Upcoming Bitcoin Price Drop Actually a Sign of Impending Rally

Finally, we’re seeing some optimism on the horizon for the bitcoin price. After a small rebound that re-established the lateral market, the charts show an upcoming bearish swing that will eventually kick off a bullish cyle in the mid-term.

Also read: Binance Kicks off ‘Lunch for Children’, a Charity Program Where Beneficiaries Actually Use Crypto

Subscribe to the YouTube channel for great videos featuring industry insiders & experts

Bitcoin Price Technical Analysis

Long-Term Analysis

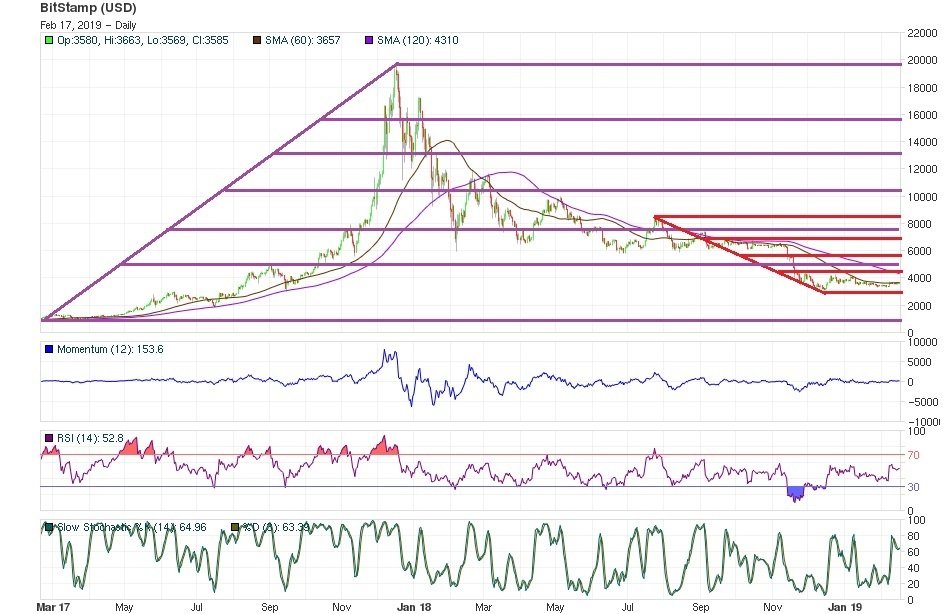

Looking at the last major up and down movements from 2017 and 2018 using Fibonacci retracement levels, several supports and resistances can be drawn in the chart to serve as global technical references for the current stage.

The lateral market is ending its cycle after accomplishing two months of sideways activity. Now, we’re looking at an approaching swing to the downsize, which could activate a mid-term bullish cycle. If this happens, the market could overcome an aggressive distribution pressure in the $4,000 USD zone.

Mid-Term Analysis

Selling pressure seems to be focused between $4,000 and $3,500, following Fibonacci’s 23 percent retracement level, and limiting every bullish attempt to break the resistance.

The ongoing lateral trend weakens bullish consensus, while holders diversify their assets in different financial products. Currently, the only support below $3,500 is the $2,500 bottom established before the 2017 bubble. Thus, a deep swing can be expected with the possibility of a strong” V” bottom bounce that propels the bitcoin price upwards.

Short-Term Analysis

Mass Psychological Analysis, combined with Japanese Candlestick’s fairy examples, suggests the bitcoin price is entering a Capitulation phase, with Soldiers abandoning the battlefield.

Therefore, a bearish break now depends solely on action from the Crows. The Crows continue dominating the current stage at the $3,000 level, their only resistance held up by a failing psychological support. Therefore, that support can be dismissed when the bearish swing returns, leaving us to look at the pre-bubble support at $2,500 as the next point of battle.

What do you think will happen to the bitcoin price? Share your predictions in the comments section.

If you find Ramiro’s analyses interesting or helpful, you can find out more about how he comes to his conclusions by checking out his primer book, the Manual de Análisis Técnico Aplicado a los Mercados Bursátiles. The text covers the whole range of technical analysis concepts, from introductory to advanced and everything in between. To order, send an email to [email protected]

Image via Pixabay

This technical analysis is meant for informational purposes only. is not responsible for any gains or losses incurred while trading bitcoin.

Previous Articles:

- Digital Asset’s Europe Head Is Latest to Leave Enterprise Blockchain Startup

- Cryptocurrency Exchange Exmo Opens Branch in Turkey

- Gladius Sends Message To ICOs: It’s Time To Come In From The Cold

- QuadrigaCX Has Sent All Its Bitcoin and Ether to ‘Big Four’ Auditor EY

- Sirin Labs Smartphone, Middle East Cbx Exchange, IPC’s Connexus Cloud