QUICK LINKS

I stumbled across something fascinating last week. Udi Wertheimer reformatted and posted an old thesis from Mike Alfred that completely blew my mind. Not because it was revolutionary theory – but because it ACTUALLY HAPPENED.

This article breaks down the most accurate Bitcoin prediction I’ve ever seen. Mike Alfred wrote this thesis 2.5 years ago when Bitcoin was trading around $40K, having crashed from its 2021 highs.

He predicted a generational rotation would eventually push Bitcoin past $100K resistance to $400K and beyond.

The scary part? He was right about almost everything.

The Dogecoin Blueprint That Everyone Missed

Alfred’s thesis centered on one brilliant comparison that crypto natives completely ignored. He looked at Dogecoin’s 2019-2021 run and saw the exact same pattern happening with Bitcoin.

The setup was identical = old holders rotating out while new institutional money rotated in.

What happened with DOGE next is wild.

Back in 2013-2019, experienced crypto traders had Dogecoin figured out. They’d accumulate during quiet periods, then dump on newcomers every cycle for 5x-10x profits. Rinse and repeat. They were making bank selling DOGE for under a penny.

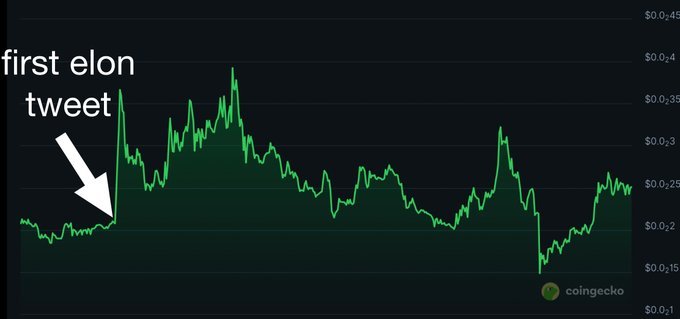

Then Elon tweeted about DOGE on April 2, 2019. Price rallied 50% from 0.00024 cents to 0.00036 cents.

Old holders thought they hit the jackpot. They thanked Satoshi and started selling. Smart money, right?

WRONG.

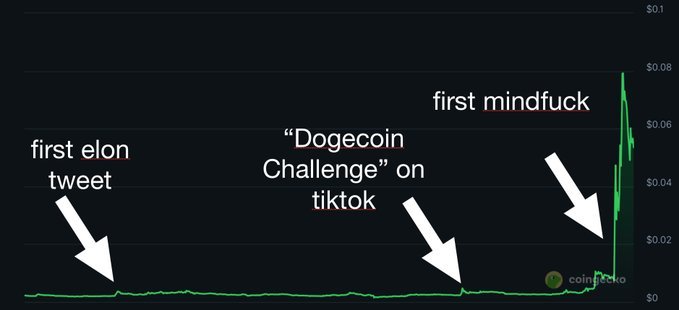

What they missed was the underground movement. While crypto Twitter focused on “charts”, “TikTok kids” were starting the “Dogecoin Challenge” on Robinhood.

Every day, more regular people bought DOGE because it was the only “fun” crypto on the platform.

The old holders kept selling every pump throughout 2020. They felt brilliant as price stayed flat. “See? Nothing ever happens with DOGE.”

But underneath, the “TikTok army” kept buying.

By January 2021, something unprecedented happened = the sellers ran out of tokens.

DOGE exploded 10x in two weeks. From $0.008 to $0.08. Market cap went from $1 billion to $10 billion.

Crypto Twitter lost their minds. Group chats exploded. Whales called each other panicking. “ARE YOU SEEING THIS?!?!”

But that was just the warm-up.

New holders didn’t know about old prices. When they looked at Robinhood charts, they couldn’t even see the historical pain. For them, “DOGE to a dollar” made perfect sense.

With old bagholders rotated out and fresh money having no anchoring bias, DOGE ripped another 10x to $0.70.

That’s 200x from Elon’s first tweet. In two years.

Most crypto natives missed the entire move.

The Bitcoin Mirror Image (And Why Alfred Saw It Coming)

Alfred recognized this exact pattern forming with Bitcoin in 2022.

But instead of TikTok kids, we would have institutions. Instead of Robinhood retail, we would have ETFs. Instead of Elon shilling DOGE, we would have the President of the United States shilling Bitcoin.

The players were bigger. The rotation was bigger. The outcome would be bigger.

“Crypto natives thought the run from $50K to $100K was the entire move,” Alfred wrote. But he was writing this when Bitcoin was actually trading around $40K in 2022, making his prediction even bolder. “The truth is it just took time to rotate the asset out of old holders. The real move didn’t even start yet.”

He was absolutely right.

Check what happened after he wrote this:

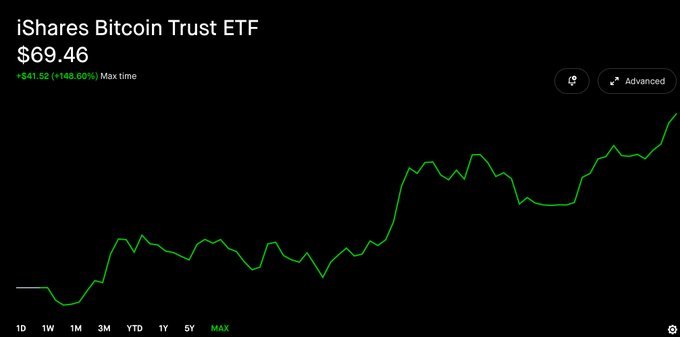

Bitcoin ETFs launched in January 2024. BlackRock’s IBIT started at $30 and trades around $70 today.

For ETF investors, Bitcoin hasn’t even 3x’d yet. (Note: This is crucial psychology – they don’t see the massive gains that scare crypto natives.)

Michael Saylor kept buying. MSTR’s market cap exploded past many altcoins. They measure purchases in dollar amounts, not Bitcoin prices. Completely price-insensitive buying.

Meanwhile, old Bitcoin maxis disappeared. Where did they go?

They sold their Bitcoin and “bought a house and a boat and fucked right off” as Alfred predicted. The “diamond hands” finally cashed out around $100K thinking they timed the top perfectly, using their Bitcoin profits to purchase real estate and luxury assets before leaving the crypto space entirely.

Crypto degenerates rotated into memes and altcoins, chasing the “next Dogecoin” without realizing the next Dogecoin is literally Bitcoin.

The Thesis Plays Out In Real Time

Today Bitcoin sits around $120K. That’s a 3x gain from the $40K levels when Alfred wrote his thesis – exactly the kind of move he predicted would happen as institutions rotated in.

“You still think that’s preposterous,” he wrote in 2022. “But old holders are out. There is simply no reason why we can’t have fast multiples anymore.”

The data backs him up completely:

ETF flows continue breaking records. Institutions keep buying. Nation-states are building Bitcoin reserves. Retail barely owns any Bitcoin compared to 2021.

Most importantly = the seller rotation worked exactly as predicted.

The crypto natives who sold around $100K thinking they timed the top? They rotated out exactly as Alfred predicted, replaced by institutional buyers who don’t care about old price anchors.

Wall Street bought everyone’s Bitcoin. And they’re just getting started.

Why This Changes Everything

Alfred made one prediction that seemed impossible in 2022: “You will actually be able to retire off of 1 Bitcoin.”

At $120K, that’s starting to look reasonable for many people. At $400K? That’s generational wealth for most.

But Alfred warned this was just the “first mindfuck.” He expected a second, larger move after $400K when “the entire world starts to believe.”

Looking at adoption curves and institutional flows, this timeline makes sense.

The comparison to Dogecoin isn’t perfect. Bitcoin is bigger, more established, with different dynamics.

But the core psychology remains identical = old holders rotating out, new holders with different price anchors rotating in, leading to explosive moves that seem impossible until they happen.

What About Altcoins?

Alfred’s prediction here was brutal but accurate: “Your altcoins are fucked.”

He specifically called out Ethereum, predicting MSTR would flip ETH’s market cap. At the time, this seemed insane.

Today? While MSTR has exploded to a $115 billion market cap – making it one of the most valuable companies in America – Ethereum still maintains its dominance at $470 billion.

The flip hasn’t happened yet, but MSTR’s meteoric rise shows Alfred understood something most missed.

“ETH holders are starting treasury companies too, but they won’t be able to catch up this cycle,” Alfred wrote. “The problem? Old bag holders still around, providing selling pressure on every pump.“

This prediction is playing out exactly as Alfred described.

While Bitcoin successfully rotated out its old holders around $100K, Ethereum still carries the weight of years of bag holders who accumulated at much lower prices. Every pump brings fresh selling pressure from holders who’ve been waiting years to exit.

Bitcoin rotated its holders. Most altcoins didn’t. That’s the difference.

The data supports Alfred’s thesis: MSTR has become a $115 billion phenomenon by acting as pure Bitcoin leverage, while traditional altcoins remain anchored by their legacy holder base. Even at Ethereum’s current $470 billion valuation, it’s struggling to break free from the selling pressure that Bitcoin successfully escaped.

The Bottom Line

I’ve never seen a crypto thesis age this well. Alfred nailed the institutional rotation, the psychology shift, the timeline, and even the altcoin weakness.

His core message remains urgent: “Please buy some Bitcoin before there isn’t any left.”

With ETF flows accelerating and nation-state adoption beginning, the supply shock he predicted in 2022 is happening now. The “bloodline retirement” thesis isn’t hyperbole anymore.

It’s math.

Wall Street is buying all the Bitcoin. The question isn’t whether Alfred’s targets will hit – it’s whether you’ll position yourself before they do.

The first mindfuck is just getting started.

DISCLAIMER: This is an opinion article and BitNewsBot takes no responsibility for any financial decisions made based on this content. The author is not a financial expert and is not licensed to provide financial advice. The views expressed are personal opinions only and should not be considered professional investment guidance. Always conduct your own research and consult with qualified financial advisors before making any investment decisions.

Previous Articles:

- CoinDCX Denies Reports of Coinbase Acquisition Negotiations

- Ruble-Backed A7A5 Stablecoin Surges Amid Sanctions Evasion Claims

- OFAC Sanctions Aeza Group for Supporting Global Cybercrime

- Shiba Inu Faces $52M Short Liquidations, Price Dip Likely

- South Korea Parties Clash Over Stablecoin Bills, Interest Ban Divides