In the ever-evolving world of cryptocurrency, market cycles bear a striking resemblance to the four seasons, according to a recent report authored by Morgan Stanley analyst Denny Galindo.

This comprehensive analysis sheds light on the ebbs and flows of Bitcoin’s value, offering insights into the patterns that have defined this digital asset’s meteoric rise and periodic dips.

Summer: Halving Event Sparks Euphoria

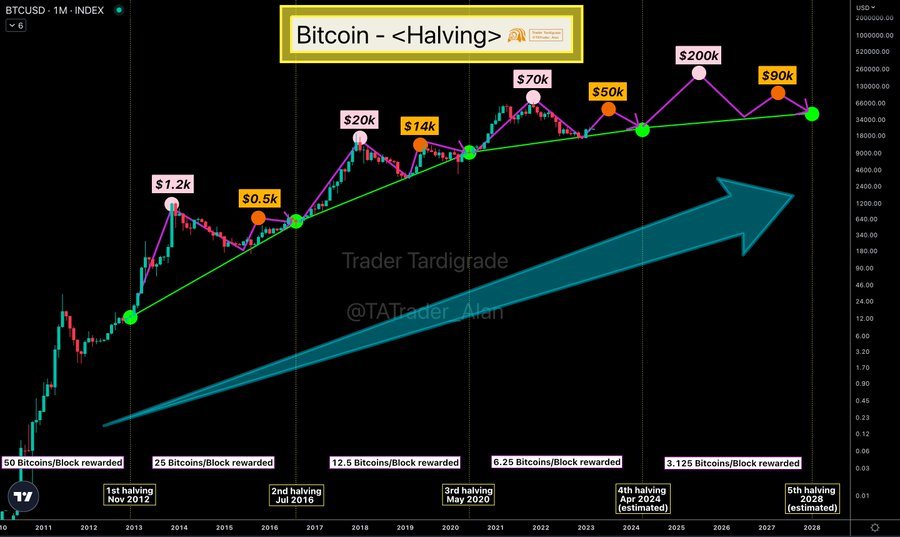

The crypto journey begins with what Galindo refers to as the “summer” phase. This season starts with the highly anticipated Bitcoin halving event, a periodic occurrence that reduces the rate at which new Bitcoins are created.

The resulting scarcity often leads to price increases, capturing the attention of crypto enthusiasts and investors alike. This phase peaks when Bitcoin soars past its previous all-time high, setting off euphoria within the market.

Media attention surges, new investors flock to the scene, and businesses look to capitalize on the crypto fervor.

Winter Approaches: The Bearish Phase

However, what goes up must eventually come down, and Bitcoin’s ascent is no exception. As the market reaches its zenith, it eventually transitions into what Galindo describes as the “bearish” phase, much like the onset of winter.

In this phase, investors begin to lock in profits and divest from Bitcoin, which results in price corrections and a more conservative approach from market participants.

Signs of Spring: Recovery on the Horizon

The transition from winter to spring in the crypto world typically takes place about 12 to 14 months after the peak.

During this period, Bitcoin prices often plummet by approximately 83% from their previous highs.

One critical indicator of this transition is miner capitulation, which is evidenced by a decrease in mining difficulty, suggesting the approach of the market trough.

Additionally, the Bitcoin Price-to-Thermocap Multiple is a crucial metric considered by analysts to determine market cycles.

A notable sign of spring is a substantial 50% price increase from the lowest point, signaling the cryptocurrency’s potential recovery.

Bitcoin’s Halving Event and Historical Patterns

The report highlights the pivotal role played by Bitcoin’s halving event in driving its value. This event’s impact on scarcity and supply dynamics cannot be underestimated.

Galindo’s research incorporates historical patterns, decline from all-time high values, miner behavior, and price action to provide a comprehensive outlook on Bitcoin’s cyclical nature.

It acknowledges that substantial price declines often follow significant gains, forming the core of Bitcoin’s roller-coaster-like journey.

In a market where predicting the future is as elusive as capturing the essence of the seasons, Denny Galindo’s report offers an essential guide for crypto enthusiasts, investors, and analysts alike.

By understanding the cyclical nature of Bitcoin, participants can better navigate the wild terrain of cryptocurrency, preparing for the changing seasons that come their way.

🔴 LATEST POSTS

- Gemini and DCG Face Allegations of Defrauding Investors in $1 Billion Lawsuit

- Crypto Firms Invest Heavily in Washington, Seeking Mainstream Acceptance and Favorable Regulations

- CryptoQuant: Spot Bitcoin ETF Approvals Could Elevate Bitcoin to a $900 Billion Asset

- Tether Freezes 32 Virtual Wallets Linked to Crypto-Funded Terrorism

- What Are Anonymous Debit Cards And How Do They Work?

Previous Articles:

- Gemini and DCG Face Allegations of Defrauding Investors in $1 Billion Lawsuit

- Crypto Firms Invest Heavily in Washington, Seeking Mainstream Acceptance and Favorable Regulations

- CryptoQuant: Spot Bitcoin ETF Approvals Could Elevate Bitcoin to a $900 Billion Asset

- Tether Freezes 32 Virtual Wallets Linked to Crypto-Funded Terrorism

- What Are Anonymous Debit Cards And How Do They Work?