Coincidentally, as I delved deeper into the world of cryptocurrency, I stumbled upon a term that caught my attention – APY.

At first glance, it seemed like just another acronym thrown around in the crypto community. However, upon further research, I discovered that APY is a crucial factor to consider for those interested in staking their crypto assets.

So what exactly is APY and how does it relate to crypto staking?

APY stands for Annual Percentage Yield and it represents the return on investment over a year. In other words, it calculates the total amount earned on an investment over 12 months, including any interest or compounding gains. This metric is commonly used in traditional finance but has been adopted by the crypto industry as well.

When it comes to staking cryptocurrencies, understanding APY can be critical in maximizing returns.

Key Takeaways

- APY is the Annual Percentage Yield representing the return on investment over a year, and understanding its calculation is crucial in maximizing returns from staking cryptocurrencies.

- Different staking platforms may offer varying APY rates based on factors such as network congestion and demand for specific tokens, and choosing a reputable platform with strong fundamentals is crucial.

- Maximizing earnings from staking requires careful evaluation of different variables such as fees, availability of rewards, security protocols, and liquidity requirements, and diversifying your staking portfolio across multiple platforms can spread out the risk.

- When choosing between high or low APYs, it’s important to weigh the long term vs. short term gains and consider individual goals and risk tolerance level, and calculating APY requires taking into account not just the stated percentage but also other variables such as compounding frequency and any additional fees or penalties.

What is APY?

APY, or annual percentage yield, is a measure of the potential return on investment for staking cryptocurrency. It’s expressed as a percentage and represents the amount of interest earned on an investment over one year.

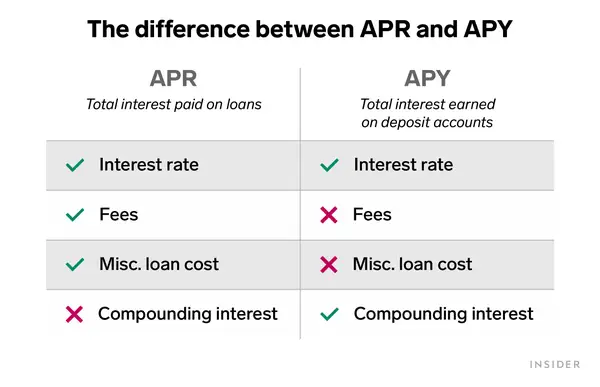

APY calculation takes into account not only the interest rate but also the frequency of compounding. When it comes to crypto staking, APY comparison is crucial in determining which platform offers the best returns.

Different platforms may offer varying APY rates based on factors such as network congestion and demand for specific tokens. It’s important to note that high APY rates may come with higher risks, so it’s essential to do your research and select a reputable platform.

Understanding APY is essential if you want to make informed decisions about investing in cryptocurrency staking.

By comparing different APY rates across various platforms, you can find the ones that offer the best returns while still managing risk effectively. As always, it’s best to consult with a financial advisor before making any investments.

How APY Works

You need to understand how the annual percentage yield (APY) works and how it affects your earnings from crypto staking rewards. Here are four key things to keep in mind:

- APY is a measure of how fast your investment grows over time.

- It considers both the interest you earn and any compounding effects.

- APY calculations vary based on factors like investment length, fees, and penalties.

- APY is often used to compare staking options and determine the best return on investment.

Understanding APY is essential for maximizing earnings from crypto staking rewards. By considering the factors that impact APY, you can make informed decisions about where to invest and how long to hold investments.

While APY can be useful for comparing staking options, it shouldn’t be the sole factor in investment decisions. Other considerations like market trends, risk tolerance, and financial goals should also play a role.

With careful research and decision-making, earning high returns through crypto staking is possible.

Maximizing Returns through APY

When it comes to maximizing returns through APY in crypto staking, there are a few key strategies that I like to keep in mind.

First and foremost, it’s important to choose the best staking option available. This means looking for projects with strong fundamentals and a solid track record of delivering results.

Additionally, it’s crucial to weigh the risks and benefits of high APY options carefully before making any investment decisions.

While higher yields can be tempting, they often come with elevated levels of risk that may not be suitable for all investors.

Strategies for Choosing the Best Staking Option

Opting for the most suitable staking option involves considering various strategies and understanding the potential risks and rewards. When it comes to choosing a staking option, there are several factors that should be taken into account. Here are four key strategies that can help you choose the best staking option:

- Comparing fees: Different staking options come with varying fees, which can significantly impact your returns. It’s essential to compare these fees and assess whether they’re justified based on the rewards offered.

- Availability of rewards: Rewards may vary depending on the coin or token being staked, as well as the platform used for staking. Before choosing a staking option, ensure that you understand how much reward is on offer and whether it aligns with your expectations.

- Security protocols: Staking often involves locking up funds for extended periods, so security is crucial. Look for platforms with robust security protocols that minimize risks such as hacking or theft.

- Liquidity: In case you need access to your funds unexpectedly, it’s important to consider how easily accessible they will be when locked in a stake contract. Consider opting for platforms that offer flexible unstake periods or partial withdrawals options to ensure liquidity when needed.

By keeping these factors in mind and conducting thorough research before committing to any particular platform or coin/token offering staking services, investors can maximize their returns while minimizing risks along the way.

Risks and Benefits of High APY

Assessing the potential risks and rewards is crucial before choosing a high APY staking option. While a high APY may seem attractive for short term gains, it comes with potential downsides that need to be considered.

One of these risks is the volatility of the market, which can cause significant losses if not mitigated properly. To mitigate these risks, it’s important to do your research and choose reputable projects with strong fundamentals and a proven track record. It’s also essential to diversify your staking portfolio across multiple platforms to spread out the risk.

Additionally, keeping an eye on market trends and adjusting your strategy accordingly can help minimize potential losses. When it comes to high APY staking options, it’s important to weigh the long term vs. short term gains.

While a higher APY may provide better short-term returns, there’s always a risk involved in chasing after quick profits. On the other hand, lower APYs may offer more stability and security in the long run. Ultimately, choosing between high or low APYs should depend on your individual goals and risk tolerance level, as well as how much time and effort you’re willing to invest in managing your staking portfolio.

Conclusion

In conclusion, understanding APY is crucial for anyone looking to invest in crypto staking. By knowing how APY works and how it can maximize returns, investors can make informed decisions about where to put their money.

While the potential for high returns may be tempting, it’s important to weigh the risks involved and consider factors such as the project’s credibility and liquidity. On one hand, APY offers a clear way of measuring returns on investment that can be compared across different platforms. On the other hand, blindly chasing high APY figures without doing due diligence could lead to losses or even scams.

As with any investment opportunity, it’s important to approach crypto staking with caution, do thorough research before committing funds, and diversify one’s portfolio to mitigate risk.

Previous Articles:

- The Funerary Mask of Tutankhamun Licensed NFTs To Release In 3D and Augmented Reality on ElmonX

- Cryptocurrency Investors Caught in the Hope Trap, Struggling to Find Profitable Altcoins

- What Is Bear Market In Crypto?

- Are crypto investors paying their taxes? (Here’s what the research shows)

- SEC Lawsuits Against Coinbase and Binance Raise Alarm for US Crypto Exchange