- Euro-pegged stablecoin market capitalization grew 102% in the 12 months after MiCA implementation, reversing a 48% decline in the prior year.

- Transaction volumes for major euro stablecoins increased 899.3%, rising from $383 million to $3.832 billion monthly after regulation took effect.

- EURS recorded the strongest individual growth at 643.86%, climbing from $38.2 million to $283.9 million between implementation and October 2025.

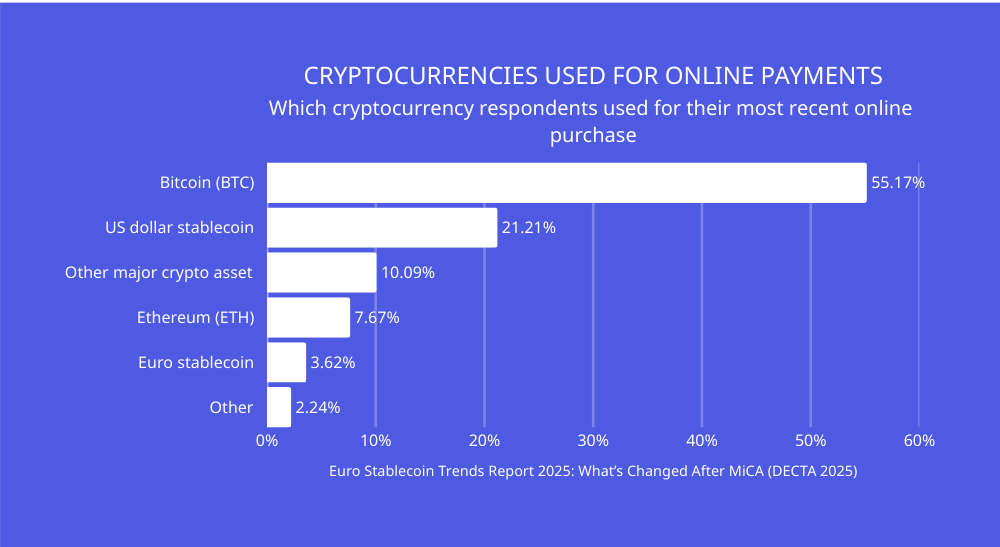

- Bitcoin remains the dominant cryptocurrency for online payments at 55.17% usage, while euro stablecoins account for just 3.62% of transactions.

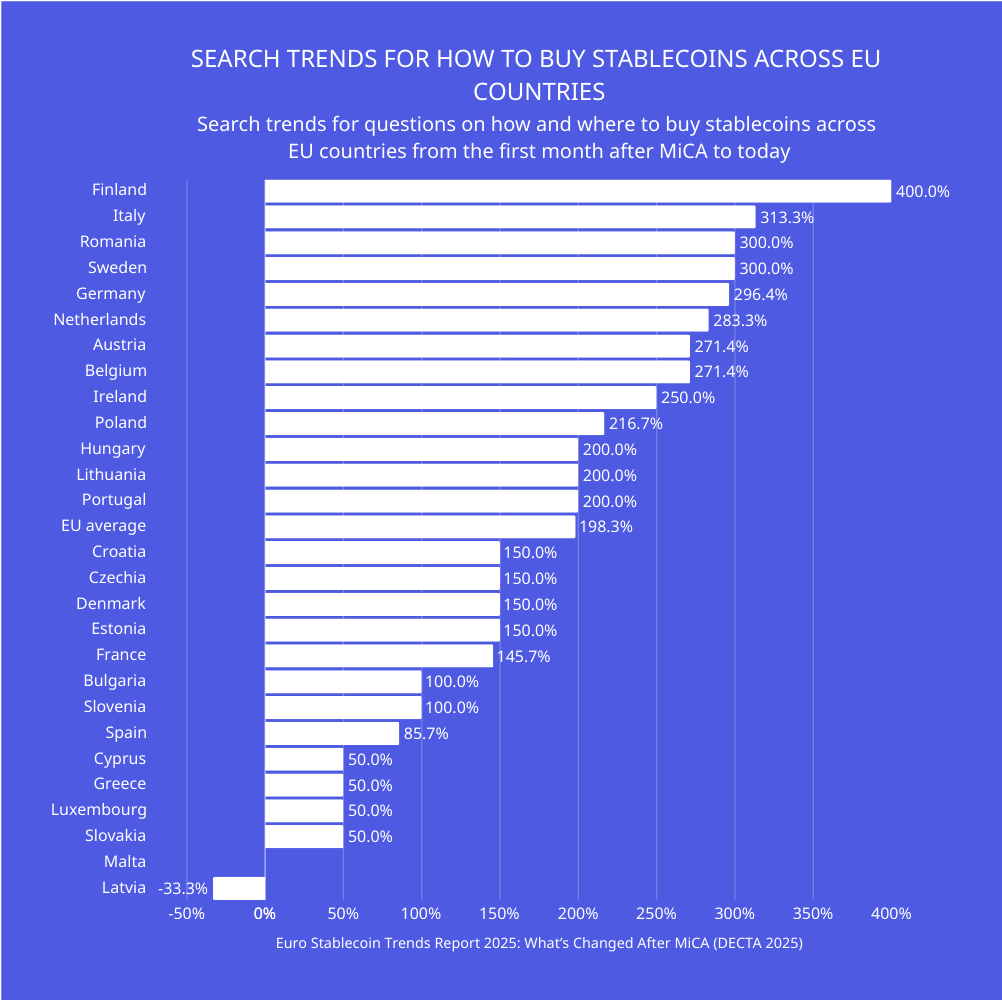

- Finland and Italy showed the highest post-MiCA search interest increases for stablecoin acquisition at 400% and 313.3% respectively.

Euro-pegged stablecoins reversed a year-long decline and doubled in market value during the 12 months following MiCA regulation enforcement, according to new data from payment infrastructure provider DECTA.

The combined market capitalization of major euro stablecoins dropped 48% in the year before MiCA took effect on June 30, 2024. That trend flipped immediately after implementation, with total market cap climbing 102% over the next 12 months and reaching $500 million by May 2025.

Transaction volumes showed even stronger momentum. Monthly trading activity across monitored euro stablecoins jumped from $383 million to $3.832 billion after MiCA, an increase of 899.3%.

Individual Stablecoins Show Divergent Growth Patterns

EURS led individual asset growth, expanding 643.86% from $38.2 million to $283.9 million by October 2025. EURC and EURCV dominated transaction volume increases, posting gains of 1,139.42% and 343.26% respectively.

Circle’s EURC operates as a MiCA-compliant euro-backed stablecoin across multiple blockchains. Société Générale’s EURCV targets institutional use cases including tokenized securities and wholesale payments.

The market shift reflects MiCA’s core requirements: full reserve backing with liquid assets, transparent reserve reporting, guaranteed redemption rights, and mandatory issuer authorization. Non-compliant tokens faced delisting from European platforms, pushing demand toward regulated alternatives.

New MiCA-authorized issuers entered the market throughout 2025. Membrane Finance launched EURe (branded as EUROe) as one of the first officially compliant stablecoins from a Finnish electronic money institution. Schuman Financial introduced EUROP, while StablR issued EURR, both emphasizing strict regulatory adherence.

Institutional Adoption Accelerates Under Regulatory Clarity

European institutions moved quickly to integrate stablecoins into payment infrastructure. Fireblocks reported that 58% of European institutions already use or plan to use stablecoins in payment flows. Only 18% cited regulation as an adoption barrier.

The European Union granted 53 MiCA licenses by late 2025, according to Bolder Group tracking. Of these, 14 went to e-money token issuers (stablecoin providers), while 39 went to Crypto-Asset Service Providers. Germany led licensing activity, followed by the Netherlands and Malta.

This licensing pace indicates active implementation rather than regulatory hesitation. As transitional periods close across member states, authorized capacity for compliant euro-denominated digital assets continues expanding.

Consumer Behavior Shows Bitcoin Dominance Persists

DECTA surveyed 1,160 EU residents who used cryptocurrency for online payments within the past 12 years. The results reveal limited euro stablecoin penetration in consumer transactions despite regulatory progress.

Bitcoin accounted for 55.17% of recent crypto payments. US dollar stablecoins captured 21.21%. Euro stablecoins represented just 3.62% of transactions.

Among respondents, 40.8% made their first crypto payment during the survey period, while 59.2% had prior experience. Service purchases dominated at 78.3%, with product purchases at 21.7%.

E-commerce and retail led spending categories at 26.55%, followed by software and technology services at 18.88%. Gambling sites took 16.47%, online entertainment 16.03%, and gaming 10.69%.

Future intent remains strong. A total of 56.7% said they are very likely to use crypto for payments again within 12 months, with another 24.9% somewhat likely. Only 7.9% indicated they are unlikely to repeat the behavior.

Search Interest Points to Growing Regional Demand

Consumer search behavior across EU member states shows rising interest in stablecoin acquisition following MiCA implementation.

- Finland recorded 400% growth in searches related to buying stablecoins between the first post-MiCA month and present.

- Italy followed at 313.3%, with

- Romania at 300%.

- Sweden, Germany, and the Netherlands each exceeded 280% growth.

The EU-wide average increase reached 198.3%. Only Latvia showed declining interest, dropping 33.3% below the reference level.

For queries specifically related to buying or transferring the three largest euro stablecoins (cEUR, EURC, and EURT), Cyprus led growth at 133.3%, followed by Slovakia at 100%. Austria, Czechia, and Sweden ranged between 80% and 87.5%.

Several markets showed declining interest in specific euro stablecoins despite broader stablecoin search growth. Malta recorded the largest drop at 50%, followed by Belgium and Hungary between 14.3% and 18.2%.

Legacy Tokens Face Compliance Pressure

Established stablecoins without MiCA authorization encountered operational challenges in the European market. Tether’s EURT remains widely used on exchanges but stays outside MiCA authorization lists, leading to adoption limits and regulatory scrutiny within the EU.

Angle’s EURA operates as an over-collateralized DeFi asset but does not qualify as a 1:1 fiat-backed stablecoin under MiCA standards. Celo’s cEUR focuses on mobile-based DeFi applications but lacks MiCA regulation in the EU.

The regulatory framework forced a clear division. MiCA-compliant tokens gained institutional traction and exchange listings, while non-compliant alternatives faced restricted access or delisting from European platforms.

2026 Outlook Depends on Distribution and Banking Integration

Continued euro stablecoin growth through 2026 hinges on several factors. MiCA-authorized issuers must expand distribution channels and banking relationships to reach broader markets.

Financial institutions need to adopt stablecoin-based settlement processes as tokenized assets and programmable payments become standard infrastructure.

Consumer demand will shape adoption rates, driven by payment use cases, exchange availability, and developments in domestic and cross-border commerce.

Regional differences in adoption will likely persist. Variations in consumer awareness, digital asset policies, and local market conditions create uneven growth patterns across member states.

The shift from non-compliant tokens toward fully regulated stablecoins should continue as European platforms complete MiCA adjustments.

By 2026, euro-pegged stablecoins are positioned to play a more defined role in the EU digital asset ecosystem, supported by a regulatory framework designed for long-term stability, transparency, and predictable oversight.

References

- Markets in Crypto-Assets (MiCA) Regulation – Official EU Text

- Fireblocks: European Stablecoin Adoption Report

- Bolder Group: Global Crypto Laws in 2025

- DECTA Consumer Survey (1,160 EU respondents)

- Google Search Console and Google Trends data

- DECTA: Euro Stablecoin Trends Report 2025

Previous Articles:

- Senior IcomTech Promoter Gets 71 Months for Crypto Ponzi Scheme

- Bank of Japan Rate Hike Fuels Crypto Rally; XRP, Bitcoin Jump

- SEC Sues VBit: Bitcoin Mining Hosting May Be Securities Offering

- Trump Appoints Crypto Regulators: Selig Heads CFTC, Hill FDIC

- OpenAI Eyes $100B Fundraise, Declares ‘Code Red’ Amid AI Rivalry