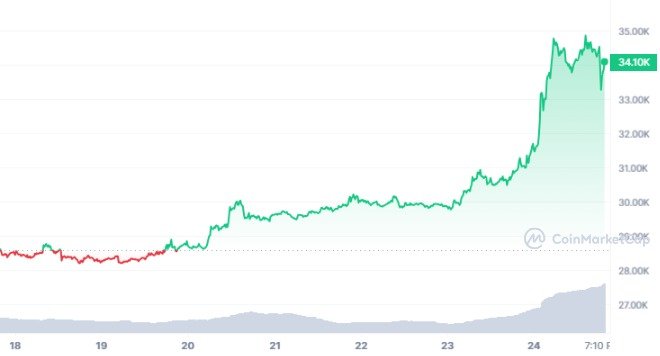

The price of Bitcoin, the leading cryptocurrency, has soared above $35,000 for the first time since 2022, sparking a rally in the shares of crypto-related firms.

Investors are optimistic about the prospects of a spot Bitcoin exchange-traded fund (ETF) being approved by the US Securities and Exchange Commission (SEC) soon.

Among the beneficiaries of the Bitcoin rally are Marathon Digital Holdings and Riot Platforms, two of the largest Bitcoin mining companies in North America.

Their shares rose by 18% and 15% respectively on Monday, outperforming the broader market.

Coinbase, the largest US-based crypto exchange, also saw a 15% increase in its shares, reaching its highest level since June.

MicroStrategy, a business intelligence firm that holds a large amount of Bitcoin on its balance sheet, saw a 13% increase in its shares.

The recovery of crypto-related stocks comes after a prolonged downturn in 2022, when regulatory uncertainty and market volatility weighed on the sector.

Coinbase, which went public in April 2022 at $250 per share, dropped to as low as $35 in December 2022.

The company has been facing increased competition from other platforms and scrutiny from regulators over its compliance practices.

The catalyst for the recent surge in Bitcoin’s price is widely attributed to its break above the psychologically important level of $30,000, which triggered a wave of buying from institutional and retail investors.

According to data from CoinMarketCap, Bitcoin now constitutes more than half of the overall crypto market, with a market capitalization of over $600 billion.

The inflows of funds into Bitcoin have also been boosted by the anticipation of a spot Bitcoin ETF being approved by the SEC.

A spot Bitcoin ETF is a type of investment vehicle that tracks the price of Bitcoin directly, rather than through derivatives or trusts. It would allow investors to gain exposure to Bitcoin without having to buy or store it themselves. A spot Bitcoin ETF is seen as a more efficient and transparent way to invest in Bitcoin than existing products, such as the Grayscale Bitcoin Trust (GBTC), which trades at a premium or discount to its net asset value.

Several companies have filed applications for a spot Bitcoin ETF with the SEC, but none have been approved so far.

The SEC has repeatedly delayed or rejected such applications, citing concerns over market manipulation, fraud and investor protection.

However, some analysts believe that the SEC may be more receptive to a spot Bitcoin ETF under its new chair Gary Gensler, who has expressed interest and expertise in crypto-related matters.

One of the applicants for a spot Bitcoin ETF is Grayscale, which currently operates GBTC. Grayscale recently won a lawsuit over the SEC’s decision to deny its application for a spot Bitcoin ETF in 2022.

The court ruled that the SEC had acted arbitrarily and capriciously in rejecting Grayscale’s application without providing sufficient reasons. Grayscale said that it would continue to pursue its goal of converting GBTC into a spot Bitcoin ETF.

Other applicants for a spot Bitcoin ETF include BlackRock and Fidelity, two of the largest asset managers in the world.

BlackRock has registered a ticker for its iShares Bitcoin Trust, which would be listed on the New York Stock Exchange if approved.

Fidelity has also filed an application for a spot Bitcoin ETF under the name Wise Origin Bitcoin Trust. According to reports, BlackRock’s investment vehicle could receive funding from a seed investor as soon as this month.

However, the approval of spot Bitcoin ETF applications is not guaranteed and may take longer than expected.

The SEC has not given any clear indication of when it will make a final decision on the matter. Some observers have speculated that the SEC may wait for more clarity from Congress and other regulators on the legal status and oversight of cryptocurrencies before approving any spot Bitcoin ETFs.

The performance of crypto-related stocks may depend largely on the outcome of the spot Bitcoin ETF applications.

If approved, they could attract more capital and legitimacy to the crypto space, benefiting both Bitcoin and its related companies.

If denied, they could dampen investor sentiment and trigger a sell-off in the sector. Either way, crypto-related stocks are likely to remain volatile and sensitive to Bitcoin’s price movements.

🔴 LATEST POSTS

- The Four Seasons of Crypto: Navigating Bitcoin’s Market Cycles

- Gemini and DCG Face Allegations of Defrauding Investors in $1 Billion Lawsuit

- Crypto Firms Invest Heavily in Washington, Seeking Mainstream Acceptance and Favorable Regulations

- CryptoQuant: Spot Bitcoin ETF Approvals Could Elevate Bitcoin to a $900 Billion Asset

- Tether Freezes 32 Virtual Wallets Linked to Crypto-Funded Terrorism

- What Are Anonymous Debit Cards And How Do They Work?

Previous Articles:

- The Four Seasons of Crypto: Navigating Bitcoin’s Market Cycles

- Gemini and DCG Face Allegations of Defrauding Investors in $1 Billion Lawsuit

- Crypto Firms Invest Heavily in Washington, Seeking Mainstream Acceptance and Favorable Regulations

- CryptoQuant: Spot Bitcoin ETF Approvals Could Elevate Bitcoin to a $900 Billion Asset

- Tether Freezes 32 Virtual Wallets Linked to Crypto-Funded Terrorism