- Crypto executives warn that rising geopolitical tensions could fragment blockchain networks and limit user access.

- Potential tariffs, especially on Chinese imports, may disrupt cryptocurrency mining hardware supply chains.

- Despite market vulnerability to trade tensions, Bitcoin shows resilience as a potential hedge against geopolitical risks.

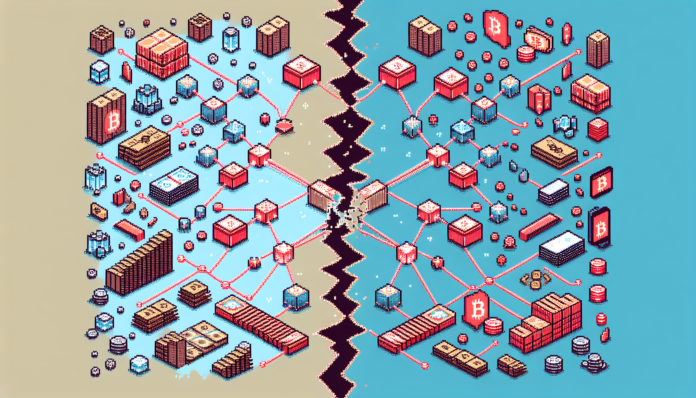

Cryptocurrency industry leaders are raising alarms that worsening global trade tensions could fragment blockchain networks and restrict user access. As reported to Cointelegraph, executives across the sector express concern about potential disruptions to the physical infrastructure supporting digital assets.

On April 9, U.S. President Donald Trump announced a temporary pause in new tariff implementations on certain countries. However, market uncertainty persists as Trump still aims to impose 125% tariffs on Chinese imports, fueling fears of an impending trade war. The cryptocurrency market responded with approximately 4% decline in total market capitalization on April 10, according to data from CoinMarketCap.

Nicholas Roberts-Huntley, CEO of Concrete & Glow Finance, told Cointelegraph that "Aggressive tariffs and retaliatory trade policies could create obstacles for node operators, validators, and other core participants in blockchain networks. In moments of global uncertainty, the infrastructure supporting crypto, not just the assets themselves, can become collateral damage."

Bitcoin’s Vulnerability to Supply Chain Disruptions

Bitcoin (BTC) faces particular vulnerability to trade restrictions due to its reliance on specialized hardware components. David Siemer, CEO of Wave Digital Assets, explained to Cointelegraph that "Tariffs disrupt established ASIC supply chains," noting the industry’s dependence on Chinese manufacturers like Bitmain for crucial mining equipment.

Beyond hardware concerns, Siemer warned that "the greater threat is the erosion of blockchain’s core value proposition—its global, permissionless infrastructure." This could significantly impact everyday cryptocurrency users.

Joe Kelly, CEO of Unchained, added that "If global trade breaks down and capital controls tighten, it may become harder for citizens in restrictive countries to acquire bitcoin. Governments could crack down on exchanges and on-ramps, making accumulation and usage more difficult."

Silver Lining Amid Market Turbulence

Despite these concerns, executives note that current geopolitical tensions actually highlight cryptocurrency’s value proposition. Bitcoin has demonstrated "signs of resilience" during recent market fluctuations, reinforcing its potential role as a hedge against geopolitical instability.

Neil Chopra, an executive at Fireblocks, observed that "While the environment is challenging, it also creates an opening for crypto to prove its long-term value and utility on the global stage." This perspective suggests that despite short-term disruptions, blockchain technology may ultimately benefit from demonstrating its utility during periods of international tension.

✅ Follow BITNEWSBOT on Telegram, Facebook, LinkedIn, X.com, and Google News for instant updates.

Previous Articles:

- US Sanctions Crypto Wallets Linked to Houthis and Russian Exchange

- Pro-Bitcoin Poilievre’s odds plummet to 25% in Canada’s PM race

- ChatGPT’s New Memory Upgrade Lets AI Access Your Entire History

- DOJ Memo Dismantling Crypto Unit Won’t Impact Do Kwon’s Prosecution

- Bitcoin Life Insurance Startup Raises $40M For Inflation-Prone Economies