Are you tired of trying to navigate the volatile world of cryptocurrency trading on your own? Do you find yourself constantly agitated by the unpredictable fluctuations in the market? Fear not, for a moving average (MA) crypto bot may be the solution you’re looking for.

A moving average crypto bot is a tool that uses past data to identify trends and make predictions about future price movements. By applying a mathematical formula to historical price data, an MA crypto bot can help you make informed decisions about when to buy and sell your cryptocurrencies.

Unlike human traders, an MA crypto bot can operate 24/7, quickly analyzing vast amounts of data to identify opportunities and execute trades in real-time. This can help you take advantage of market movements and maximize your profits, without the need for constant monitoring and manual intervention.

With an MA crypto bot on your side, you can have peace of mind knowing that your investments are in good hands. No more sleepless nights or stressful days spent worrying about the ups and downs of the market. Instead, you can sit back, relax, and let your MA crypto bot do the hard work for you.

In this article you will learn

- What is the moving average?

- Types of moving average

- How to apply moving average for trading

- What is MA crossover

- How to automate MA strategy with a crypto bot

- Bottom Line

What is meant by moving average?

In case you don’t know what moving averages are or haven’t dived into the numerous technical indicators available to assist you in your cryptocurrency trading, you are really missing out on interesting tools that can help you set fruitful trading strategies and increase your gains.

Investors and market analysts can use a moving average as a technical indicator to pinpoint a trend’s direction. To get an average, it adds up the data points for a stock, cryptocurrency or any financial security over a given time frame and divides the sum by the total. The reason it is referred to as a “moving” average is that it is constantly updated using the most recent pricing information.

By analyzing price changes for an asset, analysts can assess support and resistance using the moving average. By design, a moving average depicts the security’s prior price movement or action and is not very effective as a live trading signal. The information is then used by analysts or investors to forecast the course of the asset price.

Moving averages are also referred to as lagging indicator because, in order to generate a signal or reveal the trend’s direction, they lag behind the asset’s price movement.

How many types of moving averages are there?

There are many different types of moving averages and the main aspect that makes them different is the way the computation of the averages is done. To not overcomplicate this article, we will tell you about the five most commonly used and simplest moving averages. Let’s start with:

Simple Moving Average (SMA): By calculating the average price of a security over a predetermined number of periods, a simple moving average is created. Most of the moving averages are calculated with the use of closing prices. For example, you can calculate a 5-day simple moving average by dividing by five the closing prices over the previous five days. The average moves along the time scale as new data is added and old data is deleted.

Weighted Moving Average (WMA): The term “weighted moving average” refers to moving averages in which the average is calculated by giving a specific weight to each data point over the moving average period. The elements in the moving average period are given a weight that increases exponentially in the case of the exponential moving average, a type of weighted moving average.

Exponential Moving Average (EMA): When the price of security surges, the simple moving averages are occasionally too simplistic and ineffective. The most recent periods are given more weight by exponential moving averages. They can therefore be utilized to develop a superior moving average strategy because they are more trustworthy than the SMA and a better depiction of the security’s recent performance.

Triangular Moving Average (TMA): The data is averaged twice since the triangular moving average is a double-smoothed curve (by averaging the simple moving average). A weighted moving average (TMA) uses a triangular pattern to apply the weights. When compared to the ones provided by the SMA, the trading signals generated by the TMA during a trending period will be further from the peak of the period, resulting in lower earnings when utilizing the TMA.

Variable Moving Average (VMA): In 1991, Tushar Chande created the variable moving average, an exponentially weighted moving average. Chande proposed that an exponential moving average’s performance might be enhanced by adjusting the smoothing period using a Volatility Index (VI). The VMA was created with the intention of accelerating the average when the market is trending in order to take full advantage of the trending prices, and to slow it down when prices are in a period of consolidation in order to prevent unprofitable trading signals.

How can you apply moving averages for your trading?

Moving averages are an interesting tool when it comes to understanding market trends and adapting your trading strategy adequately. As you may already know, it is not possible to predict how long a given trend will last using a secret formula. While some are brief, others might persist for several days, weeks, or even months.

Moving averages, however, can provide some insight into trends and their strength in the following ways:

- The price is below a moving average when a bearish trend is in effect.

- The price is in a bullish trend when it is above a moving average.

- The steeper the slope of the moving average, the stronger is the bullish or the bearish trend.

Moving Average Crossover

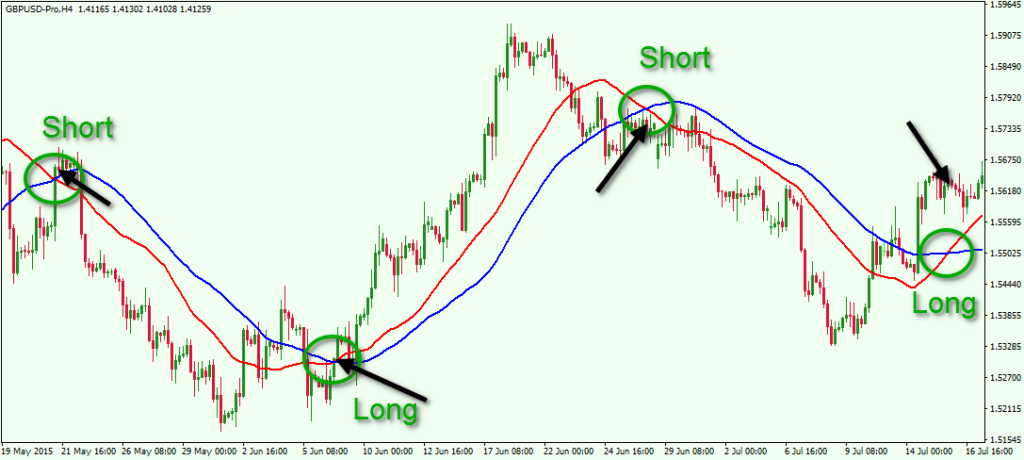

One of the most used trading strategies when using moving averages is focusing on the crossover between two moving averages. This technical indicator can give you a clear indication of a trend reversal, in other words, when to buy or when to sell.

In trading, a moving average crossover happens when two different moving average lines cross over one another. You need to activate two different moving averages, one having a shorter period than the second, like MA(50) periods with MA(200) periods, for example.

When the shorter MA crosses over the longer MA, you have your buy signal, and when it comes back under the longer MA, you have your sell signal.

How can you automate your MA trading strategy with a crypto bot?

Crypto bots are very powerful tools that can allow you to use many technical indicators to automate your trades. There are many options for automatic trading and not all of them can be trusted.

Bitcoin Code, for example, is famous for being unsafe, having countless evidence of money and data theft. On the other side, using a trading bot is not a magical internet money generator and here you can learn why most people never succeed with crypto trading bots.

Using, for example, Coinrule — an intuitive trading bots platform, you can create automated trading bots that will monitor the markets 24/7, waiting for your trading signal to be triggered.

These bots can allow you to generate additional gains when you are not available to trade and can be a very interesting addition to your toolbox, unlocking the possibility of generating passive income.

To create a moving average bot on Coinrule, you can easily set your trigger event to be the 50 periods MA crossing over the 200 periods MA, which will then trigger the buy action to buy a predefined amount of the coin of your choice.

To proceed and sell your coins, you can set the sell trigger to be the shorter MA crossing under the longer MA. You now have an automated MA trading strategy that can be executed in a fully passive manner!

Bottom Line

In conclusion, a moving average is a widely-used technical analysis tool that helps traders identify trends and make predictions about future price movements.

By smoothing out the fluctuations in data, a moving average can provide a clearer picture of the overall direction of a market and help traders make more informed decisions.

Whether used on its own or in combination with other indicators, a moving average can be a valuable tool for traders looking to gain an edge in the volatile world of cryptocurrency trading.

Author: Kong Lu

Certified blockchain and front-end developer, contributor at www.scammerwatch.com

Previous Articles:

- Amber: The layoffs, the end of Chelsea sponsorship and crypto market turmoil

- Coinbase sides with Circle’s stablecoin in its competition against Tether

- Crypto.com proves its customer’s reserves

- Cuba and its blackouts could drive cryptocurrency mining on the island to extinction

- Decentraland allows you to rent your digital property