Concerned about the dominance of the United States over the global financial system and its ability to turn the dollar into a weapon to impose sanctions, a growing list of countries are using other alternatives, such as bitcoin (BTC), gold, or yuan for international trade.

China, Brazil, Russia, India, Saudi Arabia, the United Arab Emirates, Argentina and Indonesia are among the nations that are forming some kind of cooperation to reduce their dependence on the dollar.

In fact, these countries have spread to almost every continent. They are looking for alternatives to diversify the currencies they use in international trade.

In Asia, China plays a key role in the plans to dethrone the dollar, given its dominant position in world trade. It is also the world’s second largest economy.

To get an idea of the level of influence that China can have, it is enough to detail the data revealed by the International Monetary Fund (IMF) on the direction of trade statistics during the year 2022.

These data show that China was the largest trading partner of 61 countries when imports and exports are combined, according to an analysis by U.S. media outlet CNBC. In comparison, the United States was the largest trading partner of 30 countries.

Indeed, to show the way forward, China has made sure to demonstrate that the U.S. dollar is no longer necessary for trade.

The yuan is gaining ground in international trade

The yuan was used in 48.4% of all cross-border transactions in China during the month of March, and in doing so, the Asian currency overtook the dollar for the first time in that nation’s international payments.

Previously, the Chinese yuan replaced the dollar as the most used currency in Russia’s international trade.

According to data from the Moscow Stock Exchange, the yuan accounted for 23.6% of Russia’s foreign exchange turnover in the first quarter of 2023, while the dollar’s share was 22.5%. For the first time, the yuan overtook the dollar in the Russian foreign exchange market.

On the other hand, in Brazil, the yuan came to represent 5.37% of the total basket of foreign exchange reserves in December last year. In this way, the Chinese currency displaced the euro, which now has a 4.74% share, according to local media reports.

Now, the Chinese currency is expected to gain even more ground in Brazil following the agreement that allowed the Industrial and Commercial Bank of China to act as a clearing bank for the yuan. This allows Brazilian and Chinese businessmen to carry out commercial transactions without going through the dollar.

Bitcoin is gaining ground as an alternative to the dollar

Russia, which borders Europe and Asia, has also been pushing the use of other assets as an alternative for its international transactions since last year, and bitcoin is one of them.

In this regard, the Russians have reported that they are working on a pilot plan for bitcoin to be used in cross-border payments. The United Arab Emirates Free Zone is also exploring BTC payments.

Meanwhile, bitcoin is on the rise in Africa, so much so that there is talk that the cryptocurrency could be the asset of choice for the entire continent.

Likewise, it has been said that Iran and Russia plan to use a gold-backed stablecoin that would serve as a payment method in foreign trade. The token itself is intended to be used throughout the Persian Gulf region, which includes the United Arab Emirates (UAE).

The country’s foreign trade minister, Thani Al-Zeyoudi said in January that “cryptocurrencies will play an important role in the future of UAE trade.”

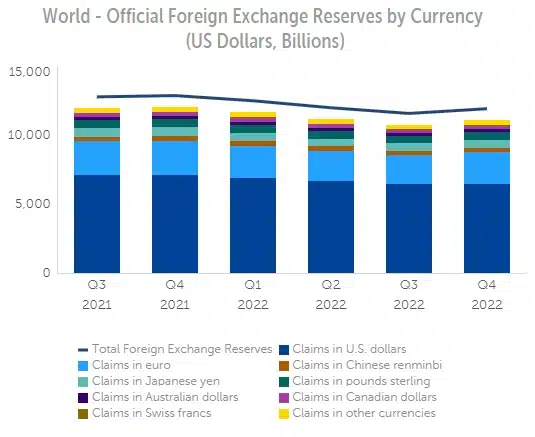

With moves to undermine the dollar’s unipolar supremacy gaining momentum, it is not surprising that the dollar’s status as a reserve currency will have eroded by 2022 at 10 times the rate seen over the past two decades, according to Eurizon SLJ Asset Management.

Gold, another ally in the battle against the dollar

On the African continent, the government of Ghana reported that it is working on a new policy to buy oil products with gold instead of using its U.S. dollar reserve.

The move is aimed at decreasing the demand for dollars by oil importers.

However, central banks are currently the main players in the gold market, as the way they approached the asset, during the first months of 2023, yielded record figures.

During that time, the main financial entities of the States bought more than 120 tons of gold.

According to the Financial Times, the big buyers of gold in 2022 were oil producers in China and the Middle East. That’s no coincidence, as these countries are driving changes in the international monetary system.

In that sense it is no secret that China has been accumulating as much gold as possible for many years.

The de-dollarization of the world is underway

While China is the world’s largest producer and buyer of gold, it is also demonstrating that it has the asset as part of its moves to de-dollarize the world.

Last year, the Shanghai International Energy Exchange launched yuan-denominated crude oil futures contracts. And for the first time since World War II, large-scale oil transactions are allowed in assets other than the U.S. dollar.

However, for oil producers who do not want to accumulate a large yuan reserve, China found a way out. It did so by linking the crude oil futures contract with the ability to convert the yuan into physical gold, through gold exchanges in Shanghai (the world’s largest physical gold market) and Hong Kong.

As a result, a large amount of oil money, which normally flowed through U.S. banks in dollars into the nation’s Treasury bonds, now flows through Shanghai into yuan and gold.

In short, the de-dollarization of the world is underway and there are more and more facts to prove it.

Moreover, bitcoin, the yuan and gold are gaining momentum as the alternative currencies that countries use, as if they were a weapon, to protect themselves from the possible sanctions with which the United States often threatens.

Read Also

- Currency Union in Latin America: Brazil and Argentina to Launch Common Currency

- Bitcoin Hodlers Continue to Increase Holdings, Recording Inflows of Over 15,000 BTC Per Month

- Lightning Strikes: Bitcoin’s Layer-2 Payment Solution Proves 1000 Times Cheaper Than Visa and Mastercard

- Google Cloud Expands Support Program for Web3 Creators with $200,000 in Credits

- Cryptocurrencies and Fiat Money: Two Sides of the Same Coin in the Fight Against Fraudulent Finance

Previous Articles:

- Why Choose Three.js Developers for Front-End Development?

- Bitcoin Hodlers Continue to Increase Holdings, Recording Inflows of Over 15,000 BTC Per Month

- Lightning Strikes: Bitcoin’s Layer-2 Payment Solution Proves 1000 Times Cheaper Than Visa and Mastercard

- 7 Best Audiobooks on Cybersecurity

- Apple Removes Bitcoin White Paper from MacOS Amid Controversy