KEY TAKEAWAYS

- Bitcoin’s four-year cycle halving and a Bitcoin ETF approval in 2024 sparked a notable increase in crypto market liquidity.

- Tech layoffs have channeled a wealth of talent into the crypto industry, fostering innovation and technological progress.

- Ethereum’s price saw a 4.73% rise, with experts suggesting it could outshine Bitcoin in the year’s performance.

- Altcoins like Cardano, XRP, and Dogecoin also experienced price increases and a positive market sentiment.

The year 2024 is going to be a pivotal one for the cryptocurrency industry, largely due to Bitcoin’s anticipated halving event occurring in April or early May.

This significant milestone, which happens approximately every four years, reduces the reward for mining new blocks by half, thereby decreasing the new supply of Bitcoin and often leading to an increase in price.

Additionally, the approval of a spot Bitcoin exchange-traded fund (ETF) has opened the floodgates for increased liquidity as it allows a broader range of investors to gain exposure to Bitcoin without having to directly purchase and store the digital currency.

Technological Growth Fueled by Big Tech Talent

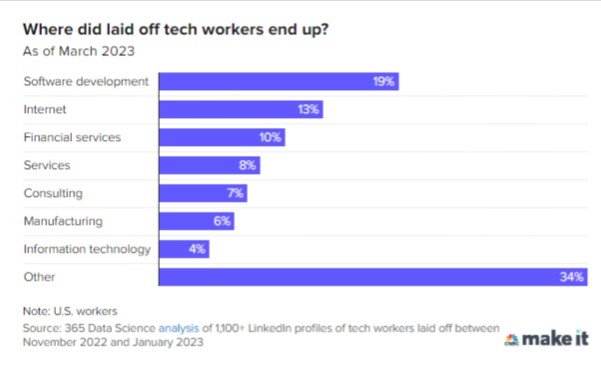

The crypto space has seen a surge in technological advancements this year, thanks in part to the 100,000 tech professionals laid off from major tech companies in the US alone.

Many of these individuals have either joined crypto startups or launched new ventures within the industry.

This influx of new talent has led to a wave of innovation, with human creativity being recognized as a driving force behind the industry’s growth and expansion.

Ethereum’s Steady Climb

Ethereum has also experienced a positive trend in 2023, with a price increase of 4.73%.

Market analysts have suggested that Ethereum may outperform Bitcoin, considering its status as a blue-chip alternative.

Bolstering this outlook are bullish signals for Metaverse-related altcoins, indicating potential gains and a strong performance for Ethereum throughout the year.

Altcoins Gaining Traction

Beyond Bitcoin and Ethereum, other cryptocurrencies, popularly known as altcoins, have also shown promising results.

Cardano’s price rose by 5.21%, while XRP and Dogecoin increased by 3.13% and 3.92%, respectively.

Analysts remain optimistic about these and other altcoins, expecting them to continue their positive trajectory in 2024.

Bottom Line

In summary, 2024 stands as a testament to the dynamic and ever-evolving nature of the crypto sector, underscored by a mix of economic factors and a fresh wave of talent entering the field.

As always, potential investors are advised to approach the market with diligence, fully aware of the risks involved.

LATEST POSTS

- Cryptocurrency Privacy Under Siege: Regulatory Challenges Lead to Exchange Delisting

- High BTC Stock Review (4.3 out of 5) – highbtcstock.com review – How To Be A Professional Online Trader

- TradeSafer Review – Is TradeSafer Scam (tradesafer.com review) Unlock the Secret to Trading Success with this Broker

- LunoFX Review – Is lunofx.com Scam or a Legit trading Broker?

- InterActive Review, inter-active.io – Is InterActive Scam or Legitimate? A Broker that Meets Every Criteria

- AUventure Review – Is auventure.com Scam or Proper Broker? Get Ready to Know about Fresh Starters’ Choice

Previous Articles:

- Cryptocurrency Privacy Under Siege: Regulatory Challenges Lead to Exchange Delisting

- High BTC Stock Review (4.3 out of 5) – highbtcstock.com review – How To Be A Professional Online Trader

- TradeSafer Review – Is TradeSafer Scam (tradesafer.com review) Unlock the Secret to Trading Success with this Broker

- LunoFX Review – Is lunofx.com Scam or a Legit trading Broker?

- InterActive Review, inter-active.io – Is InterActive Scam or Legitimate? A Broker that Meets Every Criteria