GMX is becoming a serious competitor to Uniswap’s decentralized exchange, as on December 1 the price of its [GMX’s] currency rose to the second highest level in its history.

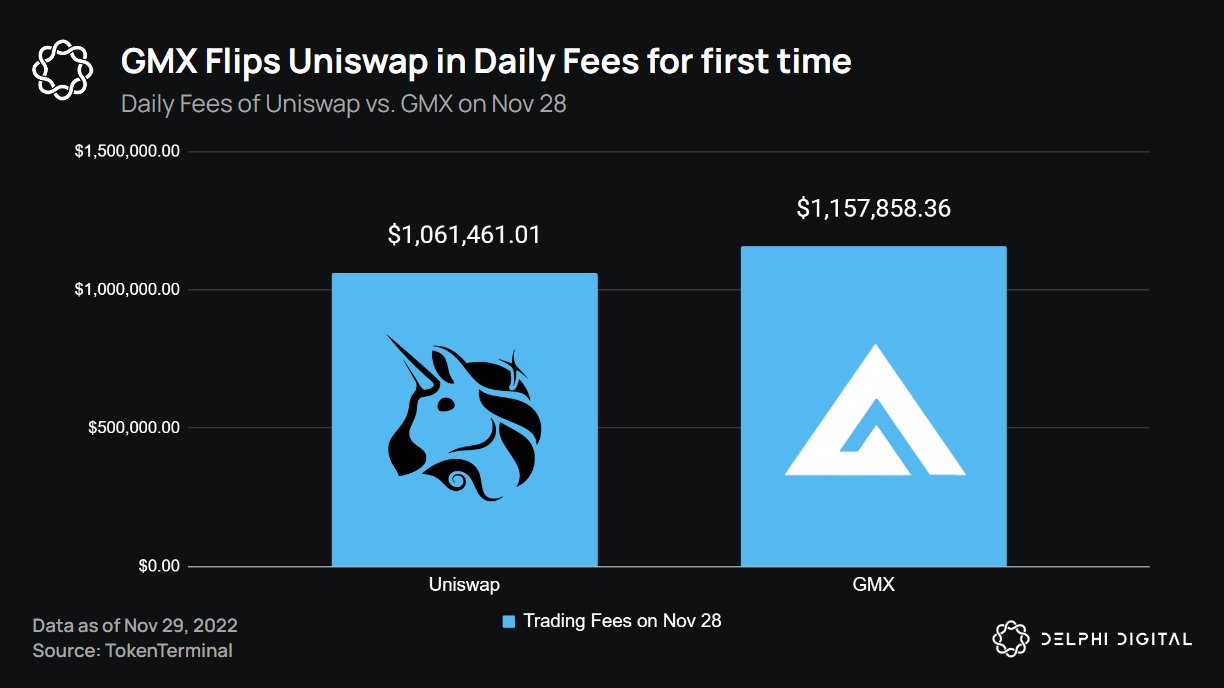

In addition, GMX earned about $1.15 million in daily trading commissions on November 28, which surpassed Uniswap’s $1.06 million in trading commissions on the same day.

The above development seems to have played a role in the GMX currency being bought and thus reaching the point we mentioned in our introduction.

In addition, GMX also benefited from the growing public doubt towards central exchanges in the wake of the FTX collapse.

The decentralized exchange’s revenue grew 107% to $5 million in November, boosted by a 128% increase in annual transaction volume and a 31% increase in daily active users.

In comparison, Uniswap’s annual revenue increased by approximately 75% and daily active users by 8%.

Share of fees to GMX holders

Independent analyst, Zen, noted that GMX’s outperformance could be due to the fact that coin holders received a large portion of the fee revenue, about 30%, according to the decentralized exchange’s official announcement.

On the other hand, Uniswap’s currency holders, UNI, did not receive a share of the platform’s fees.

“GMX is an obvious case of ‘buy and hold’ during this bear market,” Zen added, saying that “it is consistently the second highest-earning protocol after Uniswap.”

Previous Articles:

- Terra Luna Classic: Becoming interoperable again in the Cosmos ecosystem

- Moscow is considering legalizing cryptocurrencies in 2023

- Nexo withdraws from the US market

- 10 Best Cloud Mining Sites in 2023 – Daily Payouts

- BitMEX will allow users to verify their liabilities