You hold tokens on one blockchain. You want to access opportunities on another.

Problem: your assets are stuck on one blockchain while the opportunity exists on another.

This disconnect between blockchain networks costs crypto users billions in missed opportunities and inefficient capital allocation every year.

Symbiosis Finance solves this problem by connecting over 50 blockchains through a single interface as a decentralized bridge protocol. No wrapped tokens. No multiple transactions. No technical knowledge required.

What is a Cross-Chain Crypto Bridge?

A crypto bridge connects separate blockchain networks, allowing you to move assets between them. Picture two islands with different currencies, languages, and laws. You can’t simply walk from one island to another. You need a bridge. Cross-chain bridges serve this exact function for blockchain networks, creating pathways where none existed before.

Think of blockchains as isolated databases. Each one operates independently with its own rules, tokens, and protocols. Without bridges, your ETH stays on Ethereum, your SOL stays on Solana, and never the two shall meet.

Cross-chain bridges break down these walls. They lock your assets on one chain and release equivalent value on another. This process = interoperability, the ability for different blockchains to communicate and exchange value.

The blockchain industry faces a fundamental challenge: fragmentation. According to DeFiLlama, over $130 billion in total value locked (TVL) spreads across hundreds of separate chains as of November 2024 [DeFiLlama, 2024]. TVL represents the total amount of assets deposited in DeFi protocols. Users need multiple wallets, different gas tokens, and technical expertise to navigate this fractured landscape.

Symbiosis Finance addresses these pain points through automated cross-chain swaps. The protocol handles the complex backend processes while you simply select your source and destination chains.

The following sections will walk you through exactly how Symbiosis works and why it stands out in the crowded bridge market.

Why Choose Symbiosis for Your Cross-Chain Needs?

COVERAGE

- 50+ Blockchains

- Both EVM & non-EVM chains

- One interface for all

BEST RATES

- Automatic route optimization

- Multiple liquidity sources

- See fees upfront

NO KYC

- Zero registration

- Direct wallet connection

- Start bridging instantly

SECURITY

- Non-custodial always

- You control your keys

- Audited smart contracts

Support for 50+ Blockchains

Symbiosis connects both EVM and non-EVM chains through a unified protocol. According to the official Symbiosis documentation, the protocol supports over 30 EVM-compatible chains including Ethereum, BNB Chain, Polygon, Avalanche, Arbitrum, and Optimism, plus non-EVM chains like Bitcoin, Solana, TON, and TRON.

You can bridge between any supported chains seamlessly.

This extensive coverage matters. Most bridges limit you to specific routes or chain types. MetaMask’s bridge aggregator, for instance, primarily focuses on EVM chains. Wormhole supports multiple chains but requires more technical steps for non-EVM transfers.

Symbiosis removes these limitations. One interface handles all your cross-chain needs, whether you’re moving stablecoins to Arbitrum for lower fees or bridging native tokens to emerging ecosystems.

Automatic Routing for the Best Rates

“But how do I know I’m getting the best price for my bridge transaction?”

Symbiosis automatically compares multiple liquidity sources and routes to find you the optimal path. The protocol aggregates liquidity from decentralized exchanges (DEXs) across all connected chains. When you initiate a transfer, the system calculates:

- Gas costs on both chains

- Slippage (price changes that occur during your transaction)

- Bridge fees

- Exchange rates across different paths

You see the final amount you’ll receive before confirming the transaction. No surprises. No hidden fees eating into your transfer.

No Need for Registration

You connect your wallet and start bridging immediately. No email verification. No KYC procedures. No account creation. This non-custodial approach means you maintain complete control over your assets throughout the entire process.

Direct Wallet Connection

Symbiosis works with all major wallets: MetaMask, WalletConnect, Coinbase Wallet, and dozens more. Your private keys never leave your wallet. The protocol cannot access, freeze, or confiscate your funds.

This security model differs fundamentally from centralized exchanges. When you bridge through Binance or Coinbase, you deposit assets into their custody. They control the keys = they control your crypto. Symbiosis eliminates this counterparty risk.

Now that you understand the benefits, let’s examine the technical process that makes cross-chain bridging possible.

A Look Under the Hood: The Symbiosis Protocol

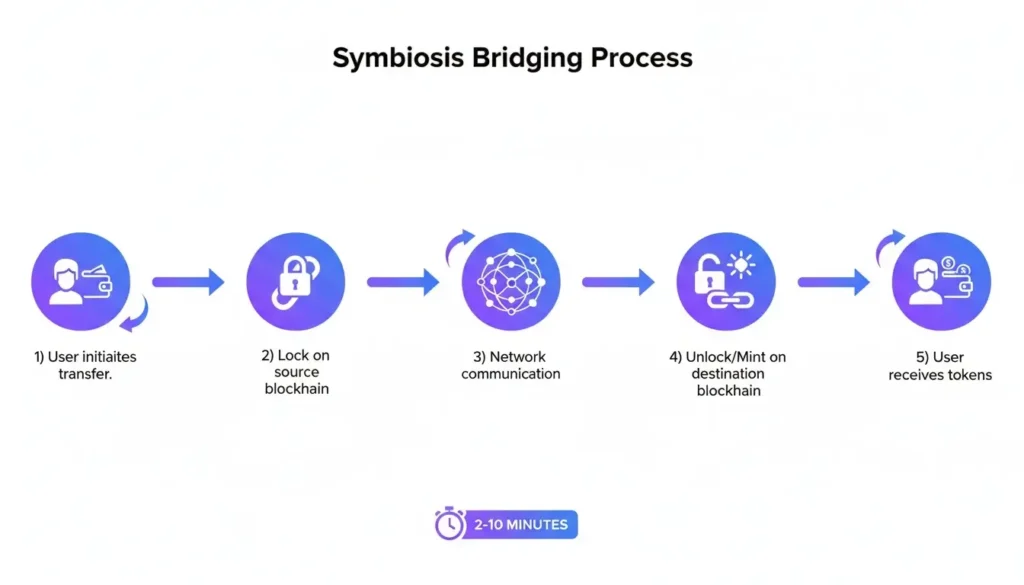

The bridging process on Symbiosis follows these steps:

- You initiate a transfer by selecting source chain, destination chain, and amount

- The protocol locks your tokens in a smart contract on the source chain

- Relayers (specialized nodes that communicate between chains) detect the lock event and communicate with the destination chain

- Equivalent tokens are minted or released on the destination chain

- You receive the tokens in your wallet on the new chain

This “lock and mint” mechanism maintains the total supply of tokens across all chains. When you bridge 1 ETH from Ethereum to Polygon, that ETH gets locked on Ethereum while an equivalent amount gets released on Polygon.

For example, if you bridge 1,000 USDC from Ethereum to Avalanche, exactly 1,000 USDC gets locked in the Ethereum smart contract, and exactly 1,000 USDC (minus fees) gets released to your Avalanche wallet.

The entire process typically takes 2-10 minutes depending on network congestion and confirmation requirements. Compare this to centralized exchange transfers which can take hours or even days for large amounts.

Symbiosis operates as a decentralized bridge protocol using a network of validators to secure cross-chain messages. These validators lock up SIS tokens (the protocol’s native token) as security deposits.

If they attempt to process fraudulent transactions, they lose their stake. This economic incentive = security without centralized control.

(Ed. note: The protocol has processed over 2.5 million transactions across all supported chains according to on-chain data from Symbiosis Explorer as of November 2024.)

Let’s walk through a real example to see this process in action.

The Symbiosis Ethereum Bridge: Your Gateway to DeFi

Ethereum hosts over $48 billion in DeFi protocols according to DeFiLlama data from November 2024. Major lending platforms like Aave and Compound, DEXs like Uniswap, and liquid staking protocols like Lido all call Ethereum home.

The Ethereum Foundation reports that Ethereum processes over 1 million transactions daily, cementing its position as the primary DeFi hub.

The Symbiosis Ethereum Bridge provides direct access to this ecosystem from any connected chain. You can bridge native tokens or stablecoins to Ethereum in minutes, ready to deploy in any protocol.

Traditional Ethereum bridging methods create friction:

| Bridge Method | Transfer Time | Custody Risk | Fees | User Experience |

|---|---|---|---|---|

| Native Bridges (Arbitrum Official) | 7 days for withdrawals | None | Low (~$10) | Complex, slow |

| Centralized Exchanges | 30 min – 24 hours | HIGH – Full custody | 0.5-2% + withdrawal fees | Multiple transactions needed |

| Other Third-Party Bridges | 10-30 minutes | Varies | 0.3-1% | Limited liquidity/routes |

| Symbiosis | 2-10 minutes | None (non-custodial) | 0.1-0.3% | One-click process |

Symbiosis eliminates these pain points through deep liquidity pools (large reserves of tokens available for swapping) and efficient routing. The protocol maintains sufficient liquidity for large transfers while keeping fees competitive.

Recent data from L2Beat shows that over $35 billion sits in Ethereum Layer 2 networks as of November 2024.

Symbiosis connects all major L2s, allowing you to move assets between Arbitrum, Optimism, Base, and mainnet Ethereum without touching a centralized exchange.

Bridging to Ethereum: Your Gateway to DeFi

Ethereum hosts the largest DeFi ecosystem with over $48 billion in total value locked. You might hold USDC on BNB Chain or Polygon and want to access Ethereum’s premier protocols like Aave, Uniswap, or Lido.

Traditional methods create friction. Centralized exchanges require KYC, charge high fees, and take hours. Native bridges lock you into specific routes with limited token support.

The Ethereum Bridge from Symbiosis simplifies this process.

Here’s how to bridge from BNB Chain to Ethereum in five steps:

- Connect your wallet to Symbiosis Finance

- Select BNB Chain as source and Ethereum as destination

- Enter the amount of USDC you want to bridge

- Review the fee breakdown and estimated arrival time

- Confirm the transaction in your wallet

- The protocol handles everything else. Your USDC arrives on Ethereum ready to deploy in any DeFi protocol. The entire process takes 2-5 minutes depending on network congestion.

Symbiosis automatically includes a small amount of ETH for initial gas costs on Ethereum, removing a common barrier for users bridging from other chains.

Ethereum remains the center of DeFi activity. Let’s explore how Symbiosis optimizes bridges to this crucial ecosystem.

Frequently Asked Questions

The Future of Cross-Chain Bridging

Symbiosis Finance simplifies one of crypto’s most frustrating experiences. You no longer need technical expertise to move assets between chains. You don’t need multiple wallets, wrapped tokens, or complex multi-step processes.

The protocol’s extensive chain support, automatic routing, and non-custodial architecture make it the most comprehensive bridging solution available today. Whether you’re chasing yield on emerging chains or consolidating assets back to Ethereum, Symbiosis handles the complexity.

Cross-chain bridges represent critical infrastructure for crypto’s multi-chain future. As new chains launch and existing ones gain adoption, seamless interoperability becomes MORE important, not less. Symbiosis positions itself at the center of this evolution.

Ready to experience frictionless cross-chain transfers? Visit Symbiosis Finance and bridge your first assets today.

The multi-chain future doesn’t require you to choose one ecosystem over another. With proper bridging infrastructure, you can access them all.

Previous Articles:

- Robinhood Weighs Adding Bitcoin to Balance Sheet as Crypto Sales Surge

- ENA Drops 80% as Token Unlock Floods Market, Trades Near $0.31

- Zcash Token Surges Past $500 on Privacy Support Boost

- Russia-Aligned Hackers Use Fake ESET to Target Ukraine Entities

- Prediction Markets Bet $1.1M on Elon Musk’s Tesla Pay Package Approval