- Tokenization’s initial promise in securities markets failed to meet expectations despite technological advantages.

- The mismatch between traditional security offerings and crypto investors’ preferences limited adoption.

- Security Token Offerings (STOs) provided marginal cost benefits but lacked revolutionary impact.

- Blockchain-based securities faced challenges in attracting crypto investors seeking higher volatility.

- Back-office operations showed some improvement through tokenization, but benefits were incremental.

The ambitious vision of tokenizing traditional financial assets has encountered significant roadblocks since its 2019 peak, according to Arthur Breitman, co-founder of Tezos. Despite promising to revolutionize securities markets through blockchain technology, the initiative has delivered mixed results.

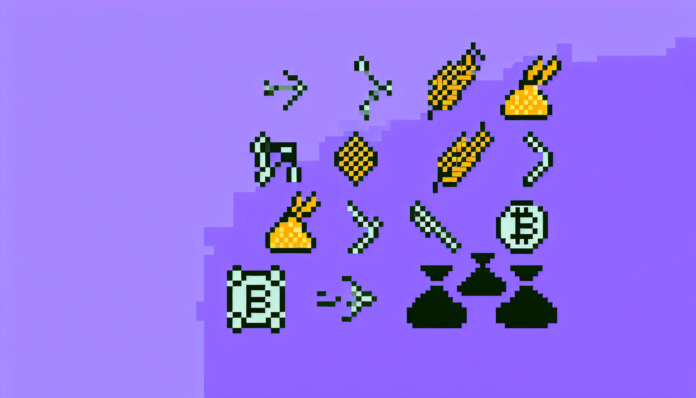

The concept of Security Token Offerings (STOs) emerged as a potential bridge between traditional finance and cryptocurrency markets. These digital representations of conventional assets aimed to reduce operational costs and expand market accessibility. However, implementation proved more challenging than anticipated.

“The neatly packaged tokenized securities being offered lacked the excitement or unique characteristics sought by the crypto crowd,” explains Breitman. This fundamental disconnect highlighted a crucial oversight in market psychology – crypto investors typically seek high-volatility assets and cutting-edge technology rather than traditional financial products.

The tokenization process did achieve some operational efficiencies in back-office functions, primarily through automated settlement and reduced administrative overhead. However, these improvements failed to generate the transformative impact initially predicted by market observers.

Historical precedent suggests that successful financial innovations must align with investor preferences and market dynamics. The STO experiment of 2019 demonstrates that technological capability alone doesn’t guarantee market adoption – product-market fit remains paramount in the digital asset space.

Moving forward, industry experts suggest that tokenization might find greater success in commodity markets, where the technology could address specific operational challenges and meet genuine market needs. This pivot represents a more targeted approach to blockchain implementation in traditional markets.

✅ Follow BITNEWSBOT on Telegram, Facebook, LinkedIn, X.com, and Google News for instant updates.

Previous Articles:

- DTCC Unveils ComposerX Platform for Multi-Chain Digital Asset Management

- Eric Trump’s ETH Price Pump Tweet Sparks Market Manipulation Concerns

- Helium Mobile Launches First-Ever Free 5G Phone Plan in US

- Scaramucci Predicts Pro-Crypto Legislation Coming to US by November

- TON Foundation President Defends Telegram’s Exclusive Blockchain Partnership Despite Price Slump