According to the official data published yesterday, the annual inflation rate in Turkey surged to 58.94% in August due to the devaluation of the lira and recent tax hikes.

With such a rapid erosion of the purchasing power of the official currency, it’s not surprising that Turkish citizens are increasingly turning to cryptocurrencies as an alternative. This was evident in a survey conducted by the KuCoin exchange for Turkey.

KuCoin researchers collected data based on responses from 500 individuals aged 18 to 60 between May 5th and May 12th, 2023.

The data collection, analysis, and resulting conclusions can be found in the report titled “Understanding Cryptocurrency Users in Turkey.”

The survey reveals a significant increase in cryptocurrency investors among Turkish adults.

- The percentage of investors among the Turkish population aged 18 to 60 increased by 12% in the last 18 months. It has risen from 40% in November 2021 to 52% in May 2023, despite the crypto market’s recent challenges. Even less affluent Turks are turning to cryptocurrencies.

- Men continue to dominate, accounting for 57% of the respondents, although there is a growing trend of female participation, especially among the younger generation. Nearly half (47%) of investors aged 18 to 30 are women, while those over 45 represent only 37% of the total.

- According to the survey, 31% of investors made their first cryptocurrency purchase in the last three months, with 54% of investors under 30 entering the market last year.

- Furthermore, 37% of investors aged over 45 have been involved in crypto for more than two years, indicating that cryptocurrency adoption is gaining long-term traction.

- 36% of investors have invested more than 100,000 Turkish lira, while the rest have smaller amounts.

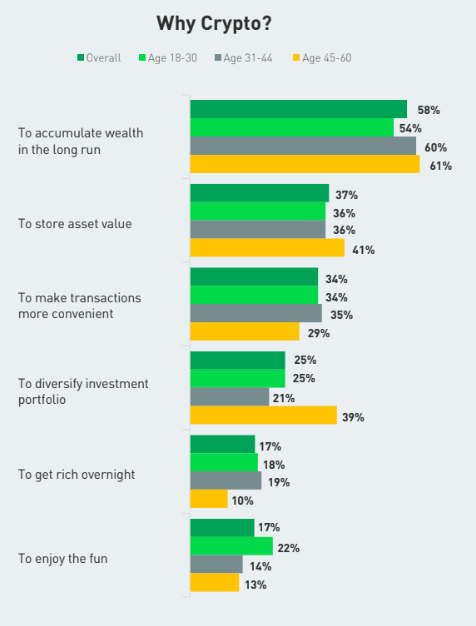

The survey results provide valuable insights into the motivations and preferences of adult cryptocurrency investors in Turkey. A significant percentage, around 58%, aims to create long-term wealth.

This perspective is consistent across all age groups, indicating that cryptocurrencies are seen as a valuable tool for achieving financial freedom.

As seen in the chart above, there is a variety of motivations among different age groups. Older investors focus on preserving value and portfolio diversification, while younger generations prioritize ease of transactions and short-term gains.

- 37% of participants state that their primary reason for acquiring cryptocurrencies is to preserve the value of their assets.

- 25% (more proportionally among older individuals) see the benefits of risk reduction and portfolio diversification.

- 34% of holders prefer cryptocurrencies for money transfer and fast transactions. 17% focus on the prospect of short-term gains and entertainment.

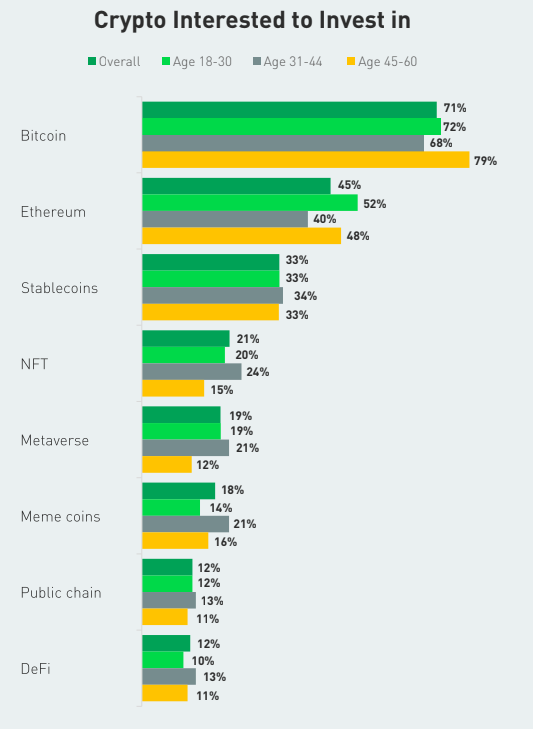

The survey provides information about the preferences of Turkish citizens regarding cryptocurrencies.

- Bitcoin is the most popular, attracting 71% of total investors.

- Ethereum holds the second position with 45%.

- Stablecoins follow at 33%. This percentage reflects the need of Turks for reliable digital assets to preserve their purchasing power.

- Assets in NFTs and the Metaverse also account for a noteworthy percentage, with 21% for NFTs and 19% for the Metaverse. High-risk tokens like meme coins also have a significant share.

70% of Turks are active in trading, while 22% are involved in NFT purchases.

Only 19% intend to become long-term holders earning passive income through staking. This category mainly includes older individuals.

Friendly and family relationships play a significant role in attracting new investors to the world of cryptocurrencies.

According to the survey, 57% of participants learned about cryptocurrencies through personal connections. Communities also play an essential role, as do other investors. Social media platforms and influencers have a somewhat smaller impact.

Finally, as a source of information, most people rely on mainstream media (57%). They are followed by YouTube, Twitter, Telegram, and Instagram.

🔴 LATEST POSTS

- Elon Musk’s X Platform Secures Rhode Island License for Crypto Transactions

- Bitcoin’s Soaring Surge: Grayscale ETF Decision Sparks Market Optimism

- FastVPN Review: Should You Trust This VPN From Namecheap?

- PandaVPN Review: Should You Use This VPN?

- Private Internet Access Review (PIA): Everything You Need To Know

- OpenAI Launches ChatGPT Enterprise: Elevating AI-Powered Business Productivity

Previous Articles:

- Elon Musk’s X Platform Secures Rhode Island License for Crypto Transactions

- Bitcoin’s Soaring Surge: Grayscale ETF Decision Sparks Market Optimism

- FastVPN Review: Should You Trust This VPN From Namecheap?

- PandaVPN Review: Should You Use This VPN?

- Private Internet Access Review (PIA): Everything You Need To Know