Cryptocurrency staking platform Freeway, which had been highly promoted by cryptocurrency market influencers, announced the suspension of its services amid “market instability”.

There is currently confusion among users as to the future of the platform as well as uncertainty about the fate of its users’ cryptocurrencies.

The extent of the financial problem is not yet known. The platform suspended its services in the wake of the cryptocurrency drop issued by the platform.

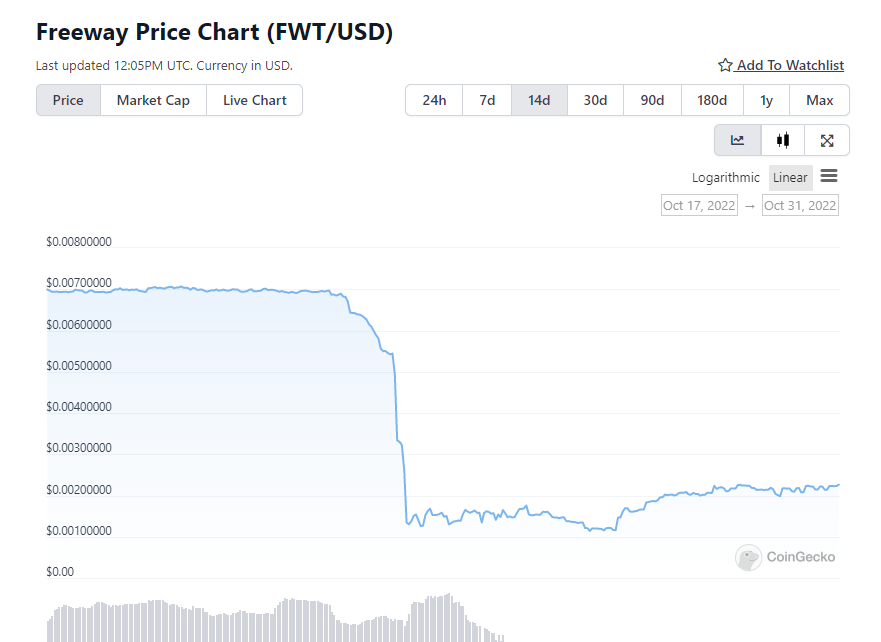

The $FWT cryptocurrency has fallen more than 80%, yet it still has a market cap of more than $10 million.

The cryptocurrency which is among the 1000 cryptocurrencies on the capitalization table is traded on very small and unreliable cryptocurrency exchanges with limited trading volume.

Most analysts agree that it was a well-orchestrated scam as it was impossible to find investment opportunities that consistently yield 43% in a bear market.

As the research reveals, the project was a rebrand of AuBit, founded in 2017. The company had launched a similar effort with TradFi fiat currencies and then realized that cryptocurrencies are more enticing.

The team had excellent marketing experience, and many of the “influencers” promoting it were making money through commissions.

At the same time, the company was inviting users to invite more people to the platform to earn more return/year. This is a classic tactic of a multi-level marketing project or pyramid scheme.

Superchargers

Freeway claimed to offer up to 43% annual rewards to so-called “Superchargers” that were attributable to both cryptocurrencies or traditional fiat currencies. Users deposited funds and had to buy a Supercharger package, which brings a return. To be able to buy they would also have to lock in the platform’s cryptocurrencies in a smart staking contract.

However there was one major problem: These Superchargers could not be redeemed for the deposited funds, but had to be sold to another user in order for the money to be returned.

However, Freeway said in its statement that it “will not purchase Superchargers until the new strategies are implemented; effectively locking in the funds“.

“As you will all be aware, there has been unprecedented volatility in the currency and cryptocurrency markets recently,” the company said in its message. “Freeway has therefore decided to diversify its asset base to manage exposure to future market fluctuations and volatility, ensuring the long-term sustainability and profitability of the ecosystem,” it added.

Freeway claimed to have $160 million in customer deposits according to the platform’s website. At no time was Freeway, considered among the major players in the cryptocurrency ecosystem.

Analysis of the onchain data suggests that the majority of the cryptocurrency’s holders, estimated at 4,342 holders, had received it for free from an airdrop distribution, and most cryptocurrencies were idle.

The largest investors in the platform lost just over $16,500, using data before Sunday’s market crash.

Meanwhile, as commented via Twitter by FatManTerra, the Freeway management team moved to delete the names of the team from the site…reinforcing many investors’ belief of a staged scam.

Even more interesting was that when registering, they asked for users’ consent even to not sue the platform – understanding the risk – while investment simulations should not be understood in any way as monetary units.

Previous Articles:

- Dogecoin: 10% jump after Musk’s acquisition of Twitter

- Core Scientific: US crypto mining company warns of Bankruptcy

- Google creates a hub engine dedicated to Ethereum

- Singapore: Knowledge test for cryptocurrency investors

- UK paves the way for cryptocurrencies