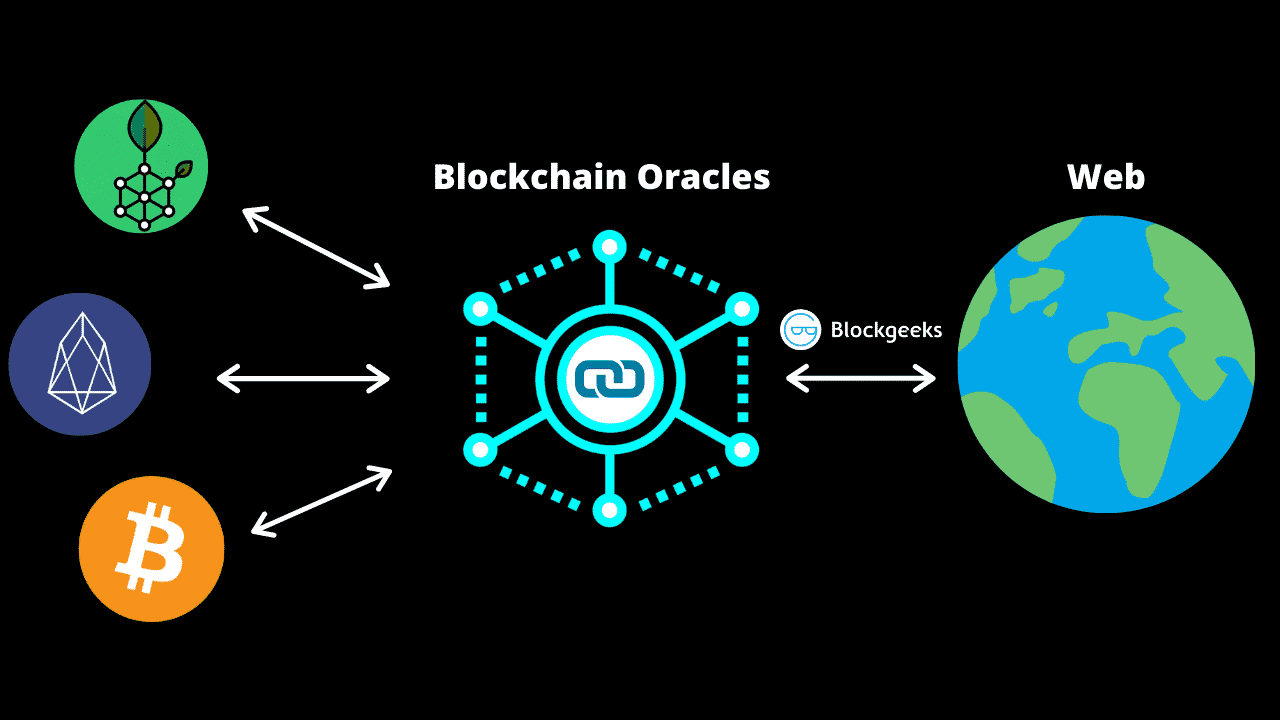

An oracle in the cryptocurrency space is a trusted entity that provides off-chain data to smart contracts. In other words, oracles provide information that is critical to a contract’s execution but which is not stored on the blockchain.

This data could include things like weather conditions, election results, or stock prices. By using oracles, smart contracts can interact with the real world in a way that would not be possible if they were limited to data that is stored on-chain.

There are a few different ways that oracles can get the data they need. They can directly query external sources, they can receive data from trusted intermediaries, or they can use decentralized protocols like Augur’s or Gnosis’ prediction markets to collect data.

Oracles can be useful for all kinds of different applications in the crypto space, including setting prices and determining the outcome of events like elections or sporting events. They are also critical to any smart contract that needs to interact with off-chain data sources like web APIs or payment networks. And because oracles can be trusted to provide accurate data, they also help reduce the risk of fraud and malicious activity.

At this point, oracles are still a fairly new concept in the crypto world, but as they become more widely used, we will likely see them playing an increasingly important role in smart contract development.

However, some challenges need to be addressed, such as the risk of centralization and the potential for data manipulation. But overall, oracles have the potential to be a very powerful tool for crypto developers, and we are likely to see more and more applications for them in the future.

Example

To maintain things simple smart contract systems (such as Ethereum or Dero) require what is known as an “oracle” to function properly. Most smart contract transactions need the involvement of an oracle (especially in the DeFi world). Smart contract blockchains have the disadvantage of being technologically closed platforms.

There isn’t any native mechanism that enables it to connect with the outer world in order to obtain data on what is going on with the outside world – yet many, if not the majority of smart contracts require information from the outside world in order to operate. It might be cryptocurrency or stock market pricing, sports results, or weather. Any pertinent data given by an external ‘feed’ is acceptable.

Read Also: What Are Layer-1 And Layer-2 Blockchains?

Assume you set a conditional buy order for Cardano inside an Ethereum network smart contract. The order may essentially state, “If the price of Bitcoin falls below $20,000, I like to trade 1,000 Cardano (ADA) tokens at the present price.”

This appears simple to handle, but in order for the smart contract to function, it must know if and when bitcoin trades below that price.

Since Bitcoin’s price does not exist naturally anyplace on the network, the smart contract requires access to a technological middleman. The oracle, as a mediator, delivers and interprets the necessary data from an external resource.

In its most basic form, an oracle is a “go fetch” for smart contract network transactions. The smart contract requires certain information, so it contacts the Oracle and requests “go fetch” this or “go fetch” that data, content or any kind of information.

The oracle receives the data and returns it to the blockchain for use in the smart contract. It is compensated for this service using each Oracle ecosystem’s native coin.

How Do Oracles Work in Blockchain?

Oracles are entities that work as intermediaries between blockchains and the “real world” by providing information to blockchains that isn’t readily available on the blockchain itself.

Oracles can be used for a variety of purposes, such as verifying the authenticity of events, data or smart contracts. To do this, oracles use various sources of information to find the answer to a question posed by a blockchain smart contract.

Once the oracle has found the answer, it submits it to the blockchain so that the smart contract can execute accordingly.

Oracles are usually created by third-party developers, and they come in different forms. Some popular Oracle platforms include Chainlink, Oraclize, and Blockchain Terminal.

While there are some concerns about the security and reliability of these Oracles, they have proven to be useful for integrating blockchain smart contracts with real-world applications.

There are several different use cases for oracles in blockchain technology. One common use is verifying the execution of a smart contract by submitting relevant data on its completion to the blockchain.

Read Also: What is a sidechain in blockchain technology?

This data can include information about whether a contract was executed as intended, whether all parties involved were paid, and so on. This use case is particularly relevant for smart contracts that involve payments, as it can help to ensure that the correct amount of money is sent to the right people.

Another common use case for oracles is verifying the authenticity of data. This is often done by submitting hashes of data to the blockchain, which can then be used to verify the data’s integrity. This is useful for ensuring that the data being used in a smart contract is accurate and up-to-date.

Finally, Oracles can also be used to trigger the execution of smart contracts based on external events. For example, an oracle can receive data from a weather source and then trigger the execution of a smart contract when certain conditions are met, such as when it’s raining or snowing outside.

This use case allows users to execute smart contracts in real time, without needing to rely on intermediaries to manually handle the data.

Chainlink is one of the most popular Oracle platforms, and it’s used by a variety of different projects.

Read Also: What Is Proof Of Concept In Blockchain?

Previous Articles:

- VELA Exchange Soars Ahead of Beta Release

- Crypto Exchange Luno Cuts 35% of Staff in Massive Layoffs

- Are All Crypto Tied To Bitcoin? Here’s What You Need To Know

- Dutch Central Bank Fines Coinbase €3.3 Million for Regulatory Violations

- Mexican Fintech Booms with 26% Growth in 2022