Bitcoin has been around for more than 10 years now, and in that time its rising price has far outpaced any other possible investment opportunity.

Raoul Pal, CEO of Real Vision, says bitcoin could still be the best asset in the next 10 years, even in its worst-case scenario.

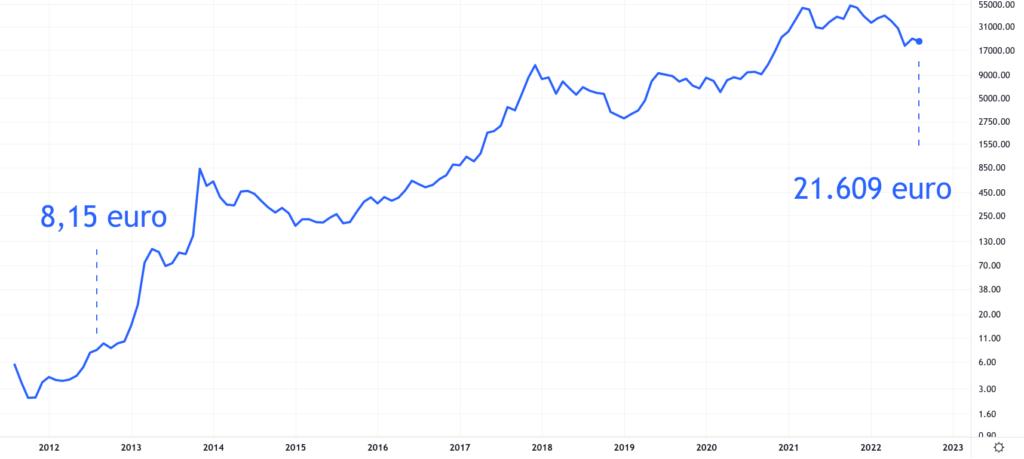

Profit on bitcoin in 10 years

Let’s say you bought one bitcoin on August 24, 2012 for $8.15, the price at the time. If you were to keep that one bitcoin until today, you would be trading at the current bitcoin exchange rate at $21,609.

The total “return on investment” for those 10 years is then 265,041%. The annualized ROI at this point is then 120%.

It is a bit of an exaggeration to say that bitcoin will also give these returns over the next 10 years, but purely for fun: bitcoin would then be worth 57.27 million USD.

The data in the chart below is logarithmic, but even then you can see that the bitcoin price is volatile and can rise and fall significantly.

Volatility in bitcoin is strength, not weakness

In a recent YouTube interview with Scott Melker Raoul Pal explains the more extreme an asset’s inherent volatility is, the higher its potential to multiply in price compared to less risky investments.

“Volatility provides the reward. Because it’s an asset of 70 vol, it gives these 20x, 50, 100x rewards, depending on what period you look at.”

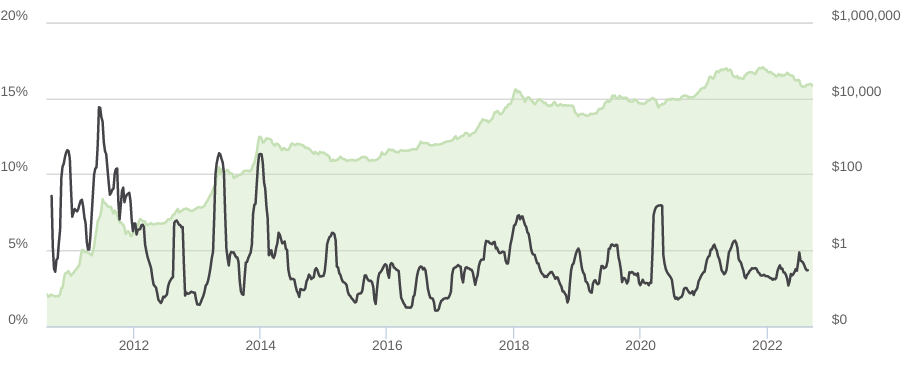

It’s not entirely clear how Pal gets to a volatility of 70. Most indexes that track this come up with much lower numbers. In addition, volatility actually seems to be decreasing as bitcoin matures and becomes more valuable.

The green line below is the price, and the black line the average deviation of the previous 60 days from the bitcoin price.

Bitcoin behaves differently from traditional assets

Pal continues:

“People are just not set up for that because they are mean-reversionists. They think the world is cyclical and everything returns to where it was, so that’s why every tree has a bust, and every bust brings it back to where it started.”

That might be true of other assets, but bitcoin behaves differently.

“But that’s not what’s happening here. It’s an exponential trend, so each bust is significantly higher. I mean bitcoin at $4,000, bitcoin at $20,000. That’s going from low point to low point and that’s extraordinary. But people don’t see that. They’re not used to it. They don’t know how to deal with it. People have to learn. We all did.”

Luck can take bitcoin to 1 million

Pal goes on to talk about his time when he first bought bitcoin well below $1,000, and says he believes bitcoin will be worth at least $100,000. And with any luck, could even rise to over a million.

“I never realized how in an exponential trend, buying and holding and adding is better. I went back and looked at all the times I traded Bitcoin from 2013 when I started for at $200. I held my bitcoin until $1,000. So it went up 5x in two months and then went all the way down 85%. I just held it because I wanted to treat it like an option. I had a 10-year vision.”

He says he recognized the potential of bitcoin around that time.

“I said that in the next 10 to 20 years it will probably become $100,000 at worst, and $1 million will be the best case scenario.”

Previous Articles:

- Ethereum’s “merge” will change the cryptocurrency space forever: everything you need to know

- Kidnappers make off with 160,000 euros in bitcoin after kidnapping Indian real estate tycoon

- Web3’s design is chaotic, but Web2 could fix it, says Jump Crypto president

- Has bitcoin reached bottom? According to these two indicators, Yes

- This is where Ukraine spent $54 million in crypto donations