcoin Holdings to Offline Vault – Stirs Global Interest

- Custodial Exchanges Explained: Why You Should Embrace Them

- 1Gbits Review: Cheap Dedicated Servers & VPS Hosting

- BNB Chain Launches Rollup-as-a-Service to Boost Layer 2 Ecosystem