Welcome to the world of cryptocurrency! If you’re new to this exciting and rapidly evolving landscape, you might feel like Alice in Wonderland, exploring a strange and unfamiliar realm.

But don’t worry – I’m here to serve as your guide, helping you navigate the complexities of cryptocurrency and understand how it works.

Think of cryptocurrency as a digital version of traditional money. Just like physical cash or credit cards, cryptocurrencies can be used to buy goods and services, transfer funds between individuals or organizations, and store value over time.

But unlike traditional currencies that are controlled by banks or governments, cryptocurrencies are decentralized – meaning they operate on a peer-to-peer network without any central authority overseeing transactions.

This unique feature is made possible through blockchain technology – the backbone of all cryptocurrencies.

Let’s delve deeper into the workings of blockchain technology next!

Key Takeaways

Understanding Blockchain Technology

Blockchain technology, which is the backbone of most cryptocurrencies, allows for a decentralized and transparent system where transactions are recorded on a public ledger.

The decentralized ledgers enable users to transact with one another without intermediaries like banks or government agencies. Transactions are validated by network nodes and verified through cryptography.

Here’s a 6 minute video explaining what Blockchain is:

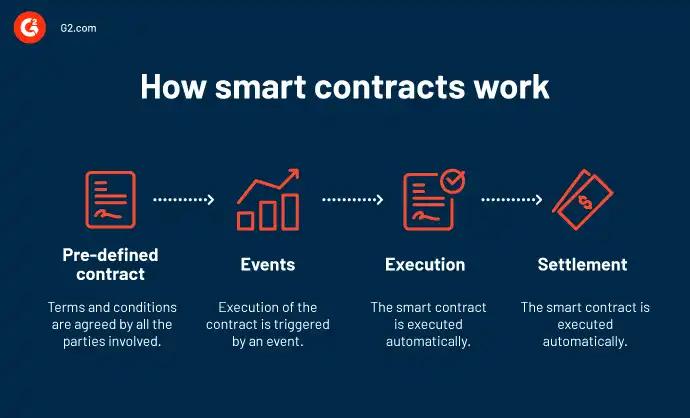

Smart contracts are self-executing codes that can be programmed into the blockchain network. These contracts automatically enforce the terms of an agreement between parties without requiring human intervention. Smart contracts help streamline financial and legal processes, making them more efficient and cost-effective.

The blockchain is a secure way to transfer value between parties using cryptocurrencies because it makes use of cryptographic algorithms to secure transactions.

Cryptography provides security by ensuring that only authorized individuals can access the data in a transaction. This ensures privacy, confidentiality, integrity, and authenticity of all transactions taking place on the network.

Blockchain technology has revolutionized how we transact with each other today by providing us with a fast, reliable, and cost-effective way to exchange digital assets globally without intermediaries involved.

Mining Cryptocurrency

One way to acquire digital currency is by mining it. Essentially, mining involves using specialized computer hardware to solve complex mathematical equations that verify transactions on a cryptocurrency network.

As more transactions are verified, the miner has a chance at earning coins as a reward for their work.

Mining cryptocurrency requires specific hardware requirements and can be costly to set up initially. Miners need high-end graphics processing units (GPUs) or application-specific integrated circuits (ASICs) designed specifically for mining purposes. These machines require a lot of power and generate significant amounts of heat, meaning they also require proper cooling equipment.

Profitability analysis is essential when considering whether to mine cryptocurrency or not. Factors such as electricity costs, pool fees, and the current difficulty level of the network all play a role in determining profitability.

It’s crucial to weigh these costs against potential earnings before investing in mining equipment.

With the right setup and conditions, however, mining can be a profitable venture for those willing to put in the time and effort required.

Types of Cryptocurrencies

When it comes to cryptocurrencies, there’s no shortage of options. As someone who’s been exploring this space for a while now, I’ve come across several types that stand out from the rest.

These include Bitcoin, Ethereum, Ripple, and Litecoin, all of which have unique features that set them apart from one another.

Let’s dive into each one in more detail to understand what makes them special.

Bitcoin

You’re probably familiar with Bitcoin, the most well-known cryptocurrency that allows you to send and receive digital payments without the need for a bank or middleman.

But do you know how it works?

Bitcoin transactions are recorded on a public ledger called the blockchain. This ledger is maintained by thousands of computers around the world, which work together to verify and validate each transaction.

To ensure that no one can manipulate the blockchain, each transaction must be verified through a process called bitcoin mining. Miners use powerful computers to solve complex mathematical equations and create new blocks in the blockchain. In exchange for their efforts, miners are rewarded with bitcoins.

The mining process also helps keep the network secure by making it more difficult for anyone to take control of the system.

Overall, Bitcoin offers a decentralized solution for digital payments that has gained popularity due to its transparency and security features.

Ethereum

If you’re interested in investing in Ethereum, you’ll be pleased to know that it offers more than just a digital currency.

One of the key features of Ethereum is its ability to support Smart contracts, which are self-executing contracts with the terms of agreement between buyer and seller being directly written into lines of code. This allows for transparency, efficiency, and cost savings.

Additionally, the Ethereum blockchain can be used to create decentralized applications (dapps) such as Golem Network (it allows users to rent out their unused computing power for tasks like CGI rendering).

Here are three important things to note about Ethereum’s smart contracts and dapps:

- Smart contracts on Ethereum can be programmed using Solidity language.

- Decentralized applications on Ethereum run on a peer-to-peer network with no central authority or control.

- The development community behind Ethereum is constantly innovating and expanding its capabilities beyond just financial transactions.

Ripple

So, let’s dive into what Ripple has to offer for those who are interested in the world of digital assets.

Ripple is a cryptocurrency that aims to revolutionize the way financial institutions transfer money around the globe. Unlike other cryptocurrencies, Ripple is not decentralized, but rather works with banks and financial institutions directly.

Ripple’s market performance has been impressive, with a current market capitalization of over $10 billion USD. Its technology allows for near-instant transactions (under 4 seconds) and low fees compared to traditional wire transfers.

Additionally, Ripple has partnered with major banks such as Santander and American Express to integrate its technology into their systems. With this kind of backing and potential adoption by major financial industries, it’s no wonder that many believe Ripple could become a game-changer in the world of finance.

Litecoin

Let’s take a look at Litecoin, the silver to Bitcoin’s gold, and see how it stacks up in the world of digital assets. Litecoin was created in 2011 by former Google engineer Charlie Lee as a faster and cheaper alternative to Bitcoin.

Like Bitcoin, Litecoin is decentralized and uses blockchain technology for secure transactions. However, there are some key differences between the two cryptocurrencies.

Here are four things you need to know about Litecoin:

- It has a faster block generation time than Bitcoin (2.5 minutes vs. 10 minutes), which means transactions can be processed more quickly.

- The total supply of Litecoins is four times greater than that of Bitcoins (84 million vs. 21 million).

- Litecoin uses a different mining algorithm than Bitcoin called Scrypt, which allows for more efficient mining with consumer-grade hardware.

- Its market capitalization is currently smaller than that of Bitcoin but still ranks among the top ten cryptocurrencies by market cap.

If you’re considering investing in Litecoin or wondering about its price prediction, it’s important to do your own research and understand the risks involved with any cryptocurrency investment.

While some analysts predict that Litecoin could see significant growth in the coming years due to its faster transaction speeds and lower fees compared to Bitcoin, others caution that cryptocurrencies are highly volatile and subject to market fluctuations.

As with any investment decision, it’s important to weigh the potential rewards against the potential risks before making a decision on whether or not to invest in Litecoin or any other cryptocurrency.

Cryptocurrency Wallets

When it comes to cryptocurrencies, one of the most important things you need is a wallet. A cryptocurrency wallet is simply a digital wallet that allows you to store, send and receive your coins securely.

There are various types of wallets available, such as desktop wallets, mobile wallets, and hardware wallets, and each has its own unique features.

It’s crucial to understand how to store and secure your cryptocurrency so you can protect your investments from any potential threats or hacks.

How to Store and Secure Your Cryptocurrency

Now that we’ve discussed the different types of wallets available for storing your cryptocurrency, let’s dive into how to store and secure them properly.

There are two main categories of wallets: hardware and software. Hardware wallets are physical devices that store your private keys offline, making it more difficult for hackers to access them remotely.

Software wallets, on the other hand, are digital programs or applications that can be installed on your computer or mobile phone.

To ensure maximum security when storing your cryptocurrency, it’s best practice to use a combination of both hardware and software wallets. The majority of your funds should be stored in a hardware wallet like Ledger Nano S or Trezor which keeps your private keys offline and provides an extra layer of protection from online threats such as phishing attacks or malware.

Meanwhile, you can allocate a smaller amount of funds in software wallets like Exodus or MyEtherWallet for easy accessibility when trading or exchanging cryptocurrencies. Remember always keep backups/copy of recovery phrases/keys in multiple locations so that if you lose one copy then you still have access to your assets through another backup location.

Protecting our cryptocurrency investments is crucial since once lost/stolen/hacked there is no way to recover them – unlike traditional banking systems where FDIC insurance exists- thus securing our digital assets is essential by following best practices such as using both hardware and software wallets along with creating backups/copies at different locations will help protect our investment from potential loss/theft over time giving us peace of mind while investing/trading/exchanging in this new financial era enabled by blockchain technology.

Using Cryptocurrency

To use cryptocurrency, you’ll need a digital wallet where you can store your coins securely. Once you have a wallet set up, you can start using your cryptocurrency to buy goods and services.

Many online merchants like hosting providers, domain registrars and merchants from other industries now accept Bitcoin and other cryptocurrencies as payment options, providing users with greater flexibility and convenience when shopping.

When using cryptocurrency, it’s important to stay up-to-date on regulations governing its use in your country or region.

Some countries have banned or restricted the use of cryptocurrencies altogether, while others have implemented regulatory frameworks to ensure that trading is conducted fairly and safely.

By staying informed about these regulations, you can avoid potential legal issues and ensure that your transactions are secure.

In addition to buying goods and services with cryptocurrency, many people also trade it as an investment opportunity.

Cryptocurrency markets can be highly volatile, with prices fluctuating rapidly based on demand and market sentiment. Before investing in cryptocurrencies, it’s important to do your research and understand the risks involved.

However, for those willing to take the risk, cryptocurrency trading can offer potentially high returns on investment.

Conclusion

In conclusion, cryptocurrency is a fascinating and complex concept that has revolutionized the world of finance. While it may seem daunting at first, understanding how it works can be a rewarding experience.

From the basics of blockchain technology to mining and types of cryptocurrencies, there’s a lot to learn. One thing I found particularly interesting was the idea of using cryptocurrency as a form of investment or payment. With its decentralized nature and secure transactions, it provides an alternative to traditional methods that are often subject to fraud or manipulation.

Coincidentally, this aligns with my personal belief in the importance of financial independence and autonomy.

Overall, I highly recommend delving further into the world of cryptocurrency for anyone looking to expand their knowledge in finance and technology.

READ NEXT

Previous Articles:

- Commonwealth Bank of Australia Implements Anti-Fraud Measures, Blocks Payments at Cryptocurrency Exchanges

- What Is A Bull Run in Crypto?

- Republican Proposal Paves the Way for Cryptocurrency Exchanges to Trade Digital Securities and Commodities, But Democrats Support Remains Uncertain

- Optimism’s Bedrock Upgrade Slashes Ethereum Gas Costs by 40%

- Navigating the Confluence of Blockchain and AI with TokenMinds