Cryptocurrencies have been making waves in the financial world for quite some time now. These digital currencies have changed the way we think about money and investment.

One term that is often used in the cryptocurrency space is ‘bull run‘. But what exactly does Bull Run mean and how does it impact the cryptocurrency market?

In simple terms:

A bull run in the cryptocurrency market refers to a period of time when the prices of cryptocurrencies increase rapidly.

During a bull run, investors and traders are bullish about the market, expecting that the prices will continue to rise. This can lead to a frenzy of buying and selling, with investors trying to get in on the action before the prices climb even higher.

But what causes these bull runs and what impact do they have on the cryptocurrency market? Let’s take a closer look.

What Is A Bull Run in Crypto?

A bull run in the cryptocurrency world is when the market experiences a significant and sustained increase in prices.

This means that the value of cryptocurrencies, such as Bitcoin, Ethereum, and others, rise rapidly and consistently over a period of time.

During a bull run, investors are optimistic and eager to buy, which drives up demand and further increases prices.

This positive sentiment can snowball, leading to a frenzy of buying and pushing prices to new all-time highs.

It’s important to note, however, that bull runs are not indefinite and eventually come to an end. The market can quickly shift, and prices can experience a sharp decline, leading to what’s known as a bear market.

Factors Fueling Bull Runs

A surge in demand from buyers and a decrease in supply from sellers are key factors in fueling the excitement of a market upswing.

One of the reasons why demand increases is because of the growing interest in cryptocurrency as an investment option.

This is especially true during times of economic uncertainty, when investors look for alternative investment options that are not tied to traditional financial markets.

Additionally, the increasing adoption of cryptocurrency by mainstream companies and institutions has also contributed to the surge in demand.

On the other hand, a decrease in supply occurs when holders of cryptocurrency refuse to sell their assets, either because they believe that the price will continue to rise or because they are waiting for a specific price point to sell.

This scarcity of supply can further drive up the price of the cryptocurrency, as buyers compete for a limited amount of available assets.

Overall, it is the combination of these two factors – increasing demand and decreasing supply – that results in a cryptocurrency bull run.

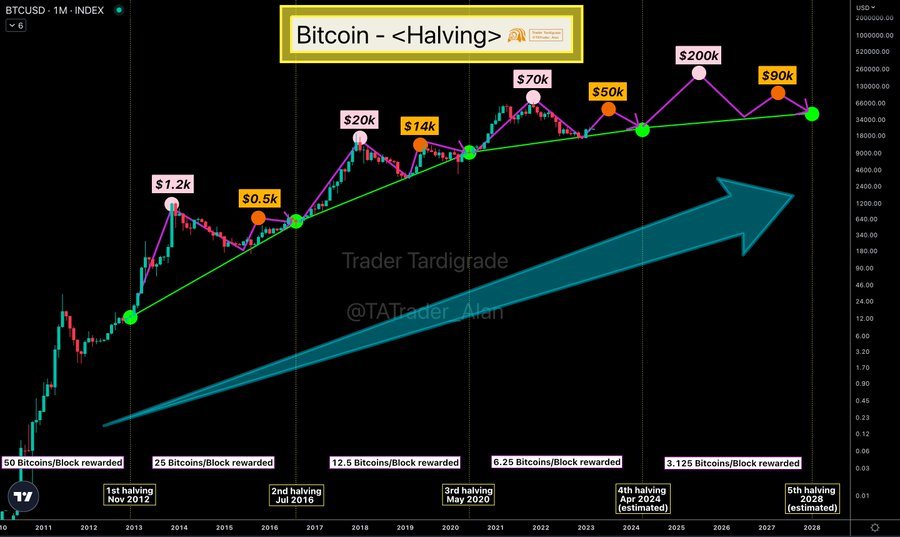

The History of Cryptocurrency Bull Runs

Throughout history, investors have witnessed dramatic and sudden spikes in the value of digital assets. In the early days of cryptocurrency, these bull runs were few and far between, with Bitcoin experiencing its first major surge in late 2013.

This was followed by a prolonged bear market that lasted until 2017, when Bitcoin and other cryptocurrencies experienced a massive bull run that saw the value of some coins increase by thousands of percent in just a few months.

The 2017 bull run was driven by a number of factors, including increased mainstream adoption, the emergence of new use cases for blockchain technology, and a wave of investment from institutional players.

While the market eventually cooled off and entered a prolonged bear market, the lessons learned from that experience have helped pave the way for future bull runs.

As cryptocurrencies continue to mature and gain wider adoption, it’s likely that we’ll see more frequent and sustained periods of upward momentum in the years to come.

Impact on the Cryptocurrency Market

The impact of recent events on the market has been significant, with many investors closely monitoring the fluctuations in digital asset prices.

The cryptocurrency bull run has had a positive impact on the overall cryptocurrency market, with many coins experiencing significant gains in value.

The bull run has been fueled by a number of factors, including the increasing adoption of cryptocurrencies by mainstream businesses and investors, as well as a growing interest in decentralized finance (DeFi) projects.

One of the main impacts of the cryptocurrency bull run has been an influx of new investors into the market.

This has led to increased liquidity and trading volume, which has in turn driven up the prices of many cryptocurrencies.

However, the bull run has also led to increased volatility, with many coins experiencing rapid price fluctuations over short periods of time.

As a result, many investors have been forced to closely monitor their portfolios and react quickly to sudden changes in the market.

Despite these challenges, the cryptocurrency bull run has generally been seen as a positive development for the industry, and many analysts expect the market to continue to grow and evolve in the coming years.

Navigating Bull Runs as an Investor or Trader

Investors and traders need to be prepared for the rollercoaster ride of price fluctuations during periods of high market activity, in order to make informed decisions and maximize potential gains.

Bull runs can be exciting, but they can also be unpredictable and volatile. It’s important to have a solid understanding of market trends, as well as a clear strategy and risk management plan in place before diving in.

One key strategy for navigating bull runs is to stay level-headed. It can be tempting to get caught up in the hype and make impulsive decisions based on emotions rather than analysis.

However, it’s important to remain objective and stick to your plan. This may involve setting clear targets for profit-taking and stop-loss orders to limit potential losses.

Additionally, it’s important to stay informed about the latest news and developments in the market, as these can have a significant impact on price movements.

By staying informed and disciplined, investors and traders can navigate bull runs with greater confidence and potentially reap the rewards of increased market activity.

Frequently Asked Questions

How long do cryptocurrency bull runs typically last?

Cryptocurrency bull runs can last anywhere from a few months to a few years, and the length of a bull run depends on various factors such as market sentiment, adoption, and technological advancements.

Are all cryptocurrencies affected by a bull run, or only a select few?

Not all cryptocurrencies are affected by a bull run. Some may experience an increase in value while others may not. The factors that influence a bull run can vary between different cryptocurrencies. In general terms though, most cryptocurrencies experience a surge in price during a bull run.

Can bull runs be predicted or are they completely random?

Bull runs in the cryptocurrency market cannot be accurately predicted and are often a result of a combination of factors, including investor sentiment, market trends, and news events. They are not completely random but can be unpredictable.

What are some potential risks associated with investing in a bull run?

Investing in a bull run can be risky due to the potential for price volatility, market manipulation, and lack of regulation. It’s important to do thorough research and only invest what you can afford to lose.

How does a cryptocurrency bull run differ from a traditional stock market bull run?

A cryptocurrency bull run differs from a traditional stock market bull run in terms of volatility, speculation, and lack of regulation. Investors should be cautious as the market can experience rapid and unpredictable changes.

Conclusion

In conclusion, a cryptocurrency bull run is a period of sustained price increase in the cryptocurrency market.

These bull runs are fueled by a combination of factors including increased demand, media attention, and positive news developments.

The history of cryptocurrency bull runs has shown that they can have a significant impact on the overall cryptocurrency market, with prices rising rapidly and investors and traders rushing to capitalize on the trend.

Navigating bull runs as an investor or trader can be a challenging task, requiring careful analysis and risk management strategies.

However, with the right approach, bull runs can also present significant opportunities for profit and growth.

As the cryptocurrency market continues to evolve and mature, we can expect to see more bull runs in the future, and investors and traders would do well to stay informed and prepared for these periods of market growth.

READ ALSO

Previous Articles:

- Republican Proposal Paves the Way for Cryptocurrency Exchanges to Trade Digital Securities and Commodities, But Democrats Support Remains Uncertain

- Optimism’s Bedrock Upgrade Slashes Ethereum Gas Costs by 40%

- Navigating the Confluence of Blockchain and AI with TokenMinds

- SEC Launches Aggressive Crackdown on Cryptocurrency Giants Binance and Coinbase

- SEC Expands Crackdown on Cryptocurrencies, Labeling 61 Coins as Securities (Full List)