QUICK LINKS

The crypto lending space has matured beyond the wild west days of 2021-2022.

While platforms like Celsius and BlockFi collapsed during the crypto winter, survivors have emerged stronger with better risk management and clearer regulatory frameworks.

Today’s crypto holders face a compelling question: let your Bitcoin and Ethereum sit idle, or put them to work earning yield while maintaining upside exposure?

This comprehensive guide examines the top seven crypto lending platforms that have proven their resilience.

We’ll break down interest rates, loan-to-value ratios, security measures, and the specific use cases where each platform excels.

Our top pick for beginners? Nexo stands out for its combination of competitive rates and institutional-grade security.

Our Methodology

We conducted extensive research across crypto forums, Reddit, and Quora to identify user sentiment around lending platforms.

After cataloging over 15 different crypto lending services, we evaluated each against our key selection criteria: interest rates, LTV ratios, security measures, supported assets, and platform reputation.

This analysis involved cross-referencing user experiences with objective platform metrics, spending over 24 hours researching and testing to ensure our recommendations reflect both quantitative performance and real-world user satisfaction.

How to Choose the Best Crypto Lending Platform: Key Factors to Consider

- Interest Rates (APR) The spread between what you earn on deposits versus what you pay on loans determines your platform’s value proposition. Look beyond headline rates = consider whether you need platform tokens for best rates and how often rates change based on market conditions.

- Loan-to-Value (LTV) Ratio Higher LTV ratios mean more borrowing power from your collateral, but they also increase liquidation risk during market downturns. Conservative platforms offer 30-50% LTV while aggressive platforms push 80-90%, requiring careful risk assessment for your situation.

- Supported Cryptocurrencies Platform diversity matters whether you hold mainstream assets like Bitcoin and Ethereum or prefer altcoins. DeFi protocols typically support more assets than centralized platforms, but centralized platforms often provide better rates on major cryptocurrencies.

- Security and Custody of Funds The difference between keeping your private keys (DeFi) versus trusting a custodian (CeFi) represents the fundamental trade-off in crypto lending. Centralized platforms offer convenience but counterparty risk, while DeFi offers transparency but requires technical expertise.

- Loan Terms and Flexibility Some platforms require fixed repayment schedules while others allow indefinite borrowing with interest-only payments. Flexible terms cost more but provide better cash flow management during volatile periods when you might not want to sell collateral.

- Platform Reputation and User Reviews Track records matter in crypto lending where multiple platforms have failed. Look for platforms that survived 2022’s market crash, maintain proof-of-reserves, and show consistent operational transparency across multiple market cycles.

In-Depth Reviews of the 7 Best Crypto Lending Platforms

| Platform | Type | APR Range | Max LTV | Supported Assets | Best For |

|---|---|---|---|---|---|

| Nexo | CeFi | 5-14% | 50% | 40+ crypto & fiat | Overall value & security |

| Aave | DeFi | 3-12% | 78% | 30+ major crypto | Beginners to DeFi |

| Coinbase | CeFi/DeFi | 5.6%+ | 40% | Major crypto | Existing users |

| Compound | DeFi | 2-15% | 75% | 15+ major crypto | Decentralized lending |

| Strike | CeFi | ~13% | Competitive | Bitcoin focus | High LTV ratios |

| Ledn | CeFi | 10.4% | 35% | Bitcoin & USDC | Bitcoin-backed loans |

| YouHodler | CeFi | 12-15% | 90% | 50+ assets | Integrated exchange |

1. Nexo – Top Pick Overall (Best for Overall Value and Security)

At a Glance:

- APR: Up to 14% flexible/15% fixed-term on stablecoins, 5-7% on Bitcoin

- LTV: Up to 50% for Bitcoin/Ethereum

- Liquidation: Automatic liquidation if LTV reaches 83.33%

- Platform Type: Centralized (CeFi)

- Founded: 2018

- Assets Supported: 40+ cryptocurrencies and fiat

- Minimum Loan: No minimum specified

Nexo offers streamlined, custodial services that survived the 2022 crypto winter when competitors collapsed. The platform has become a go-to choice for users seeking institutional-grade security without sacrificing competitive rates. Nexo’s real-time proof-of-reserves and regulatory compliance across multiple jurisdictions demonstrate their commitment to transparency.

The platform eliminates the complexity of DeFi while maintaining professional-grade features. Users can borrow against their crypto holdings without fixed repayment schedules, paying only interest until they choose to repay principal. This flexibility proves valuable during volatile market periods when selling collateral isn’t optimal.

Pros:

- Survived multiple market downturns and regulatory challenges

- No monthly payment requirements – pay at your own pace

- High liquidity and instant loan approval

- Strong regulatory compliance and transparency

- Lower rates if you hold NEXO tokens

- Real-time proof of reserves

- Excellent customer service response times

Cons:

- Requires NEXO tokens (10% of portfolio) for best rates

- Not available in all US states due to regulatory restrictions

- Higher liquidation risk during volatile market conditions

- Limited to 50% LTV ratio

➡️ Visit Nexo.io to start earning up to 14% APY on stablecoins while maintaining the flexibility to borrow against your crypto assets.

2. Aave – Best for Beginners (DeFi Protocol)

At a Glance:

- APR: Borrowing APY starts at 0.29% with variable rates typically 3-12%

- LTV: Up to 80.5% for major assets like Ethereum

- Liquidation: Smart contract-based automatic liquidation

- Platform Type: Decentralized (DeFi)

- Assets Supported: 30+ major cryptocurrencies

- Unique Features: Flash loans = instant borrowing and repayment within a single transaction, fixed-rate borrowing options

Aave uses interest rates based on a supply curve, creating market-driven pricing that adjusts to supply and demand dynamics. The protocol pioneered flash loans = instant borrowing and repayment within a single transaction and offers both variable and stable interest rates, giving users sophisticated control over their borrowing costs.

The platform’s intuitive interface makes decentralized lending accessible to newcomers while offering advanced features for experienced users. Some assets, such as Balancer and Curve, are isolated, meaning you can’t use other assets as collateral when borrowing, but this isolation protects the broader protocol from asset-specific risks.

Pros:

- Non-custodial – you maintain control of your private keys

- Transparent smart contracts with extensive auditing

- Higher LTV ratios available (up to 78%)

- Pioneer of flash loans and innovative DeFi features

- No credit checks or KYC requirements

- Global accessibility

- Active community and governance

Cons:

- Requires understanding of DeFi and wallet management

- Gas fees can be expensive on Ethereum mainnet

- Smart contract risk, though heavily audited

- More complex for absolute beginners

- Variable rates can fluctuate significantly

➡️ Connect your wallet to Aave.com to start earning yield on deposits and borrowing against your crypto with industry-leading DeFi technology.

3. Coinbase (via Morpho) – Best for Widest Range of Supported Assets

At a Glance:

- APR: Starting from 5.6% (rates vary by volume)

- LTV: Up to 50% maximum

- Liquidation: 86% LTV threshold

- Platform Type: Centralized with DeFi backend

- Assets Supported: Bitcoin, Ethereum, and major cryptocurrencies

- Integration: Full Coinbase ecosystem integration

Coinbase uses Morpho, which operates on-chain via smart contracts, combining the convenience of a major exchange with DeFi-level functionality. This hybrid approach appeals to users who want institutional backing without sacrificing the transparency benefits of on-chain protocols.

The platform provides loans within minutes through the Coinbase app, with no credit checks required. Users can track their loan health in real-time and easily add collateral or repay portions of their loans. The integration with traditional banking makes it seamless to receive funds directly to bank accounts.

Pros:

- Extremely user-friendly mobile app interface

- No credit checks required

- Fast loan approval (under 5 minutes)

- Integration with traditional banking

- Backed by publicly traded company

- Strong regulatory compliance

- Real-time loan management tools

Cons:

- LTV varies based on the asset and whether the user stakes CRO tokens

- US-only availability currently

- Higher liquidation threshold than some platforms

- Limited to major cryptocurrencies only

- Coinbase custody means you don’t control private keys

➡️ Access Coinbase’s crypto lending feature through the Coinbase app to borrow against your crypto holdings with the security of a publicly traded exchange.

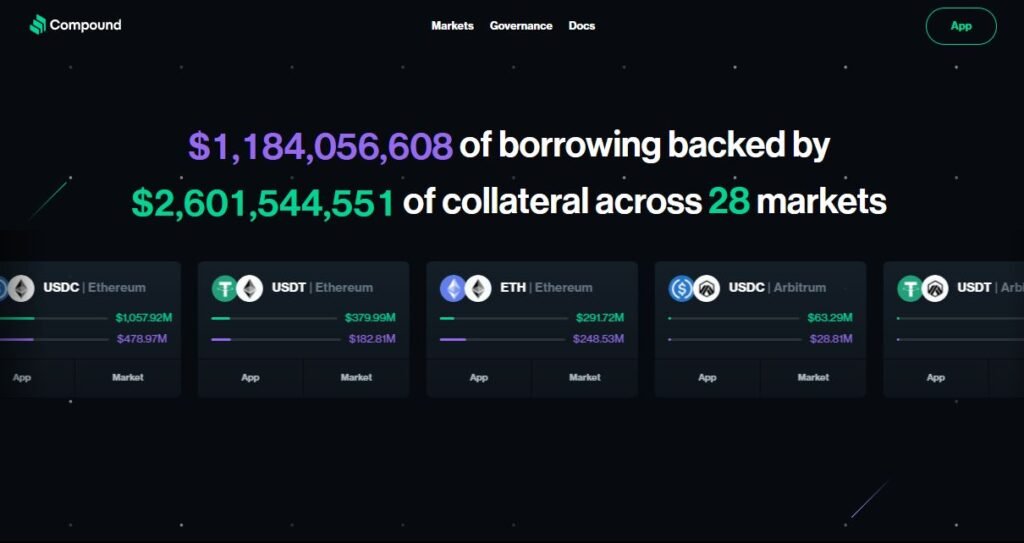

4. Compound Finance – Best for Decentralized Lending (DeFi Option)

At a Glance:

- APR: Averages around 4.7% with variable rates 2-15% based on supply/demand

- LTV: Up to 75% on select assets

- Liquidation: Algorithmic liquidation at preset thresholds

- Platform Type: Decentralized (DeFi)

- Assets Supported: 15+ major cryptocurrencies

- Governance: Community-governed protocol

Compound offers a low APR thanks to over-collateralization and offers an average APY of 4.54%. The protocol uses algorithmic interest rates that adjust based on supply and demand, creating efficient market-driven pricing that responds to real-time market conditions.

The platform allows users to earn interest on supplied assets while borrowing against them simultaneously. Its battle-tested smart contracts and long operational history since 2018 provide confidence in the protocol’s stability and security measures.

Pros:

- Completely decentralized and non-custodial

- Market-driven interest rates ensure competitive pricing

- Long track record since 2018

- Extensive audit history and battle-tested code

- Automatic compound interest earning

- Governance token (COMP) rewards

- No geographical restrictions

Cons:

- Requires DeFi knowledge and wallet setup

- High Ethereum gas fees during network congestion

- Limited customer support compared to CeFi platforms

- Smart contract risks despite extensive auditing

- Interface less polished than centralized alternatives

➡️ Visit compound.finance to start supplying assets and borrowing in the most established DeFi lending protocol.

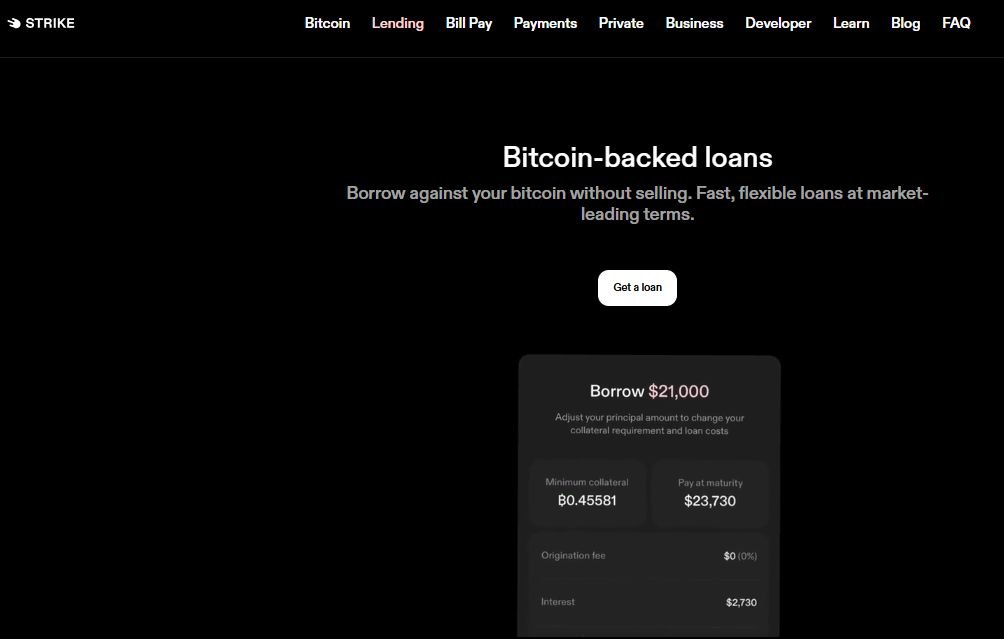

5. Strike – Best for High LTV Ratios (Bitcoin-Focused)

At a Glance:

- APR: Around 13% (reported by recent users)

- LTV: Competitive ratios for Bitcoin collateral

- Liquidation: Automated liquidation with warnings

- Platform Type: Centralized, Bitcoin-focused

- Specialization: Bitcoin-native financial services

- Processing Time: Loans approved within hours

Strike’s Bitcoin-centric approach appeals to users who prefer specialized rather than generalized crypto services. The platform focuses specifically on Bitcoin financial services, making it attractive to Bitcoin maximalists who want deep expertise in their preferred asset class.

Recent user experiences highlight Strike’s straightforward process and fast funding times, with loans typically approved within a few hours of application. The platform integrates well with Bitcoin’s Lightning Network and provides seamless Bitcoin-to-USD conversions.

Pros:

- Bitcoin-focused expertise and specialization

- Very fast loan approval and funding

- Lightning Network integration

- Competitive rates for Bitcoin holders

- Simple, streamlined user experience

- Strong focus on Bitcoin ecosystem development

Cons:

- Higher interest rates compared to some competitors (13%)

- Limited to Bitcoin as collateral

- Newer platform with less established track record

- Limited geographic availability

- Fewer features compared to multi-asset platforms

➡️ Download the Strike app to access Bitcoin-native lending services with lightning-fast processing times.

6. Ledn – Best for Bitcoin-Backed Loans

At a Glance:

- APR: 10.40% with monthly interest charges

- LTV: No credit checks, minimum loan size of $1,000

- Liquidation: 35% LTV threshold for collateral release

- Platform Type: Centralized (CeFi)

- Specialization: Bitcoin and USDC focus

- Features: B2X leveraged Bitcoin product.

Ledn offers monthly Proof-of-Reserves, and custody model for collateral management, focusing specifically on Bitcoin and USDC products. This specialized approach appeals to users who prefer focused expertise over broad asset support.

The platform’s automatic collateral top-up feature helps prevent liquidations during market volatility. Their B2X product allows users to leverage their Bitcoin holdings for additional Bitcoin exposure, appealing to long-term Bitcoin holders seeking to increase their stack.

Pros:

- Specialized focus on Bitcoin lending

- Automatic collateral top-up to prevent liquidation

- B2X product for Bitcoin leverage strategies

- Conservative approach to risk management

- Proof of reserves and regular auditing

- Competitive rates for Bitcoin-focused lending

Cons:

- Limited asset selection (primarily Bitcoin/USDC)

- Higher fees compared to some competitors

- No mobile app (web-based only)

- Manual claiming process for some features

- Geographic restrictions in some regions

➡️ Visit Ledn.io to access specialized Bitcoin lending services with automatic collateral management features.

7. YouHodler – Best for Integrated Exchange Features

At a Glance:

- APR: Up to 12% on USDC, 15% on altcoins

- LTV: Up to 90% – among the highest in the market

- Liquidation: Loans from one to 364 days with flexible terms

- Platform Type: Centralized (CeFi)

- Features: Multi-HODL trading tools, cloud mining

- Geography: Swiss-based with EU regulation

YouHodler supports fiat and crypto loans, savings accounts, and unique products like Multi HODL and Turbocharge. The platform offers a comprehensive suite of crypto financial services in a single interface, making it attractive to users who want multiple services from one provider.

“In a world where lending rates remain stagnant or even increasing in some cases, YouHodler wanted to provide some relief” according to their recent platform update. Users appreciate that YouHodler doesn’t require platform tokens to earn the highest interest rates, unlike some competitors.

Pros:

- High LTV ratios up to 90%

- Comprehensive suite of crypto financial services

- Swiss regulatory oversight and EU compliance

- Competitive stablecoin rates up to 12%

- Multiple trading and investment tools

- No platform tokens required for best rates

Cons:

- Recent changes to loyalty program structure

- Manual claiming required for some rewards

- Mixed user experiences with customer service

- Limited marketing presence and awareness

- Withdrawal fees on some assets

- Geographic restrictions in certain regions

➡️ Sign up at YouHodler.com to access comprehensive crypto financial services with competitive rates and Swiss regulatory protection.

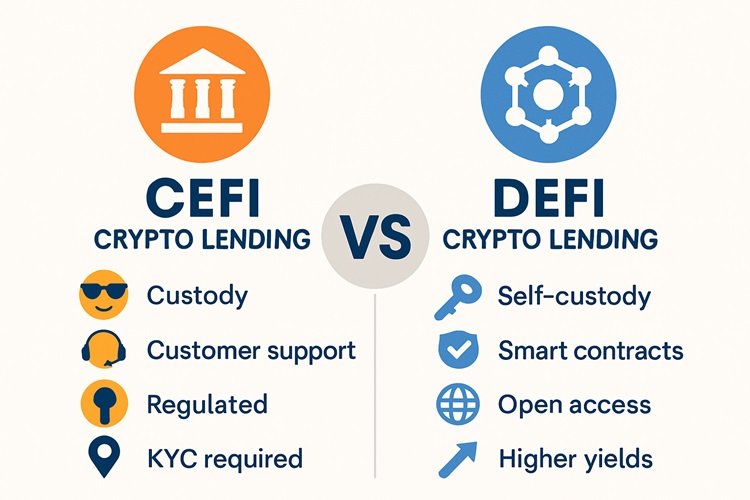

Understanding Cryptocurrency Lending: CeFi vs. DeFi

Cryptocurrency lending allows you to earn yield on idle assets or borrow against holdings without selling them. Two distinct approaches have emerged: Centralized Finance (CeFi) and Decentralized Finance (DeFi), each offering different trade-offs between convenience and control.

Centralized Finance (CeFi) Lending

CeFi platforms operate like traditional financial institutions – you deposit funds, they custody your assets, and they handle all technical complexity behind the scenes. These platforms typically offer customer support, regulatory compliance, and user-friendly interfaces that make crypto lending accessible to mainstream users.

Pros of CeFi lending include simplified user experience with no wallet management required, customer support and dispute resolution, regulatory oversight and compliance measures, and often better rates for major cryptocurrencies. However, CeFi cons include counterparty risk where you trust the platform with your funds, KYC requirements and geographic restrictions, potential for platform failure or regulatory shutdown, and less transparency in fund management.

Decentralized Finance (DeFi) Lending

DeFi protocols use smart contracts = automated computer programs to automate lending without intermediaries. You maintain control of your private keys and interact directly with blockchain-based protocols. This approach offers maximum transparency since all transactions occur on public blockchains.

DeFi advantages include maintaining custody of your private keys, transparent smart contracts with auditable code, global accessibility with no geographic restrictions, and often higher yields on diverse assets. DeFi disadvantages require technical knowledge of wallet management, smart contract risks despite extensive auditing, high gas fees during network congestion, and no customer support or dispute resolution.

The choice between CeFi and DeFi depends on your technical expertise, risk tolerance, and priorities around convenience versus control.

The Risks of Crypto Lending and How to Mitigate Them

Crypto lending involves significant risks that every user must understand before committing funds. These risks vary between platforms and lending models, but awareness and proper mitigation strategies can help protect your capital.

Market Volatility and Liquidation Risk

Crypto’s notorious volatility creates the primary risk in collateralized lending. When your collateral value drops, your loan-to-value ratio increases. If it exceeds the platform’s threshold, automatic liquidation occurs – your collateral gets sold to repay the loan, often at unfavorable prices.

Mitigation strategies include using conservative LTV ratios well below platform maximums, monitoring collateral health regularly and adding funds during downturns, choosing platforms with gradual liquidation processes rather than immediate full liquidation, and diversifying collateral across different assets to reduce correlation risk.

Smart Contract Vulnerabilities (for DeFi)

DeFi protocols rely on smart contracts that, despite extensive auditing, can contain bugs or design flaws. Successful exploits have drained millions from lending protocols, though major platforms like Aave and Compound have strong track records.

Reduce smart contract risk by choosing protocols with extensive audit histories and bug bounty programs, starting with small amounts to test platform functionality, understanding that smart contract insurance exists but may not cover all scenarios, and diversifying across multiple audited protocols rather than concentrating risk.

Counterparty Risk (for CeFi)

Centralized platforms create counterparty risk – the possibility of platform insolvency, regulatory shutdown, or mismanagement of user funds. The 2022 collapses of Celsius and BlockFi demonstrated this risk vividly.

Mitigate counterparty risk by researching platform financials and proof-of-reserves regularly, diversifying across multiple platforms rather than concentrating funds, choosing platforms with regulatory oversight and compliance, and monitoring platform health indicators like withdrawal processing times and customer service responsiveness.

Regulatory Risks

Crypto lending operates in evolving regulatory environments. Changes in laws or enforcement actions can affect platform operations, potentially freezing funds or forcing operational changes that impact user returns.

Address regulatory risk by understanding your jurisdiction’s current and proposed crypto regulations, choosing platforms with strong regulatory compliance records, diversifying geographically across platforms in different jurisdictions, and staying informed about regulatory developments that might affect your chosen platforms.

Frequently Asked Questions (FAQ)

How do I get a crypto loan?

Getting a crypto loan involves selecting a platform, completing any required KYC verification, depositing cryptocurrency as collateral, and borrowing against that collateral up to the platform’s LTV limits. For DeFi platforms, you’ll need to connect a compatible wallet and interact with smart contracts directly. Most loans are approved instantly once collateral is deposited.

Is it safe to lend my crypto?

Crypto lending carries risks including platform failure, smart contract bugs, and liquidation during market downturns. However, established platforms with strong track records, extensive audits, and proper risk management can provide reasonable safety for informed users. Never lend more than you can afford to lose completely.

Can I get a crypto loan without collateral?

Unsecured crypto loans are extremely rare due to the irreversible nature of crypto transactions and lack of traditional credit infrastructure. A few platforms offer unsecured loans to institutional clients or users with extensive platform history, but retail users typically need collateral worth 150-300% of their loan value.

What happens if the value of my collateral drops?

When collateral value drops, your LTV ratio increases. Platforms typically send warnings as you approach liquidation thresholds. If your LTV exceeds the maximum, automatic liquidation occurs – selling your collateral to repay the loan. You can prevent this by adding more collateral or repaying part of the loan to reduce your LTV.

How are interest rates determined on crypto loans?

Interest rates reflect supply and demand for specific assets, platform operational costs, and risk assessments. DeFi protocols use algorithmic interest rate models that adjust automatically based on utilization rates. CeFi platforms set rates based on market conditions, competitive positioning, and their cost of capital. Rates can be fixed or variable depending on the platform and loan terms.

Have more questions about Crypto Lending? Send them over here.

Our Final Verdict and Top Recommendations

For newcomers seeking the best balance of security and ease of use, Nexo provides institutional-grade features with competitive rates and survived multiple market stress tests. Their flexible repayment terms and regulatory compliance make them ideal for conservative users.

DeFi enthusiasts should consider Aave for its transparent smart contracts and higher LTV ratios, while users wanting the highest possible LTV ratios might prefer YouHodler’s 90% offerings despite the increased liquidation risk.

Bitcoin maximalists have excellent options in Strike for speed and Ledn for specialized Bitcoin lending features, while Compound remains the gold standard for fully decentralized lending despite slightly lower yields.

The crypto lending landscape continues evolving with improved risk management and clearer regulatory frameworks.

Today’s survivors have proven their resilience through multiple market cycles, but users must always remember the fundamental rule: never lend or borrow more than you can afford to lose completely.

The potential for earning yield on idle crypto assets remains compelling, but only for those who understand and accept the associated risks.

Previous Articles:

- XRP Eyes $5 Amid ETF Buzz, Despite Price Dip to $2 Range

- China Launches International Hub for Digital Yuan in Shanghai

- Ethereum Price Plunges 23%: Can ETH Recover From New Lows?

- bepay money Powers Invest Web3 Forum in Dubai, Showcasing bepay business Merchant Solutions for Global Commerce

- $17B in Bitcoin Options Set to Expire as $108K Level Tested