Blockchain technology and bitcoin, which has for a few years now triggered a monetary revolution, are expected to strengthen the common currency project that the BRICS+ countries and other led by China and Russia are planning to implement.

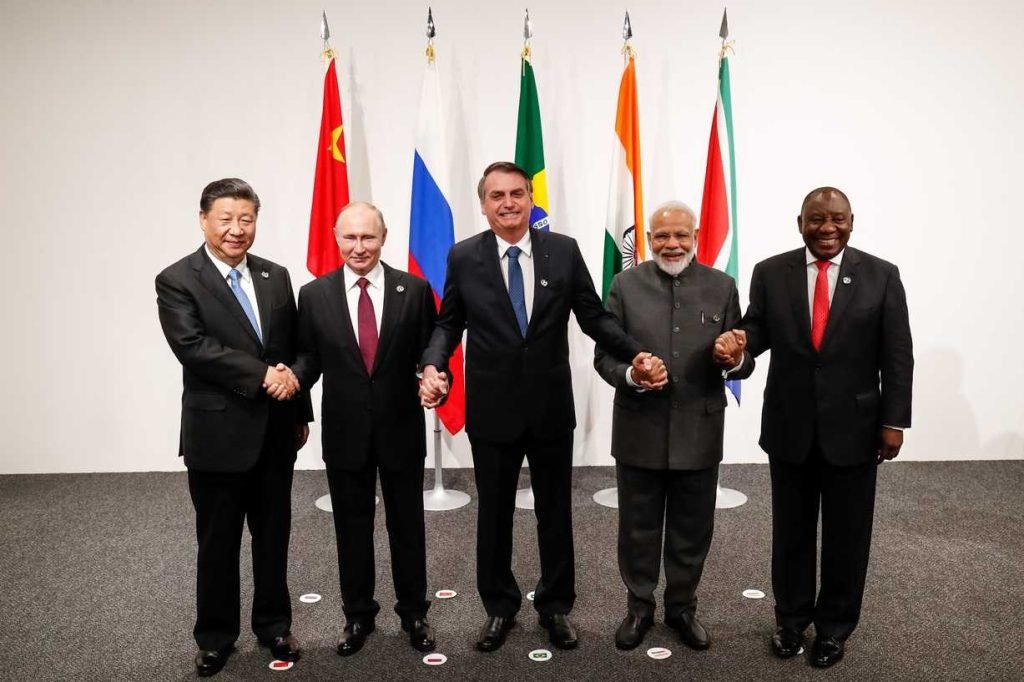

Ana Palacio, a former World Bank executive, has expressed the view that the BRICS countries, including Brazil, Russia, India, China and South Africa, are considering forming a “new monetary order” based on recent developments.

Palacio in an article points out that member states of the Global South are gradually coordinating on a plan to “de-globalize” trade and foreign exchange reserves and are exploring alternatives such as using a common currency against the US dollar.

At least 19 countries have expressed interest in working with the BRICS, including Argentina, Turkey and Saudi Arabia.

The former World Bank executive points out that a perceived gap between the current system of global economic governance under the West and the interests of some developing countries has led to a search for alternatives to the dollar.

In her article, Palacio underlines that developing economies are frustrated by the oppressive conditions imposed on them by US-driven international economic institutions.

They are not willing to tolerate attempts to “constrain” their economies through the use of the dollar to make countries into “debt colonies” or through restrictions on technology sharing.

The West’s unwillingness to restructure global economic governance so that emerging economies such as China and India have greater influence commensurate with their economic weight has intensified efforts to form a different economic bloc that will challenge US economic hegemony.

Other factors that may have fuelled emancipatory tendencies include economic imbalances, mismatched representation in international institutions, geopolitical tensions and ideological differences.

Meanwhile, the BRICS group is not the first to declare a desire to minimize its dependence on the dollar.

Saudi Arabia and Iran have already done so.

These states have strongly expressed their desire to reduce their dependence on the US currency, especially to regain control of their economies.

The Bitcoin plan

Although plans have not yet been finalized, BRICS countries may use Bitcoin as one of the main alternative currencies with which to conduct international transactions.

The attractiveness of Bitcoin could prove to be important for a number of reasons.

First, the maintenance of Bitcoin as a reserve currency by a state may offer significant autonomy from the US dollar in the field of international transactions.

This form of monetary diversification may act as a means of mitigating exchange rate risks and economic volatility.

Moreover, the blockchain technology on which Bitcoin is based is often seen as shaping a transformational duality of economies with the potential to transform financial systems and increase the efficiency of money flows in economies.

By adopting Bitcoin or expanding its use, BRICS countries have the potential to be at the centre of monetary innovation, adopting emerging technologies and strengthening their position on the global stage.

The benefits

Bitcoin offers many advantages for the BRICS economies that can help address these economic challenges.

- First, it can provide a secure and transparent platform for transactions.

This can help eliminate corruption and fraud, which are major issues in many BRICS countries due to the lagging political systems that hinder the functioning of the market economy. The decentralized nature of Bitcoin also makes it less vulnerable to government corruption, providing a stable alternative for citizens.

- Second, Bitcoin can provide a fast and low-cost platform for cross-border transactions.

This can prove particularly beneficial for businesses looking to expand internationally and for individuals looking to receive remittances from abroad.

Bitcoin’s low transaction fees and fast processing times make it an attractive option for cross-border transactions.

- Third, Bitcoin can help provide a stable currency reserve for the BRICS economies.

Several of these countries have experienced high inflation rates, leading to a decline in purchasing power.

The limited supply and decentralized nature of Bitcoin can provide a stable reserve asset that is not subject to inflationary pressures like traditional currencies.

How BRICS can leverage Bitcoin

One of the most important advantages of Bitcoin for the BRICS countries is its potential for cross-border transactions.

Traditional payment methods can be slow, costly and subject to fraud, making it difficult for businesses and individuals to expand internationally.

Bitcoin can offer a fast and low-cost alternative to traditional payment methods, allowing businesses to expand and individuals to receive remittances from abroad.

To leverage Bitcoin for cross-border transactions, BRICS countries could set up Bitcoin exchanges and encourage their citizens to use it as a payment method.

They could also establish partnerships with Bitcoin companies to facilitate cross-border transactions and provide education on the benefits of using Bitcoin.

Governments could also consider accepting Bitcoin as a form of payment for government services, further promoting its use and adoption.

Increasing trust between traders

One of the main issues with supporting a physical commodity currency – one that is dominated by many BRICS nations is trust.

There must be trust that the commodities are real and that the declared quality and quantity is valid.

This can be difficult to ensure, particularly when dealing with many countries with different regulatory systems and levels of transparency, so digital currency is an innovative solution to solve the issue of clearing cross border transactions and it is a problem that Bitcoin successfully solves.

While the BRICS group nations are strengthening their economic ties and discussing alternatives to the US dollar, Bank of America experts have argued that neither the BRICS currency nor the Chinese yuan will be able to replace the dollar in the near future but there is now general agreement that the countdown to its hegemony has begun.

READ NEXT

Previous Articles:

- Unicoin (UMU): The IMF’s Game-Changing Digital Currency Set to Transform Global Finance

- Transforming education with BeNFT: Blockchain, NFTs and growth opportunities.

- How to Buy Dedicated Hosting With Crypto

- Hosterbox Review: Affordable and Reliable Canadian Web Hosting Service

- Ripple CEO Warns of Crypto Exodus from US as Europe Emerges as Regulatory Haven