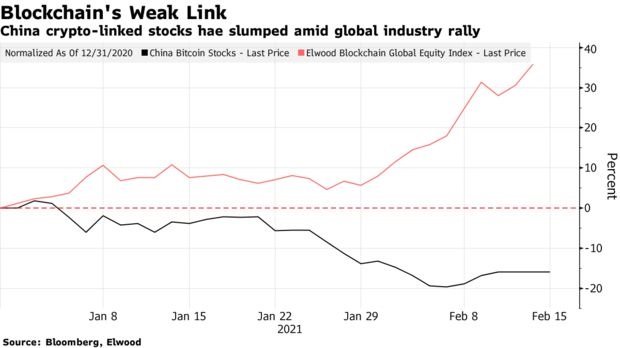

China’s blockchain stocks are left behind on the cryptocurrency craze that has pushed their global competitors to record highs – says a report by Bloomberg.

According to the report by Bloomberg, A Bloomberg-curated basket of seven major Chinese A-share stocks with affinities to the blockchain technology underpinning cryptocurrencies – comprising Shenzhen Forms Syntron Information Co., Shenzhen Ysstech Info-Tech Co., and Brilliance Technology Co. – has plunged about 16% so far this year. That contrasts with a 36% growth in an Elwood Asset Management index tracking global blockchain-linked shares.

“Not every company will stand out in the blockchain sector,” said Reo Liao, a market analyst with IG Australia. “The recent surge in Bitcoin price may suggest that digital currency and digital-asset trading platform concepts will be the ones that attract all investors. That’s why we see all related stocks climb these days.”

Global crypto stocks have risen as Bitcoin more than climbed 4 times higher in value over the past year, with the Elwood index-tracking blockchain-linked shares scoring an all-time high this month. However, after a successive clampdown on the industry, including a prohibition on transactions between fiat and cryptocurrencies in 2017, China badly requires a cohort of local stocks bound to digital coin exchanges and trading platforms.

Moreover, domestic firms that have gone with Chinese regulators, i.e. Huobi Group, are registered in Hong Kong, whereas some of the biggest China-based miners have adopted a U.S.-listing. Canaan Inc. has more than doubled over the last year, and Ebang International Holdings Inc. has jumped over 30% since its mid-2020 listing.

Chinese firms such as Syntron and Ysstech are operating elsewhere in the crypto arena, developing blockchain technology for multiple business purposes, Liao said. Others serve in security tools and banking machines.

“These companies have lots of diversification in other areas,” he said. The stocks that have rallied “have a high focus on digital currencies. They are more sensitive to the Bitcoin price movement.”

China’s cryptocurrency aspect is further complicated by the central bank’s development of the digital yuan at the same time as authorities restrict the wider industry, leaving investors abiding by the government’s lead.

“For the most part, retail investors in China follow the ‘supreme leader’ mode when it comes to out-of-the-norm investment structures,” said Stephen Innes, chief global market strategist with Axi.

Previous Articles:

- How much bitcoin do ”Whales” Hold?

- More Than $300,000 in Bitcoin Donations for The Navalny movement

- 6 Online Trading Strategies for Beginners

- What You Should Know About Bitcoin Mining?

- EthereumX – The DeFi solution for reducing gas fees, staking rewards, and lightning transactions.