KEY TAKEAWAYS:

- Privacy coins are being targeted by regulators, leading to delistings on exchanges, especially in Europe.

- New MICA regulations challenge the listing of cryptocurrencies that offer anonymization features.

- Firo is exploring options to comply with exchange requirements while maintaining user privacy.

- The community is being consulted to find a balance between privacy and broader adoption.

- Exchanges are pushing for identifiable transactions, creating friction for privacy-centric projects.

Cryptocurrencies designed to protect users’ privacy are encountering heightened regulatory pressure, with several facing delistings in different regions, notably in Europe.

The recently introduced Markets in Crypto-Assets (MICA) regulations are particularly challenging for these coins, as they prohibit the listing of cryptocurrencies that enable anonymization.

Exchanges Demand Compliance

Cryptocurrency exchanges are increasingly cautious about accepting deposits from unidentified sources and have started excluding certain transactions, such as those involving masternode rewards or the Lelantus protocol.

Privacy coins like Monero (XMR) are especially at risk, as they lack mechanisms for transactions from transparent addresses, which is now a requirement by some exchanges.

Firo’s Dilemma: To Remove or Not to Remove Privacy

To remain listed on exchanges, Firo – a privacy-focused cryptocurrency that aims to provide secure and untraceable transactions which was previously known as Zcoin before rebranding in 2020 – has been presented with two stark options:

- either completely remove privacy features or

- provide users with a means to prove their private transaction deposits.

Firo has proposed a solution that would allow users to sign a message with their wallet to verify a Lelantus transaction, though feedback on this solution is still pending.

User Interface Adjustments and Potential Workarounds

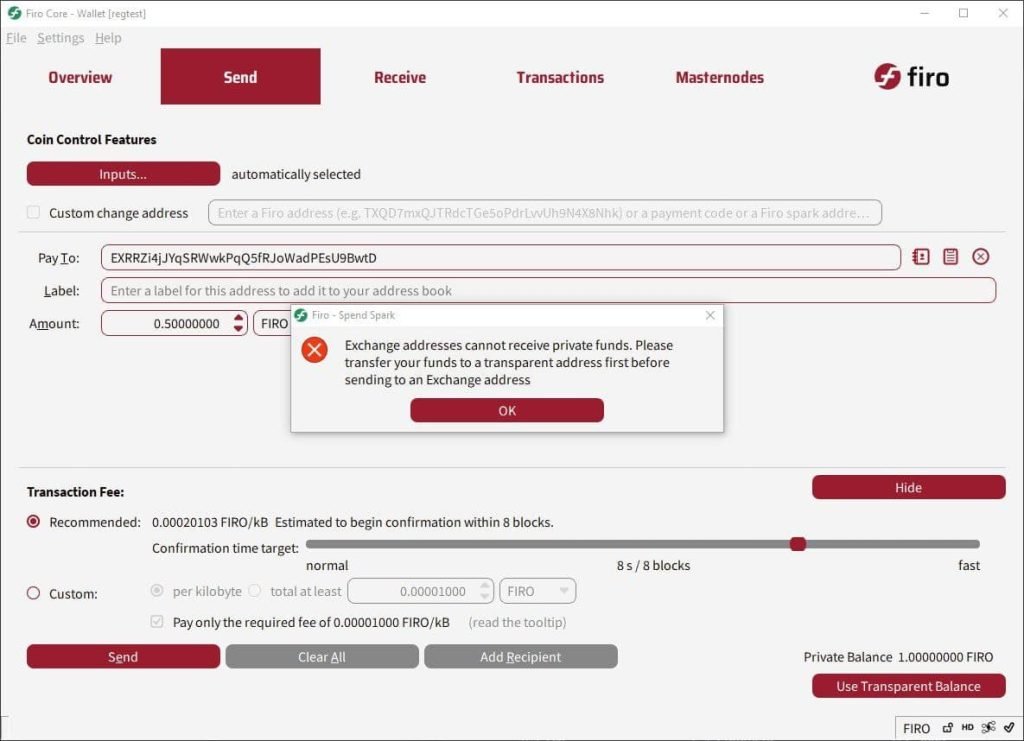

Firo’s wallet user interface may soon include warnings for users sending funds to transparent addresses if the source is private (Shielded funds).

Another considered alternative is the creation of an “Exchange only Address“.

This type of address operates similarly to transparent addresses, with the key distinction that it does not support shielded inputs spends and coinbase transactions. Only transparent (Unshielded) funds are accepted.

However, there are concerns this could create unnecessary barriers between private and transparent transaction layers.

For now, users have the option to unshield funds to a transparent address before sending them to an exchange, though this introduces additional steps.

Community Consultation in Progress

The Firo community is being actively engaged to gather opinions on the proposed changes and approaches.

Despite the development team’s efforts to promote the adoption of Spark addresses, which provide privacy, a more pragmatic approach is deemed necessary to ensure the project’s sustainability.

🤖 Funds that are kept in Spark addresses, remain confidential, ensuring private storage of your Firo. These addresses are not searchable on a blockchain explorer, further enhancing Firo's privacy features.

The community is expressing its frustration with the stringent regulations, but there is a consensus on not compromising the project’s fundamental principles.

Striking a Balance Between Privacy and Market Presence

While Firo and similar privacy-focused cryptocurrencies aim to offer mandatory and uncontested transaction privacy, they also face the need to remain listed on major centralized and decentralized exchanges (CEXes and DEXes) to ensure liquidity and broader adoption.

The challenge lies in maintaining a strong stance on privacy without excluding themselves from significant marketplaces.

The ongoing debate seeks to find a viable middle ground that upholds privacy without sacrificing the project’s viability.

LATEST POSTS

- High BTC Stock Review (4.3 out of 5) – highbtcstock.com review – How To Be A Professional Online Trader

- Elon Musk Gears Up for Payment Services on Social Media Platform X

- Find Dragon’s Treasure in the 1xBit’s Tournament!

- British Virgin Islands Court Freezes $1.14Bn Assets of Three Arrows Capital Founders

- Crypto Casino Bonanza: Unleashing the Power of Crash Games

Previous Articles:

- High BTC Stock Review (4.3 out of 5) – highbtcstock.com review – How To Be A Professional Online Trader

- TradeSafer Review – Is TradeSafer Scam (tradesafer.com review) Unlock the Secret to Trading Success with this Broker

- LunoFX Review – Is lunofx.com Scam or a Legit trading Broker?

- InterActive Review, inter-active.io – Is InterActive Scam or Legitimate? A Broker that Meets Every Criteria

- AUventure Review – Is auventure.com Scam or Proper Broker? Get Ready to Know about Fresh Starters’ Choice