According to Federal Reserve Chairman Jerome Powell, cryptocurrencies remain an insecure store of value, and the central bank is not in a rush to launch a rival, as CNBC reported.

In his first three public apperance this week, Fed’s Chairman Powell discussed digital currencies at a bank for an international settlement case, whose feedback was the most unrealistic for the present situation on the market.

But this time, Powell would not claim that it is inevitable. The move to a digital dollar central bank does not have to be rushed as “we must be at the leading edge of grasping the technical complexities of the digital currencies and the costs and advantages of that.

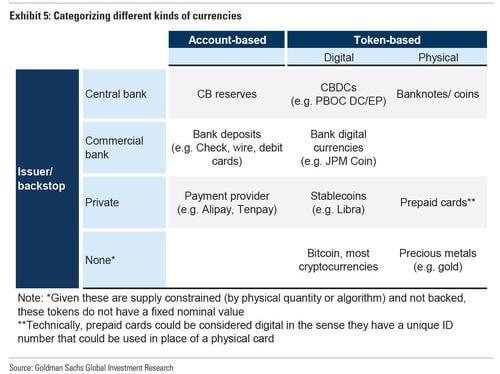

Powell said that “a CBDC currency may have large impacts here and throughout the world, “But his next statement, the crypto is more like gold than the dollar”, will trigger a much hot financial debate, as the following matrix demonstrates.

And talking about Crypto, Powell said, “Crypto asset – we’re calling it ‘crypto asset’ – is volatile, see Bitcoin, and therefore not very usable as a store of value and they don’t have any backbones,” he said.

“They’re more of an asset for speculation, so they’re not particularly in use as a means of payment. It’s more a speculative asset. It’s essentially a substitute for gold rather than for the dollar.”

Jerome Powell, Chairman, Federal Reserve

Powell’s comments also provided some of Bitcoin’s most direct Fed views in recent weeks and also contributed to the outlook in 2019. They also cite her concern around decentralized cryptocurrency weeks after coming from Treasury Secretary Janet Yellen. Like Yellen, Powell caused an explosion of a pessimistic market attitude, and after his response, bitcoin dropped nearly $1,000.

In the last couple of years, the Fed has been focusing on its own payments system that enables quicker money transactions, which is to be launched within the next two years.

In addition, the Federal Reserve has carried out several tests to find out whether a digital coin is required or practicable for a central bank.

Previous Articles:

- Visa plans to activate Bitcoin payments for 70 million merchants

- Robinhood To Expand Crypto Sevices

- Flyp.me, your instant crypto exchange now supports Liquid Network

- WallStreetBets switches to crypto miners after prohibition from bitcoin posts

- Ripple (XRP) Forecast for 2021: Is There Any Prospect for Growth?