- Global cryptocurrency trading volume is estimated to exceed $108 trillion in 2024.

- The United States is the leading country in crypto trading with over $2 trillion.

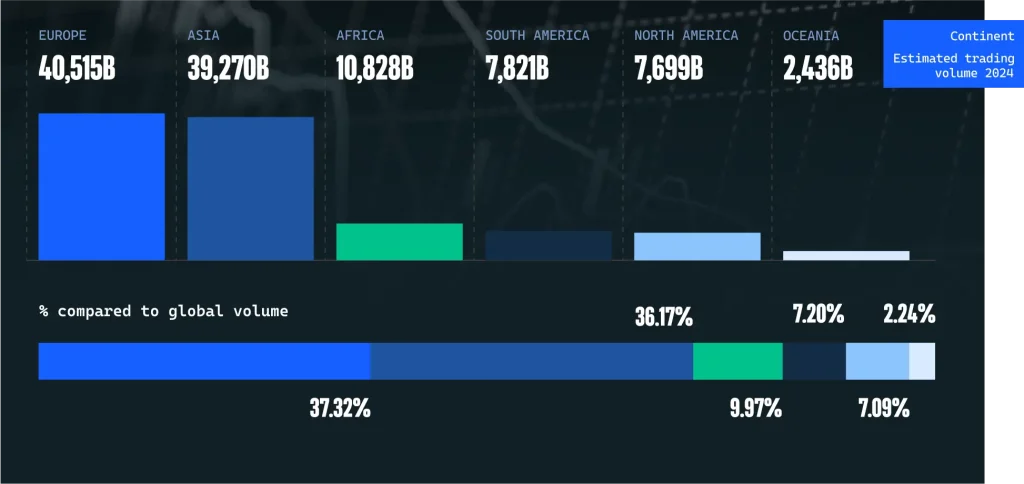

- Europe accounts for 37.32% of the global crypto transaction value.

- Turkey and India are major players, each with trading volumes exceeding $1 trillion.

- Binance dominates the market, being the top exchange in 100 out of 136 countries.

The Surge in Global Crypto Trading

The global cryptocurrency market has grown immensely over the past few years, reaching new heights in trading volume and mainstream acceptance – according to a Coinwire report.

According to a comprehensive analysis of 136 countries, the estimated global trading volume in 2024 will exceed $108 trillion, marking a significant increase from previous years.

Leading Countries in Crypto Trading

The United States on Top

The United States leads the world in cryptocurrency trading with an estimated volume of over $2 trillion in 2024.

This dominance is due to a combination of factors including technological advancements, a high level of internet usage, and a strong regulatory environment that supports digital currency innovation.

Europe’s Significant Contribution

Europe is another major player in the cryptocurrency market, contributing 37.32% to the global transaction value. The continent’s trading volume is set to reach $40.5 trillion in 2024, reflecting a strong financial infrastructure and progressive regulatory frameworks.

Countries like Russia and the United Kingdom are at the forefront, with trading volumes of $633 billion and $624 billion, respectively.

Emerging Markets: Turkey and India

Turkey and India rank second and third globally in cryptocurrency trading volumes, each exceeding $1 trillion.

High inflation rates and economic instability in these regions have driven people to adopt cryptocurrencies as a means of preserving value.

Key Players in the Crypto Exchange Market

Binance Leading the Way

This makes Binance a pivotal player in the global cryptocurrency market, due to its extensive reach and user-friendly platform.

Other Major Exchanges

Other notable exchanges include Binance US, OKX, and CEX.IO, which also have significant market shares.

OKX leads in 93 countries with a trading volume of $759 billion, while CEX.IO dominates in 92 countries with $1.83 billion in trading volume.

Coinbase and Bybit are also major players, operating in numerous countries and handling large volumes of trades.

Sure, here is the data in a table format:

| CEX | Number of Countries | Trading Volume (USD) |

|---|---|---|

| Binance | 100 | 2,771,882,322,560 |

| Binance US | 100 | 3,913,665,415 |

| OKX | 93 | 759,452,606,645 |

| CEX.IO | 92 | 2,771,882,322,560 |

| Coinbase Exchange | 90 | 662,374,143,565 |

| Bybit | 87 | 2,771,882,322,560 |

| HTX | 85 | 643,093,793,095 |

| Blockchain.com | 84 | 53,026,105 |

| Bitflyer | 80 | 29,537,476,810 |

| Kraken | 80 | 234,860,154,105 |

| Kucoin | 75 | 234,860,154,105 |

| Nicehash | 74 | 116,725,905 |

| Bitmex | 73 | 16,843,535 |

| Bitget | 70 | 777,200,384,895 |

| Crypto.com Exchange | 70 | 2,771,882,322,560 |

| Bitstamp | 68 | 44,528,947,340 |

| Bitfinex | 67 | 41,107,121,615 |

| Coinex | 65 | 25,194,449,485 |

| Gemini | 64 | 28,103,721,770 |

| Gate.io | 62 | 589,678,644,815 |

Factors Driving the Crypto Market

Technological Advancements – Advancements in blockchain technology and increased internet accessibility have played a crucial role in the growth of the cryptocurrency market. These developments have made it easier for people to trade and use cryptocurrencies globally.

Economic Conditions – In many countries, economic instability and high inflation rates have led people to seek alternative financial solutions, including cryptocurrencies. This trend is particularly evident in countries like Turkey, India, and Ukraine, where traditional currencies have struggled to maintain value.

Regulatory Environments – Progressive regulatory environments in regions like Europe have fostered innovation and adoption of cryptocurrencies. Countries with clear and supportive regulations have seen higher trading volumes and greater public trust in digital assets.

Conclusion and Reflections

The rapid growth of the global cryptocurrency market highlights its increasing acceptance and integration into mainstream financial systems.

As countries like the United States, Turkey, and India continue to lead in trading volumes, the market is expected to evolve with advancements in technology and changes in economic conditions.

Binance’s dominance as the leading exchange underscores the competitive nature of the crypto market. The role of regulatory frameworks will be crucial in shaping the future of cryptocurrency trading, ensuring both security and innovation.

In the years to come, it will be essential to monitor these trends and understand their implications for the global financial landscape. As the market grows, so will the opportunities and challenges it presents to investors and enthusiasts alike.

LATEST POSTS

- Ripple SEC Settlement Speculations Stir XRP Market, Price Surges 38%

- California Loopholes Help Scammers Exploit Tether’s Name

- Top 9 VPNs That Accept Bitcoin And Crypto

- What Are Compute-Over-Data Applications?

- Exploring the Intersection of Crypto and AI: A New Frontier

Previous Articles:

- Ripple SEC Settlement Speculations Stir XRP Market, Price Surges 38%

- California Loopholes Help Scammers Exploit Tether’s Name

- Top 9 VPNs That Accept Bitcoin And Crypto

- What Are Compute-Over-Data Applications?

- Exploring the Intersection of Crypto and AI: A New Frontier