After spending five years with Nexo, I’ve seen the platform evolve from a promising crypto lending service to a thorough wealth management institution.

As someone who’s been dealing with crypto since 2016, I know first hand how important is to have a reliable platform that balances security with user experience. While Nexo is my go-to choice for earning interest on crypto holdings, it’s not without its flaws.

In this “simple”, Nexo Review, I’ll share the things I like and the things I don’t like about Nexo, after 5 years of being their user.

NEXO.com

Nexo is a crypto lending platform that's been around since 2018. It managed to surpass the crypto lending platforms "meltdown" and nowadays it evolved into a fully fledged crypto and wealth management platform.

Product Brand: NEXO

4.7

Pros

- - Easy to use

- - Quick easy loans

- - Takes security seriously

- - Increase your crypto wealth

- - No Fee USDT withdrawals when using Polygon and Arbitrum networks

- - Connects seamlessly with Revolut

Cons

- - Requires KYC

- - Can't repay loans before one month

Why You Should Trust My Review?

As a long-time cryptocurrency investor, I’ve seen countless Nexo reviews that barely scratch the surface of what this platform offers.

After nearly 5 years of using Nexo and maintaining a substantial portfolio on their platform, I can provide insights that go beyond the typical surface-level analysis.

Why My Review is different:

- I’m an active user since 2018

- My currently holdings exceed $30,000

- I use the platform on a daily basis to get paid, make payments, withdraw and trade.

- I have Deep understanding of all features and services

I’ve experienced Nexo through multiple market cycles, platform updates, and regulatory changes. This long-term perspective allows me to share both the platform’s evolution and its current state with authentic, firsthand knowledge.

I’ll share the good and bad, based purely on my experience – no sugar coating and no hidden agenda.

So, enough fluff, let’s get started:

What is Nexo?

Now that I’ve outlined what I’ll cover in this review, let me introduce you to Nexo itself.

As someone who’s been using their platform since 2018, I can tell you it’s become one of the biggest players in the crypto financial services space, processing over $320 billion in transactions and managing about $12 billion in assets worldwide – according to their data – which nobody debunked until now, so, no reason not to believe them.

The company was founded by Antoni Trenchev and Kosta Kantchev, two forward-thinking entrepreneurs who saw the need for traditional banking services in the crypto world.

I’ve followed their journey from the start, and their approach makes sense: give crypto holders the financial freedom they deserve!

Here’s what Nexo actually does:

- Provides crypto-backed loans so you can access cash without selling your coins

- Offers interest-earning accounts with rates up to 16% annually

- Runs trading services through Nexo Pro and Prime platforms

- Invests in Web 3.0 and Metaverse projects through Nexo Ventures

Think of Nexo as your crypto bank – but with more flexibility and higher earning potential than traditional banks. They’ve built their business model around giving crypto holders like us more options for using our digital assets.

👎What I Don’t Like About Nexo

Usually, I start with the things I like. In this case, I am going to start with the things I don’t like since they are less than the things I like:

1. Their fees are higher than other platforms

Among Nexo’s few drawbacks, their fee structure is slightly costlier than it’s competitors. I’ve noticed this particularly in their trading fees, where I’m paying 0.40% as a taker and 0.30% as a maker on

While these aren’t deal-breakers, they’re definitely higher than what I get on platforms like

The fee difference becomes more apparent when I do standard swaps on their main platform:

- Standard swaps can cost me 1% to 1.5% through spreads.

- Trading fees on competitors like Binance are around 0.1%

- Withdrawal fees kick in after I exceed my monthly free limit.

I’ve learned to work around these costs by:

- Planning my trades carefully to minimize frequency.

- Staying within my free monthly withdrawal limits.

- Taking advantage of loyalty tier benefits.

Despite the higher fees, I find value in Nexo’s overall package. The interest-earning features and platform convenience often outweigh the extra costs.

However, if you’re a frequent trader or regularly need to move funds, you might want to evaluate how these fees could impact your bottom line.

2. You can’t repay your loan instantly.

Perhaps more frustrating than Nexo’s fee structure is their loan repayment policy. When I first started using their platform, I realized that you can’t simply repay your loan whenever you want.

Instead, you have to wait an entire month before making any repayment.

This mandatory waiting period creates several challenges:

- Loss of flexibility in managing your finances

- Potential for higher interest charges

- Inability to quickly respond to market conditions

- Reduced control over your collateral assets

The one-month lockup period feels unnecessarily restrictive, especially in the fast-moving crypto market. I’ve found myself in situations where I wanted to repay my loan early to free up my collateral, but couldn’t.

This policy seems to benefit Nexo more than its users, as they earn guaranteed interest during the waiting period.

While other platforms offer more flexible repayment options, Nexo stands firm on this policy. I recommend carefully considering this restriction before taking out a loan, as it could impact your investment strategy and overall financial planning.

3. Not many crypto on their platform

Nexo’s limited cryptocurrency selection stands out as one of its major drawbacks – at least for me. While they offer popular coins like Bitcoin and Ethereum, and add new tokens frequently (e.g as of writing this post, they’ve added Bittensor), their platform lacks many altcoins that I’d like to transfer and earn interest on.

This restriction can be frustrating when you’re trying to diversify your crypto portfolio or take advantage of emerging opportunities.

I’ve often found myself having to use other platforms when I want to work with specific altcoins that aren’t available on Nexo.

This means maintaining multiple accounts and dealing with extra transfers, which isn’t ideal for managing my crypto investments efficiently.

CURRENTLY SUPPORTED CRYPTOS:

| BTC – Bitcoin | USDT – Tether | XRP – XRP | AVAX – Avalanche |

| ETH – Ethereum | DOT – Polkadot | FTM – Fantom | AXS – Axie Infinity |

| SOL – Solana | USDC – USD Coin | ADA – Cardano | XLM – Stellar |

| NEXO – NEXO Token | BNB – BNB | DOGE – Dogecoin | TRX – Tron |

| TON – Toncoin | PAXG – PAX Gold | TUSD – TrueUSD | DAI – Dai |

| USDP – Pax Dollar | POL – Polygon | LINK – Chainlink | BCH – Bitcoin Cash |

| LTC – Litecoin | NETH – Staked Ethereum | EOS – EOS | APE – ApeCoin |

| AAVE – Aave | ARB – Arbitrum | LDO – Lido DAO | ENS – Ethereum Name Service |

| MANA – Decentraland | SAND – The Sandbox | UNI – Uniswap | SUSHI – Sushi |

| GALA – Gala | CRV – Curve DAO Token | MKR – Maker | 1INCH – 1inch |

| RUNE – THORChain | ATOM – Cosmos | KSM – Kusama | NEAR – NEAR Protocol |

| HBAR – Hedera | LUNA2 – Terra | LUNC – Terra Classic | USTC – TerraClassic USD |

| OP – Optimism | SWEAT – Sweat Economy | ETHW – Ethereum PoW | GRT – The Graph |

| COMP – Compound | GMT – StepN | SNX – Synthetix | GMX – GMX |

| FXS – Frax Share | DYDX – dYdX | CVX – Convex Finance | CHZ – Chiliz |

| APT – Aptos | OSMO – Osmosis | YFI – yearn.finance | BAT – Basic Attention Token |

| KNC – Kyber Network | ENJ – Enjin Coin | CAKE – PancakeSwap | FLR – Flare |

| WLD – Worldcoin | ALGO – Algorand | BONK – BONK | INJ – Injective |

| ALT – AltLayer | TIA – Celestia | SHIB – SHIBA INU | SEI – Sei |

| SUI – Sui | ONDO – ONDO | ENA – Ethena | W – Wormhole |

| PENDLE – Pendle | ICP – Internet Computer | PEPE – Pepe | ETHFI – ether.fi |

| FLOKI – FLOKI | WIF – Dogwifhat | RENDER – Render | FIL – Filecoin |

| JUP – Jupiter | BOME – BOOK OF MEME | EIGEN – EigenLayer | STX – Stacks |

| FET – Artificial Superintelligence Alliance | IMX – ImmutableX | KAS – Kaspa | TAO – Bittensor |

4. Verification (KYC)

The fourth thing I don’t like about Nexo is the verification process, particularly the KYC (Know Your Customer) requirements. Generally, I’m not a fan of KYC procedures, but I do get that platforms need them to operate within certain jurisdictions and avoid getting shut down by governments.

Nexo has three verification levels.

- The first level, Starter Verification, is just for creating the account.

- The second level, Basic Verification, kicks in when you deposit crypto.

- Finally, there’s the Advanced Verification, which requires a KYC/AML procedure involving a photo of your ID and a selfie holding the ID.

Although the process was relatively easy and I’m comfortable with it, I still find it a bit intrusive. The higher your verification level, the more withdrawals and deposits you can make, and you need at least Basic Verification to start using Nexo’s borrow and earn features.

👍 What I Like About Nexo

After sharing my concerns, here are the things I like about Nexo:

1. Very User-Friendly Platform

The first thing that stands out about Nexo is its remarkably user-friendly interface. After exploring numerous crypto platforms over the years, I’ve found Nexo’s app to be straightforward and intuitive.

The design prioritizes simplicity without sacrificing functionality.

What impresses me most is how quickly you can learn to use the platform. Whether you’re buying crypto, earning interest, or taking out a loan, each process flows naturally from one step to the next.

Even if you’re new to crypto, you won’t feel overwhelmed. The app guides you through each action with clear instructions and helpful prompts.

Nexo is available for both Android and iOS devices. It has all the features the desktop version has and it is very user-friendly.

2. Easy Loans

Building on its user-friendly foundation, one of my favorite features on Nexo is their streamlined loan process.

When I need quick access to funds, I don’t have to deal with traditional banking hassles or endless paperwork. The process to take a loan is very simple.

Key Benefits of Nexo’s Loan System:

- Instant approval with no credit checks

- Zero paperwork or documentation required

- Flexible loan amounts – depending on how much crypto your have in your account.

- Repayment options after one month WITHOUT any penaltys.

- Your crypto serves as collateral

- You can withdraw your loan in fiat money to your bank account.

Let me just repeat that:

You can withdraw your loan in fiat money to your bank account.

Super important.

If for any reason I default on the loan, Nexo simply keeps my crypto – no debt collectors or credit score impacts to worry about.

The fact that I have an extra source of funding for anything I want, makes NEXO my financial wingman.

HOW NEXO’s CRYPTO LOANS WORK?

To get a loan from NEXO, you need to have an Advance Verification.

Let’s say you want to get a $10.000 loan from NEXO, you first need to decide which Crypto you are going to use as collateral.

For example, if you choose Bitcoin as your collateral, then you need to deposit $20.000 worth of Bitcoin in your account. The reason is that Bitcoin has a 50% TVL Ratio (Total Value Locked).

On the other hand, if you choose Polkadot as your collateral, which has a 30% TVL Ration, then you will have to deposit $30.000 worth of DOT to get the same amount of Loan.

A third example is Tether (USDT) which has a 90% TVL Ratio. To get a $10.000 loan from NEXO your need to deposit as collateral only $11.106 USDT.

As soon as you top up your account, money are instantly available for your to borrow.

With NEXO’s crypto loans you get instant cash flow as soon as you deposit your collateral. No paperwork, no questions, no hidden fees and low interests rates.

3. No Upfront Interest Payment

Unlike traditional banks where you’re required to pay off the interest before even touching the principal, Nexo does things differently.

They charge you interest as you go along with your loan repayment, and you pay off both the interest and the principal simultaneously.

This means the faster you repay your loan, the less interest you end up paying.

Key Benefits of Nexo’s Interest Structure:

- Pay interest only for the time you use the loan

- No hidden fees or surprise charges

- Interest and principal paid simultaneously

- Zero interest if you repay within one month

I’ve found this system incredibly flexible for my financial needs.

This approach gives you more control over your borrowing costs and helps you manage your cash flow better. Whether you’re planning to hold your loan for a week or a year, you’ll only pay interest for the actual time you use the funds.

4. Daily Passive Income

Among Nexo’s most attractive features, daily passive income stands out as a game-changer for crypto investors. The platform offers incredible returns that make traditional banking look outdated. I’m earning a substantial 3% daily return on my Bitcoin holdings and an impressive 9% on my USDT investments.

Key Benefits of Daily Passive Income with Nexo:

- Consistent daily returns

- Higher yields than traditional banks

- Automatic payments

- No waiting for monthly interest

- Compound growth potential

- Withdraw your funds anytime you want – no locking.

Just of the record, I earn 9% on my USDT holdings in unlocked mode (means I can withdraw them any time I want), If I choose to lock them, the interest “jumps” to 12%.

Plus, when it comes to Bitcoin, I couldn’t find a platform that earns me more than 3% and have my Bitcoins unlocked.

In contrast with my local “scambanks’s” interest rates that offer “peanuts” to store your money, that barely keep up with inflation, Nexo’s daily passive income structure provides real wealth-building potential.

I’ve found that these regular payments create a reliable income stream that I can either reinvest or use for daily expenses – via my Nexo card.

With Nexo, you can earn up to 17% interest on your cryptocurrency, stablecoins, and fiat money depending on your Loyalty Level. To check the interest rates in all the above, visit NEXO.

5. Convenient Crypto Spending

The Nexo card is another problem-solving feature that Nexo offers. Most people who deal with cryptocurrencies need easy ways to liquidate their earnings or their crypto assets.

With the Nexo card, now you can. Although it’s similar to other crypto cards, it offers some pretty neat functionalities that I really appreciate.

For example:

- Instant access to both crypto funds and credit line: I can choose to spend directly from my crypto holdings in debit mode, which I typically prefer, or switch to credit mode and access my credit line. That means I can spend without losing my crypto.

- Seamless Google Pay integration: Yes, just tap-to-pay at any merchant accepting Google Pay (which is almost everywhere, at least where I live).

- No need to carry physical cards: Although I do have the option to order a physical card, I don’t really care, since I’m using it via Google Pay.

- Instant transactions without manual crypto conversions: I remember back in the old days, I had to enter the app I was using at that time, convert crypto to USD or EURO and then spend them. I don’t have that “hassle” anymore.

- Access to emergency funds through credit line: Currently, my credit line is $15K, which I have access to anytime I want.

6. Works seamlessly with Revolut

I often switch between crypto and regular banking, and Nexo’s integration with Revolut makes it a breeze. These two platforms work together seamlessly, so moving money back and forth is super easy.

- Easy withdrawals and deposits in different currencies (like EUR and USD)

- Fast conversion between crypto and regular money

- Dependable transaction processing

- No technical headaches

I find it especially simple when dealing with USDT. Here’s what I usually do:

- Send USDT from Nexo to my Revolut wallet

- Exchange the USDT to regular money directly in Revolut

- Access my funds right away in my preferred currency

What I love about this integration is how consistent it is. I’ve done lots of transactions, and I haven’t run into any major problems.

Whether I’m adding money to my account or taking it out, the process is always smooth and reliable. That kind of dependability is crucial for anyone who frequently moves between crypto and traditional banking systems.

7. No USDT Fees

A standout advantage of using Nexo is its fee-free USDT transfers on select networks.

I’ve found this feature particularly valuable when managing my crypto assets across different platforms.

Network Options for USDT Transfers:

- Polygon Network – Zero fees

- Arbitrum Network – Zero fees

- Ethereum Network – Standard network fees apply

- Tron Network – Standard network fees apply

- Binance Smart Chain – Standard network fees apply

When I need to move USDT, I always opt for either Polygon or Arbitrum networks to avoid any transfer costs. This has saved me significant money over time, especially when making frequent transfers.

Pro Tip: If you’re new to Nexo, make sure to verify which networks your other platforms support before making transfers. Not all platforms support every network, but most major ones work with Polygon or Arbitrum these days.

This fee-free feature has become one of my favorite aspects of using Nexo, making it more cost-effective than many competing platforms.

8. Trusted Security

Although I’m not a cybersecurity expert, Nexo’s marketing team has done a great job at communicating this. For example:

- They never got hacked. That means they’re doing something right – right?

- Their loans are overcollateralized. That means they are playing safe. And honestly, although I haven’t snooped into their wallets, I never heard anyone debunking their overcollateralization claims.

- Multiple security certificates. They feature multiple security certificates on their website.

- Financial services licenses. They feature multiple licenses from various financial agencies world wide.

- Risk Management. Plus they have regular security audits, Multi-layered protection systems, Strict regulatory compliance and Transparent business practices. At least that’s what they claim, they make you feel and no one debunks them.

Plus, Nexo was among the few that stayed solvent during the 2022 crypto lending crisis when many competitors defaulted. Remember Celsius, Voyager Digital, and FTX? Yeah, those guys didn’t make it, but Nexo did.

Anyways, they’re consistently delivering on their security promises, and I’ve never experienced any issues with my funds.

9. Good Support

Although it’s been a long time since I used their support I get the feeling that they’re still good at it.

Back when I started using their platform, I used their support system a couple of times. They were always quick to respond – both times I reached out, they got back to me really fast. One time, I remember they went above and beyond to help me – which I impressed me.

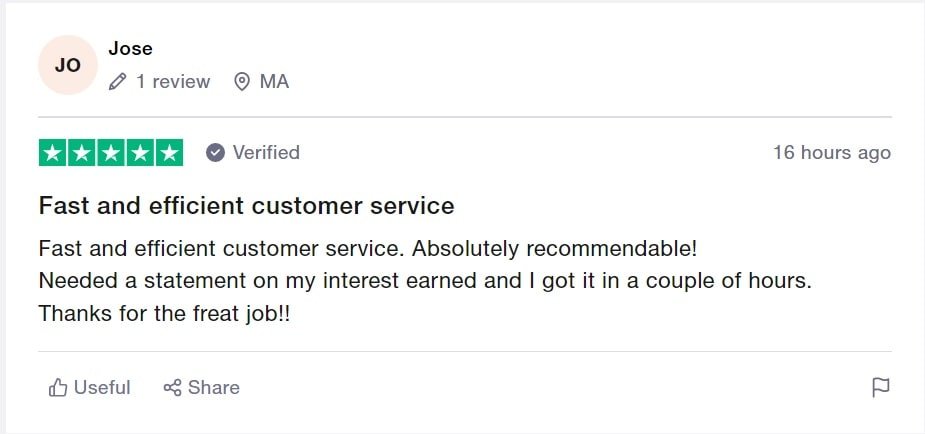

As I said, it’s been a long time since I last used their support. I looked at Nexo reviews on Trustpilot and people are still saying great things about their support system, so I believe they’re still doing a good job.

Other Features Worth Mentioning

Beyond its core lending services, Nexo offers several additional features that I must mention. While I don’t use all of them, I’ll share the ones that I believe you should know.

- CRYPTO SWAPS: The crypto exchange function lets you swap between supported cryptocurrencies quickly. It’s straightforward, though not as feature-rich as dedicated exchanges.

- NEXO PRO: For those interested in trading, Nexo Pro provides an advanced platform with futures markets. I personally stay away from futures trading, as it’s fundamentally gambling with borrowed funds.

- TIERED LOYALTY SYSTEM: The tiered system rewards users who hold Nexo tokens with better rates and perks. I’ve opted out of this since selling my NEXO tokens, but it might appeal to long-term platform users. I won’t go into details about their tiered loyalty system. If you want to learn more check this explanatory article by Nexo itself.

- NEXO WALLET: One important distinction to note is between the Nexo platform and Nexo Wallet. While the platform is custodial (meaning Nexo controls your keys), the separate Nexo Wallet is non-custodial, giving you full control of your private keys.

- NEXO Token: Nexo has its own native token called… NEXO token. NEXO Token’s utility is primarily to determine your loyalty level within NEXO’s platform. As I mentioned before, the more NEXO tokens you hold (in regards to your crypto holdings) the higher your Loyalty level is and the better your perks.

This choice between convenience and control is vital for those who value financial sovereignty.

Nexo’s Fees and Charges

As I mentioned at the beginning, their fees are a bit higher that other platforms, but, personally, I don’t really care because I don’t engage in trading activities that often, rather than increasing my wealth by keeping my crypto in Nexo’s platform and spending them via the Nexo Card.

Nevertheless, here are the fees and charges NEXO has for those of you who do care. For more detailes about Nexo’s fees, click here for Nexo Card fees and here and here for Nexo Pro Trading fees.

Nexo Card Fees

The Nexo card allows you to spend your crypto assets without selling them. The fees associated with the Nexo card include:

Annual Fee: There is no annual fee for the Nexo card.

Transaction Fees: Users may incur transaction fees depending on the currency used and the merchant’s policies.

ATM Withdrawal Fees:

- For withdrawals in cryptocurrencies, a fee applies based on the type of asset.

- For fiat withdrawals, fees may vary depending on the ATM provider.

Currency Conversion Fees: When spending in a currency different from the one held in your account, a conversion fee will apply.

Limits: There are daily and monthly limits on spending and withdrawals, which vary based on user verification levels.

Nexo Pro Trading Fees

Nexo Pro offers a trading platform with specific fees that depend on whether you are a market makers or taker:

Trading Fees:

- Market Takers: A standard fee of 0.20% applies to market takers.

- Market Makers: They benefit from lower fees, which can be as low as 0.10%.

Fee Reduction: Users can reduce their trading fees by using NEXO tokens to pay for them. This can result in a discount of up to 50% on trading fees.

Withdrawal Fees: There are also withdrawal fees for transferring cryptocurrencies out of the platform, which vary by asset.

Scrutiny Over Time

Nexo has faced a lot of scrutiny from various sources over time. This includes a negative review from P2PEmpire, an investigation by Bulgarian authorities launched in early 2023, and a frustrated user who created a negative review site dedicated to Nexo.

I’ll briefly debunk everything, though you might see this as biased. But I believe I’m right.

User with Negative Experience

This particularly troubling case involved a user who lost $15,000 in assets due to technical errors during a market crash. The user tried to repay their loan but encountered persistent errors, which led to the liquidation of their assets at a lower value.

Frustrated, he felt Nexo’s delayed response and subsequent offer of a recovery program were insufficient.

From Nexo’s side, they do acknowledge technical issues can happen, especially in volatile markets. They’ve built a robust infrastructure to protect assets, but glitches are sometimes inevitable.

Their attempt to offer a “Special Crypto Relief Program” was a step to rectify the problem, even though it wasn’t the perfect solution for everyone.

So, while the user’s frustrations are valid and highlight areas for improvement, it’s clear Nexo made efforts to address the issue.

You can read the original version here.

P2PEmpire’s Review

While individual user experiences offer valuable insights, I’ve also examined third-party reviews of Nexo, particularly the one from P2PEmpire.com. Their review claims that Nexo misleads investors about its business model and warns that capital is at risk.

However, my “investigation” tells a different story. For example:

- Their warnings appear to lack substantial evidence.

- Many of their conclusions seem based on speculation rather than facts.

- Their review contradicts my direct experience with the platform.

After fact-checking P2PEmpire’s claims myself, I found their assessment to be largely unsupported. During my five years using Nexo, I’ve seen consistent transparency in their business practices and clear communication about their services.

Plus, if you check the review yourself, you’ll see that this is an automated review. Why the f*** is even ranking in the first results of Google?

So, to sum-up, while healthy skepticism is important, it’s equally important to distinguish between legitimate concerns and unfounded criticism. P2PEmpire’s negative review doesn’t align with the platform’s track record or my personal experience over the years.

Bulgarian Authorities

One significant event in Nexo’s history involved Bulgarian authorities conducting a raid on their offices in early 2023. The investigation centered around serious allegations that could have damaged Nexo’s reputation such as:

- Suspected money laundering activities

- Potential violations of international sanctions against Russia

- Full compliance audit of Nexo’s operations

What’s important for you to know is that this investigation concluded on December 27, 2023, with a complete clearing of Nexo’s name.

I’ve followed this case closely, and although I got really scared and moved some of my funds out of the platform at the time of the incident, the final outcome reinforced my trust in the platform.

The authorities found no evidence of wrongdoing after their thorough investigation.

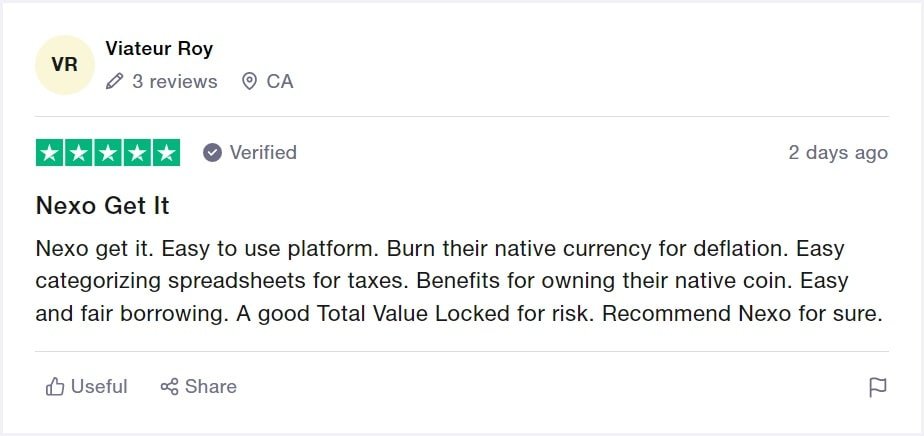

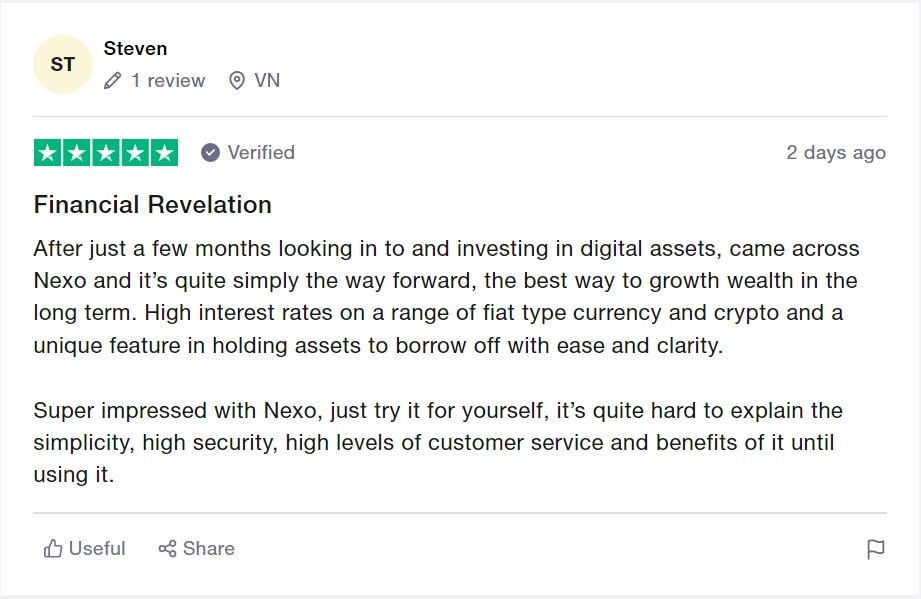

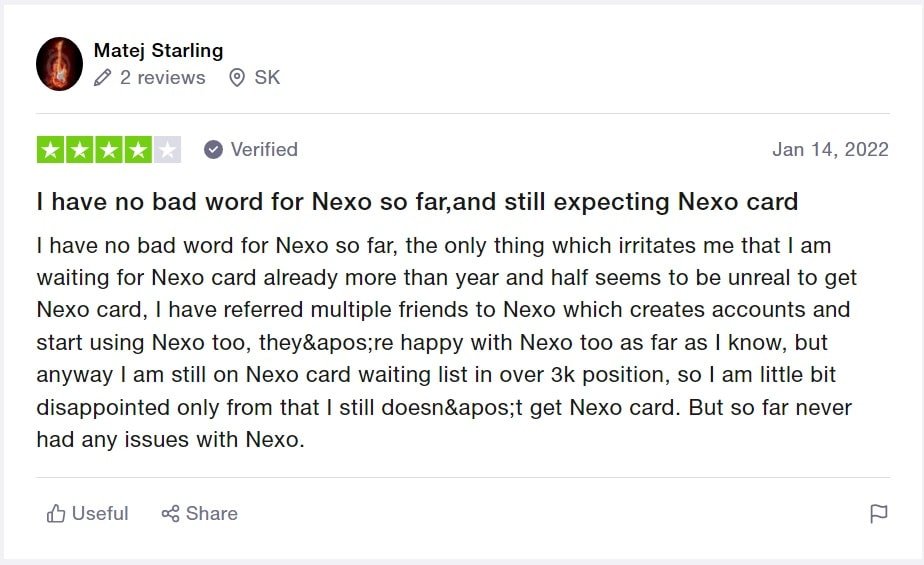

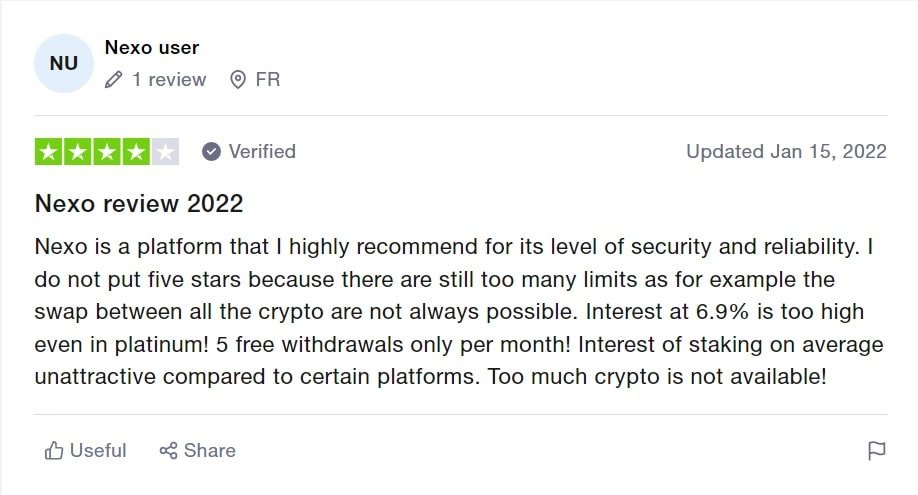

Nexo Reviews

Now, because I am a fan of Nexo, I might as well be biased the way I talk and present their services, right? I mean, I do have a Nexo account which I actively use.

To remove even the slightest doubt from your head, I am ”throwing” some reviews from other crypto holders like you and me, found on the popular reviews platform Trustpilot. Btw, if you want to check their Trustpilot profile, you can do so by visiting this link (opens in a new tab).

With over 7500+ reviews on Trustpilot and a commutative score of 4.6 / 5, Nexo – at least for me – earns my trust and my respect.

Conclusion

So, after five years with Nexo, I can confidently say it’s a solid platform for crypto investors seeking passive income through lending.

While the higher trading fees and limited crypto selection for loans aren’t ideal, the platform’s security, regulatory compliance, and competitive interest rates make it worthwhile.

If you’re looking for a reliable crypto lending platform with a proven track record, Nexo deserves consideration despite its drawbacks.

If you have any questions regarding Nexo, feel free to ask them in the comment section below. If you enjoyed reading my NEXO Review, feel free to give this article a thumbs up and share it on social media..

Previous Articles:

- Ripple CTO Warns of Price Swings as Dollar-Pegged RLUSD Stablecoin Nears Launch

- Bitcoin Surges Past $104K as Trump Victory Fuels Crypto Market Rally

- Pudgy Penguins Parent Launches Abstract Chain to Target Consumer Crypto Market

- Trump’s New Crypto Czar Sacks Signals Major Policy Shift for Digital Assets

- Dogecoin Gaming Surge: Seven Games Feature Meme Coin’s Iconic Shiba Inu