If you’ve been following the blockchain space lately, you may have come across the term “liquid staking.” But what is liquid staking anyway?

Liquid staking is a relatively new concept in the world of Proof of Stake (PoS) blockchains that allows stakers to unlock the value of their staked tokens without having to wait for the staking period to end.

In this article, I’m going to explore what liquid staking is, how it works, and its benefits and drawbacks.

Staking and Proof of Stake

Before we dive into liquid staking, let’s take a moment to discuss staking and PoS consensus.

In a PoS blockchain, validators are chosen based on the number of tokens they stake.

When a validator is selected to create a new block, they are rewarded with additional tokens.

Staking, therefore, is the process of locking up tokens to become a validator.

PoS consensus is an alternative to the more widely used Proof of Work (PoW) consensus algorithm used by Bitcoin.

PoW requires miners to solve complex mathematical puzzles to create new blocks, and the first miner to solve the puzzle is rewarded with new coins.

PoW is energy-intensive, while PoS is more energy-efficient and secure.

Traditional Staking vs Liquid Staking

With traditional staking, once a user has staked their tokens, they cannot be withdrawn until the staking period ends.

This means that stakers cannot use their tokens for other purposes, such as trading or investing in other projects, until the staking period is over.

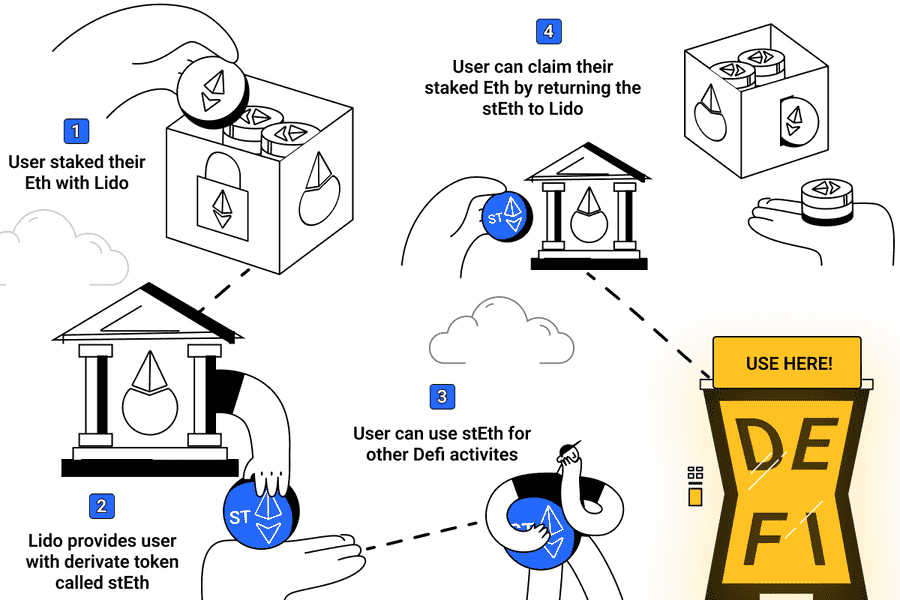

Liquid staking, on the other hand, enables stakers to unlock the value of their staked tokens before the end of the staking period.

This is achieved by creating a new token that represents the staked tokens. This new token can then be traded, sold, or used as collateral for other purposes.

Benefits of Liquid Staking

Liquidity

One of the main benefits of liquid staking is increased liquidity. By unlocking the value of their staked tokens, users can trade or sell them on the open market.

This can be particularly useful for investors who want to take advantage of market opportunities or diversify their portfolio without having to wait for the staking period to end.

Flexibility

Another benefit of liquid staking is flexibility. With traditional staking, stakers are locked into a fixed staking period, which may not always align with their investment goals or market conditions.

With liquid staking, stakers can choose to withdraw their tokens at any time, providing them with more control over their investment.

Accessibility

Liquid staking also provides accessibility to users who may not have enough tokens to become validators. With liquid staking, users can participate in staking without having to stake the full amount required to become a validator. This can help to decentralize the network and increase the number of participants.

Risks and Limitations

Like any new technology, liquid staking comes with its own risks and limitations.

Impermanent Loss

One of the main risks of liquid staking is impermanent loss. Impermanent loss occurs when the price of the staked asset changes compared to the value of the asset received in return. This can lead to a loss of value for the staker.

Centralization

Another risk of liquid staking is centralization. Liquid staking relies on a trusted third party to issue the new token that represents the staked tokens.

This can create a central point of failure, which could potentially compromise the security of the network.

Finally, liquid staking may also introduce additional security risks. The creation and management of a new token that represents staked tokens creates additional attack vectors that bad actors may try to exploit.

Use Cases

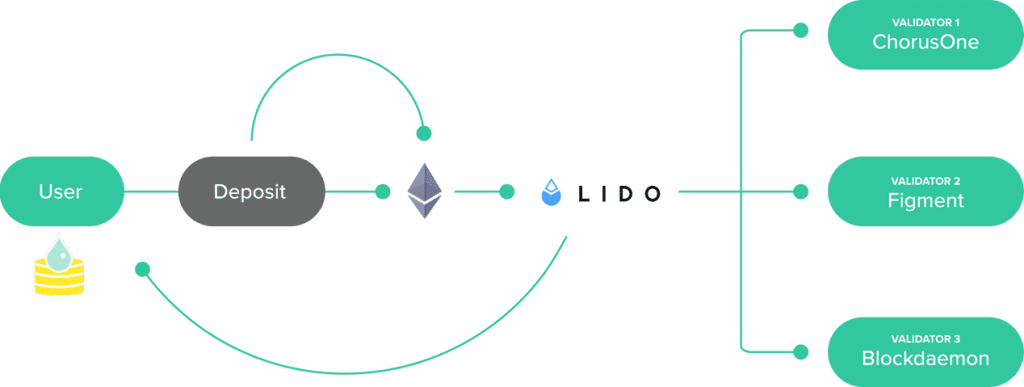

Liquid staking is already being used in various blockchain ecosystems. For example, the Lido protocol allows users to participate in Ethereum 2.0 staking while also receiving a liquid token, stETH, in return. StETH can be traded, sold, or used as collateral while still earning staking rewards.

Another use case was the Terra ecosystem, which allowed users to stake their Luna tokens and receive a liquid token, UST, in return.

UST was pegged to the US dollar (not it went bankrupt), providing a stablecoin option for users who want to participate in staking but also want to mitigate the volatility of the cryptocurrency market.

Which platforms offer liquid-staking?

There are several platforms that offer liquid staking. Here are some examples:

- Lido: Lido is a liquid staking platform that allows users to stake their Ethereum 2.0 tokens and receive a liquid token, stETH, in return. StETH can be traded, sold, or used as collateral while still earning staking rewards. Lido also offers liquid staking for other cryptocurrencies such as Solana, Terra, and more.

- Ankr: Ankr is a decentralized cloud computing platform that also offers liquid staking for various cryptocurrencies, including Ethereum, Binance Smart Chain, and more. Users can stake their tokens and receive a liquid token, which can be traded or used as collateral.

- StakeWise: StakeWise is a liquid staking platform that offers a non-custodial and decentralized solution for staking. Users can stake their Ethereum 2.0 tokens and receive a liquid token, swETH, in return. SwETH can be traded or used as collateral, while still earning staking rewards.

- Rocket Pool: Rocket Pool is a decentralized staking platform that allows users to stake their Ethereum 2.0 tokens and receive a liquid token, rETH, in return. rETH can be traded or used as collateral while still earning staking rewards.

- Terra: The Terra ecosystem offers liquid staking for its native cryptocurrency, Luna. Users can stake their Luna tokens and receive a liquid token, UST, in return. UST is pegged to the US dollar, providing a stablecoin option for users who want to participate in staking but also want to mitigate the volatility of the cryptocurrency market.

These are just a few examples of platforms that offer liquid staking. As the technology continues to develop, you can expect more platforms to start offering liquid staking for different cryptocurrencies.

Bottom Line

Liquid staking is a promising new development in the world of PoS blockchains that offers increased liquidity and flexibility to stakers.

However, it also comes with its own risks and limitations that should be carefully considered before participating.

As the technology continues to develop, we can expect to see more use cases and innovations in the liquid staking space.

Check more cryptocurrency related terms in our Glossary page

READ NEXT

- What Are Smart Contracts?

- The Role of Analytical AI Agents in Predicting Cryptocurrency Price Movements

- Is Steve Jobs the Mysterious Satoshi Nakamoto? The Bitcoin White Paper Discovery Sparks Theories

- Interview with Denis Sklyarov — Co-founder and CEO of WiFi Map App

- LooksRare upgrades to v2, reducing fees by 75% and implementing new features

- What is An Oracle in Crypto?

Previous Articles:

- Is Steve Jobs the Mysterious Satoshi Nakamoto? The Bitcoin White Paper Discovery Sparks Theories

- The Role of Analytical AI Agents in Predicting Cryptocurrency Price Movements

- What Are Smart Contracts?

- Interview with Denis Sklyarov — Co-founder and CEO of WiFi Map App

- LooksRare upgrades to v2, reducing fees by 75% and implementing new features