- Strategy meets S&P 500 eligibility requirements but faces committee discretion over its Bitcoin-focused business model.

- Index inclusion would trigger automatic fund purchases worth approximately $16 billion.

- Bitcoin price could experience sustained institutional demand or face selling pressure if excluded.

If the S&P Dow Jones Indices committee approves Strategy for the S&P 500, the decision would set in motion a series of market events with measurable Bitcoin implications. The company currently holds 252,200 Bitcoins worth approximately $27.7 billion at current prices around $110,000 per coin.

The inclusion scenario presents multiple pathways for Bitcoin price impact. Strategy meets the basic eligibility criteria outlined in market requirements: U.S. listing, market value above the threshold, daily trading volume exceeding 250,000 shares, sufficient public float, and positive earnings over recent quarters.

(Ed. note: The source cites $8.2 billion market cap requirement, but S&P Global updated this to $22.7 billion in July 2025).

What happens next depends on committee approval.

If Strategy gains inclusion, (passive index funds = investment vehicles that automatically mirror index composition) would face mandatory purchasing requirements. These funds manage approximately $10 trillion in assets tracking the S&P 500, according to market estimates.

The mechanical process works straightforwardly.

Fund managers would need to acquire Strategy shares proportional to the company’s index weighting, which analysts estimate at approximately $16 billion in total purchases. This buying pressure would occur regardless of fund managers’ individual views on Bitcoin investment merit.

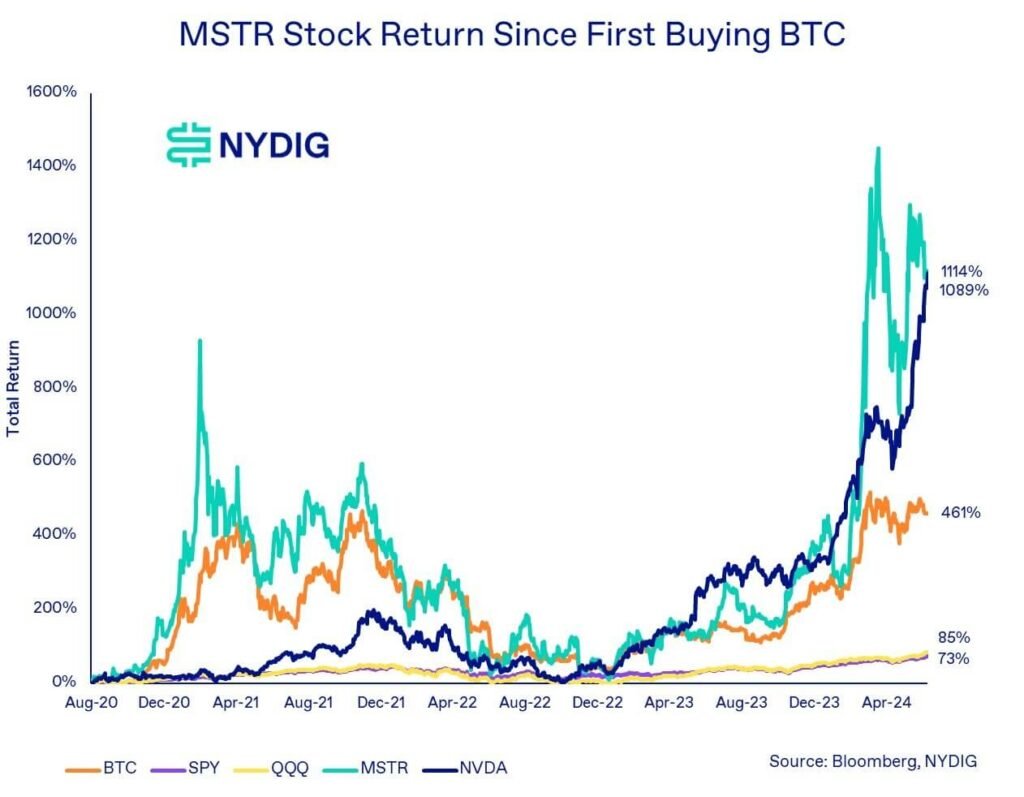

Historical data suggests mixed outcomes for index inclusion effects. Research from S&P Global indicates the median excess returns from S&P 500 additions have declined from 8.32% in 1995 to smaller figures in recent years.

The phenomenon has diminished as more investors anticipate inclusion decisions and trade ahead of announcements.

Consider the Bitcoin exposure scenario. Strategy’s inclusion would create indirect cryptocurrency holdings for millions of retirement accounts, pension funds, and institutional portfolios.

Major S&P 500 tracking funds include the SPDR S&P 500 ETF (SPY) with over $658 billion in assets, Vanguard’s S&P 500 ETF (VOO), and Fidelity’s 500 Index Fund (FXAIX).

«But wouldn’t this just be another tech stock in these portfolios?»

Not exactly.

Strategy operates differently from traditional technology companies. The firm’s market value correlates directly with Bitcoin price movements rather than operational performance.

Its software business generated only $116 million in Q3 2024 revenue, representing a small fraction of its $90 billion market cap.

The price impact mechanism works through supply and demand dynamics. If Strategy joins the index, fund managers must purchase shares within specific timeframes to maintain tracking accuracy.

This concentrated buying could push Strategy’s stock price higher, potentially creating a premium to net asset value = the market value of its Bitcoin holdings minus debt and expenses.

Alternative scenarios present different outcomes. If the committee rejects Strategy’s inclusion, speculative positioning might unwind rapidly. Traders who bought shares anticipating index inclusion could sell, creating downward pressure on both Strategy stock and potentially Bitcoin prices.

Market volatility adds complexity to any inclusion scenario. Strategy exhibits 96% thirty-day volatility, far exceeding typical S&P 500 constituents. This extreme price movement could amplify both positive and negative effects from index-related trading activity.

The committee’s decision timeline creates additional market dynamics. S&P typically announces changes on September 5 with implementation occurring September 19. This two-week window allows funds time to adjust portfolios but also enables speculative trading around the decision.

Bitcoin’s price could respond through several channels. Direct impact would come from Strategy’s stock price movements, as the company represents one of the largest corporate Bitcoin holders globally. Indirect effects might emerge from changing institutional perceptions of Bitcoin legitimacy as a treasury asset.

Historical precedent offers limited guidance. Coinbase’s S&P 500 inclusion and Block’s addition provided cryptocurrency sector validation, but both companies generate revenue from diverse business operations beyond digital asset holdings.

The committee faces discretionary evaluation beyond mechanical criteria. Strategy’s business model essentially functions as a corporate Bitcoin treasury rather than a traditional operating company. This structure raises questions about index representation and sector balance.

Market timing influences potential outcomes. Bitcoin recently approached $110,000, providing a strong backdrop for any inclusion decision. Strategy purchased its Bitcoin holdings at an average price of approximately $39,000, creating significant unrealized gains that support current profitability metrics.

Fund manager perspectives add another layer to inclusion scenarios. While passive funds must purchase Strategy shares if included, active managers maintain discretion over cryptocurrency exposure levels. Some institutional investors might welcome indirect Bitcoin access, while others could view it as unwanted volatility.

The broader cryptocurrency market could experience spillover effects. Strategy’s inclusion might encourage other companies to adopt similar Bitcoin treasury strategies, potentially increasing institutional demand for the digital asset. Conversely, exclusion could signal committee skepticism about cryptocurrency-focused business models.

Risk factors complicate any scenario analysis. Strategy’s debt structure includes $4.3 billion in convertible bonds with staggered maturities. If Bitcoin prices decline significantly, the company might face refinancing challenges that could affect index eligibility.

The September announcement approaches with multiple possible outcomes. Strategy could gain immediate inclusion, face delayed consideration pending additional committee review, or receive outright rejection based on business model concerns. Each scenario carries distinct implications for both Strategy’s stock price and Bitcoin’s institutional adoption trajectory.

Whatever the committee decides, the outcome will establish precedent for how traditional finance indices handle cryptocurrency-focused companies. The decision extends beyond a single stock addition to broader questions about Bitcoin’s role in mainstream investment portfolios.

Previous Articles:

- Arbitrum Launches $40M DeFi Incentive Amid 80% Token Drop

- HTX Lends 92% of USDT Reserves on Aave, Raising Risk Concerns

- Nasdaq Tightens Crypto Buy Rules, Treasury Stocks Slide Now.

- If Shiba Inu Hits $1, Investors Could See Unimaginable Profits

- Hedera Hackathons Offer $1.5M+ in Prizes, Attract 10,000+ Builders