KEY TAKEAWAYS

- Finance professionals are attracted to crypto jobs due to higher salaries and industry prestige.

- About one-third of crypto job applicants come from traditional banking backgrounds.

- The migration of bankers to crypto is seen as a sign of the industry’s growth and maturity.

- Salaries in crypto roles often exceed those in traditional banking, sometimes significantly.

- This shift in employment from banking to crypto may influence market dynamics and lead to more collaboration.

The allure of the cryptocurrency sector for banking professionals is becoming increasingly apparent.

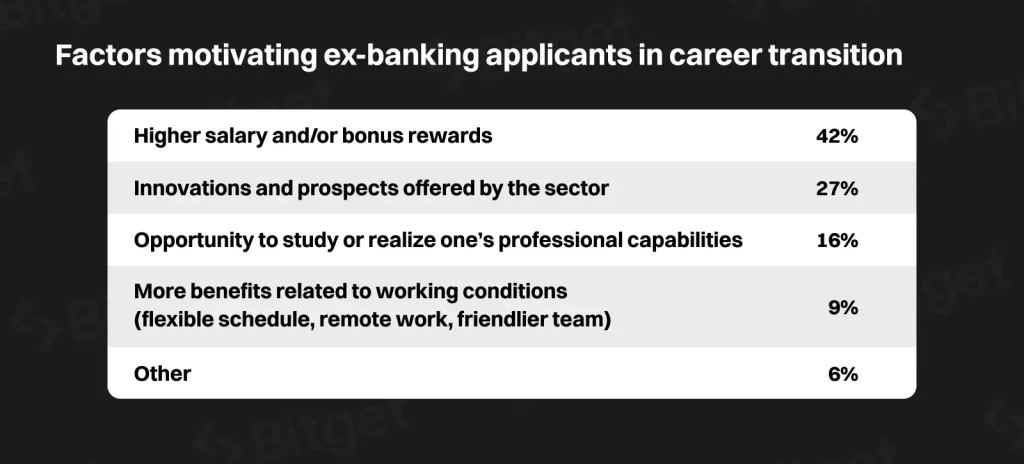

One of the most compelling reasons for this shift is the promise of substantial financial rewards.

Crypto firms are known to offer salaries that can be almost double those found in traditional banking – according to a Biget report. This substantial income bump, paired with the prestige of working in a burgeoning industry, is drawing talent away from conventional financial institutions.

Opportunities and Flexibility: The Crypto Advantage

In addition to financial incentives, the crypto industry offers substantial growth opportunities for professionals.

The sector’s rapid development means that employees often find themselves on the cutting edge of financial technology, involved in projects that push the boundaries of traditional finance.

Moreover, the flexibility of remote work, a common perk in crypto firms, has an undeniable appeal for many seeking a better work-life balance.

The Brain Drain: Traditional Banking’s Challenge

Traditional banking has felt the impact of this trend, as remote work conditions have led to salary adjustments that do not always match the lucrative offers from crypto companies.

This has resulted in a notable “brain drain” effect, with many finance experts leaving their positions in established banks for the dynamic world of digital currencies.

Statistics show that one-third of the applicants for positions within cryptocurrency companies are from a background in banking and traditional finance.

A sizable portion of these candidates is interested in roles that emphasize regulatory compliance, such as KYC Manager and AML Analyst, indicating a transfer of critical skills from traditional finance to the crypto industry.

Signs of Sector Maturation

The entry of seasoned banking professionals into the crypto space is widely regarded as a sign of the sector’s maturation.

The interest from major global banks, such as JPMorgan Chase and Barclays, in integrating blockchain technology into their services is a testament to the evolving financial landscape.

The crypto industry has not only seen a 180% increase in applications from finance experts but also from professionals across various sectors, signaling a reshaping of the labor market driven by the integration of blockchain technology.

Banking vs. Crypto: The Salary Gap

When comparing salaries between the banking and crypto sectors, the disparity is clear. Junior engineers at banks typically earn about $87,810, while their peers at crypto startups see average salaries around $125,000.

Overall, the average salary in crypto firms, at $115,667, dwarfs the $54,000 offered by traditional banks.

This significant difference reflects the crypto firms’ ability to offer competitive salaries for equivalent roles, which has prompted traditional banks to reevaluate their hiring strategies and compensation structures.

The Labor Market in Transition

The ongoing migration of banking talent to the cryptocurrency industry could have far-reaching effects on the labor market.

This trend may spur increased mergers and acquisitions as traditional banking continues to adapt to the decentralizing force of cryptocurrency.

The job dynamics within finance are shifting, with the potential for enhanced collaboration between the legacy banking institutions and the burgeoning crypto industry.

As this trend unfolds, its impact on the labor market and the future of finance are being closely observed by industry professionals and market analysts alike.

LATEST POSTS

- Nexo AG Files $3 Billion Arbitration Claim Against Bulgaria

- TOP 12 Day Trading Crypto Books For Beginners

- Nigerian Crypto Startups Seek Regulatory Approval Amidst Market Changes

- 2023 Sees a Decrease in Illicit Crypto Activity

- Tron Emerges as a Top Contender in the Smart Contract Arena

Previous Articles:

- Verpex Review: Unveiling the Pros and Cons of This Hosting Provider

- Nexo AG Files $3 Billion Arbitration Claim Against Bulgaria

- TOP 12 Day Trading Crypto Books For Beginners

- Nigerian Crypto Startups Seek Regulatory Approval Amidst Market Changes

- 2023 Sees a Decrease in Illicit Crypto Activity